Global demand will decline by more than 4% over the course of this year if normal services are restored as we head into the third quarter, from July onwards, according to the latest Sea-Intelligence Sunday Spotlight report.

Over recent weeks Sea-Intelligence has tracked the effects of the global pandemic on key markets, monitoring cuts in capacity and the demand for services. The latest analysis from the Danish consultancy will raise the expectation that the returns for shipping lines this year will be bleak and that some lines may not survive.

“As it is well-known how much demand declines each year due to Chinese New Year, it is possible to also estimate the demand impact from the pandemic outbreak. The blank sailings must be seen as the carriers’ reaction to an actual demand decline. Comparing the pandemic blank sailings to the Chinese New Year blank sailings it can be seen that we are currently facing a demand decline of roughly 6.4 million TEU globally,” said the Sunday Spotlight.

By estimating the lost demand and assuming that normal services will resume after the second quarter, an event that Sea-Intelligence deems unlikely, the consultancy conservatively estimates a loss of 4% demand for the full year. If demand fails to rebound fully during the third quarter, traditionally the busiest period for the lines, the losses could be substantial over the year.

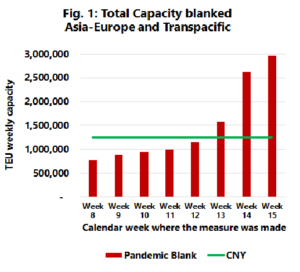

On the Asia-Europe and Transpacific trades combined, the carriers have now removed 3 million TEU of capacity, said the Sunday Spotlight.

“To put this into perspective, this equals 2.4 times the normal removal seen during Chinese New Year.”

This can be seen in the adjacent graph, which shows the amount of capacity blanked, which had been announced or scheduled in each week, for the combined Asia-Europe and Transpacific trades since week eight. The green static line shows the level of capacity that was removed in relation to Chinese New Year in 2020.

In total 384 sailings have been cut from carrier schedules, including 83 during the week up to 11 April.

If the main purpose of the capacity cuts is to maintain freight rate levels then the latest Freightos Baltic Rate Index (FBX), now available through a link on the Container News homepage, shows that the strategy is currently working.

On 12 April 2019 the FBX shows that average rates on the Asia to Europe trades at US$1,079/FEU, on the 10 April this year the average rate on the trade stood at US$1,399/FEU.

On the Transpacific, rates a year ago stood at US$1,582/FEU, however, this year rates on 10 April were US$1,607/FEU.

If the lines can maintain similar rate levels throughout the year, they may be able to mitigate their losses, though revenues will decline anyway. Costs too will fall, particularly with the current price of oil at roughly half the price that it was in January.

Nick Savvides

Managing Editor