The International Bunker Industry Association’s (IBIA) Bunkering and Shipping in Transition online conference has reported that bunker volumes in key markets of the United States are still being affected by the Covid-19 pandemic.

Volumes in markets such as the US Gulf are still 10% or more down compared to the pre-pandemic levels, and while there were signs of recovery recently, there are concerns that the spread of the Delta variant of Covid-19 could delay the recovery process.

However, the impact of the pandemic was not seen in every sector across the shipping industry. While some segments like the cruise industry are still struggling, the container ship sector is looking healthy, driven by the increase in online consumer spending.

In the meantime on week 36, the Marine Bunker Exchange (MABUX) World Bunker Index did not show any significant changes. The 380 HSFO index rose to U$457.42/MT, the VLSFO index increased to US$552.76/MT, while the MGO index grew to US$649.38/MT.

The energy sector prices in Europe have been rallying, while the most significant upward factor was a rebound in Asian spot LNG prices, which could translate into lower LNG deliveries to Europe.

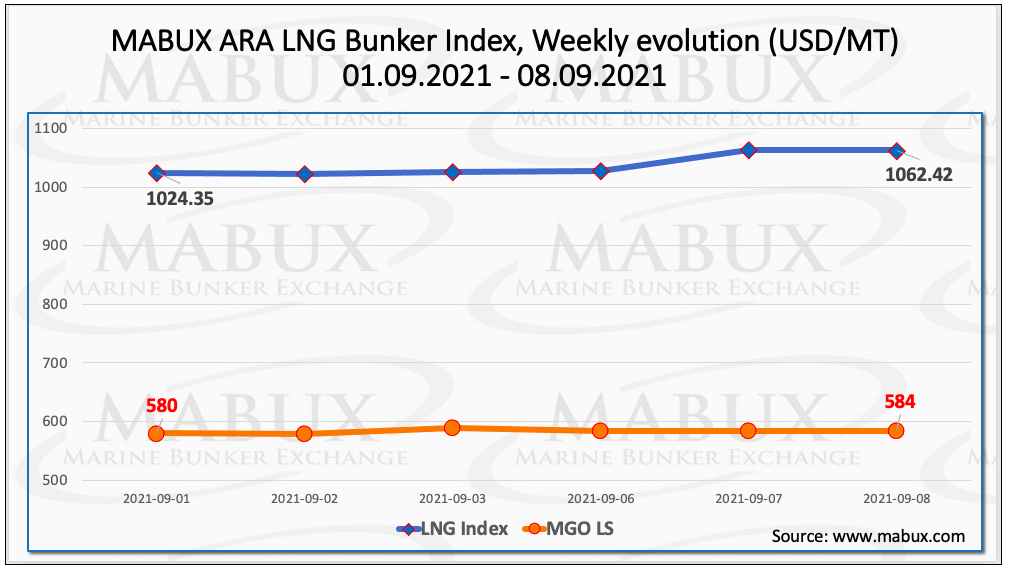

MABUX Amsterdam-Rotterdam-Antwerp (ARA) LNG Bunker Index, calculated as the average price of LNG as a marine fuel in the ARA region, continued to grow over Week 36 to US$1,062.42/MT.

Meanwhile, the average LNG Bunker Index increased by US$78.65 compared to the previous week. The average price of MGO LS in Rotterdam for the same period increased by US$10.83/MT, and the average price difference between bunker LNG and MGO LS in Rotterdam rose to US$454.24.

LNG bunker fuel prices continue to rise at the Port of Rotterdam and gas tankers are forced to switch to traditional bunker fuels to maintain the profitability of operations.

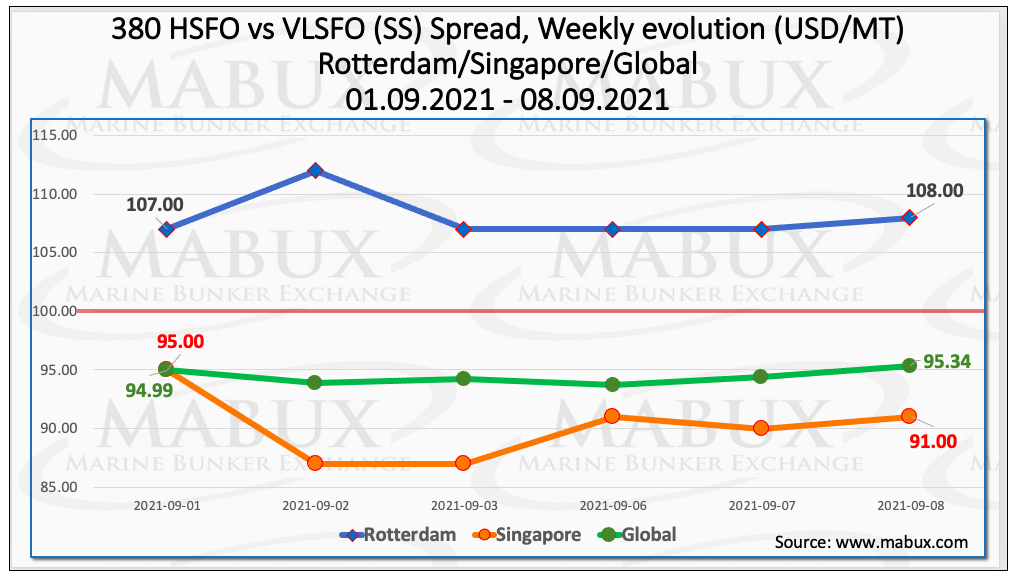

The average weekly Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - remained virtually unchanged over the week to US$94.43.

At the same time, the average SS Spread in Rotterdam was US$108, while SS Spread in Singapore has not exceeded US$95 during the week, and its average value fell to US$90.17.

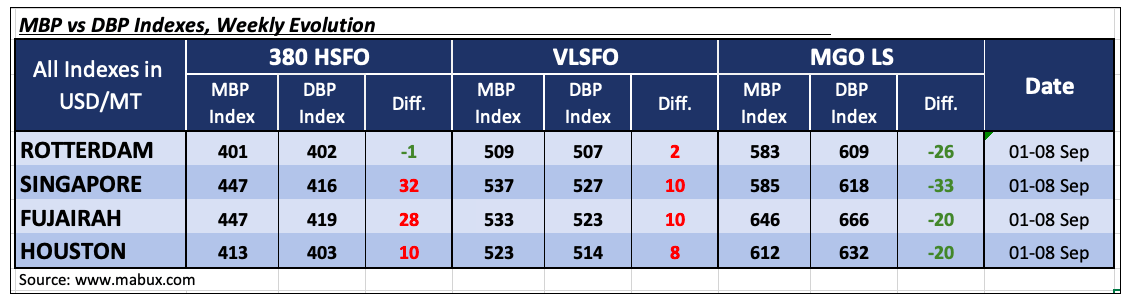

Correlation of MABUX MBP Index (Market Bunker Prices) vs MABUX DBP Index (MABUX Digital Benchmark) in the four global largest hubs over the past week showed that 380 HSFO fuel was overvalued in three of the four selected ports: in Singapore, the overpricing averaged plus US$32, in Fujairah - plus US$28 and in Houston - plus US$10 with no change.

The only port where 380 HSFO fuel grade remains undervalued is Rotterdam - minus US$1 versus minus US$3 during last week.

Furthermore, VLSFO fuel was overpriced in all selected ports, according to the MABUX MBP/ DBP Index. The undercharge margins were registered as follows: in Rotterdam - plus US$2, in Houston - plus US$8, in Singapore - plus US$10, in Fujairah - plus US$10.

"In general, the overvalue ratio of this type of fuel has changed insignificantly over the week," commented MABUX.

Regarding the MGO LS during week 36, the MABUX MBP/DBP Index registered an undercharge of this fuel grade at all selected ports: minus $20 in Houston, minus US$26 in Rotterdam, minus US$33 (unchanged) in Singapore and minus US$20 in Fujairah. The most significant change was another increase of underestimation ratio in Fujairah by US$10.