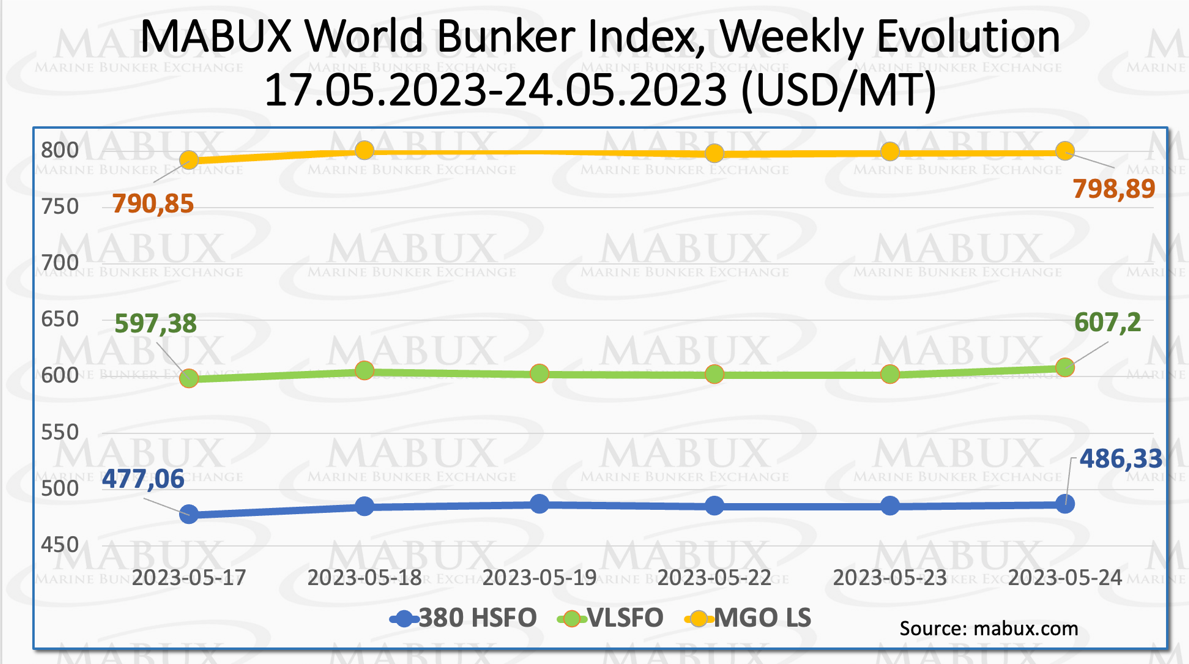

Global Marine Bunker Exchange (MABUX) indices turned into an upward trend. The 380 HSFO index experienced a rise of US$9.27, the VLSFO index, in turn, increased by US$9.82, while the MGO index recorded a gain of US$8.04.

“At the time of writing, the market was in an uptrend,” noted a MABUX representative.

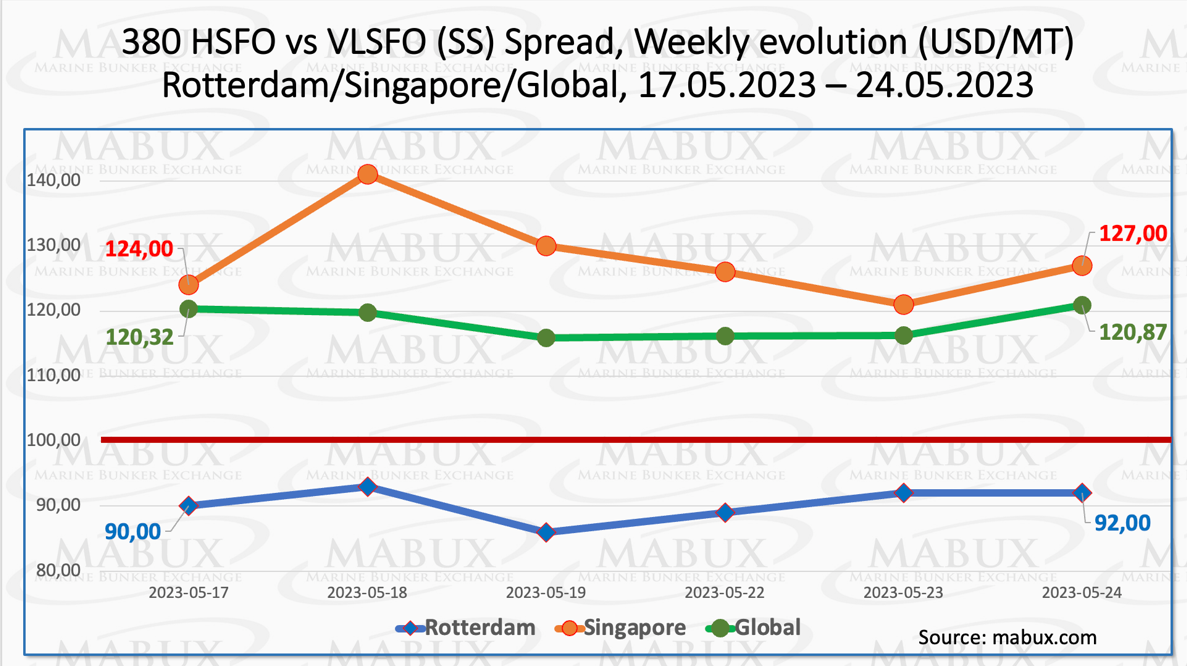

The Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – experienced minimal changes during Week 21, with a marginal increase of US$0.55.

However, the weekly average continued its downward trajectory, decreasing by US$3.27. In Rotterdam, the SS Spread saw a modest rise of US$2, reaching US$92.

Conversely, the weekly average declined by US$3. In Singapore, the price difference between 380 HSFO and VLSFO also exhibited an upward trend, with an increase of US$3 by the end of the week.

The weekly average recorded a gain of US$9.84. Presently, the downward trend in the SS Spread has halted, and there is a possibility of an upward correction in the near-term outlook.

The European Union (EU) announced the successful outcome of the first-ever international tender for the joint purchasing of EU gas supplies. During this tender, the EU managed to attract bids from 25 supplying companies equivalent to more than 13.4 billion cubic meters of gas (bcm) – surpassing the 11.6 bcm of joint demand that EU companies submitted through the recently established AggregateEU mechanism.

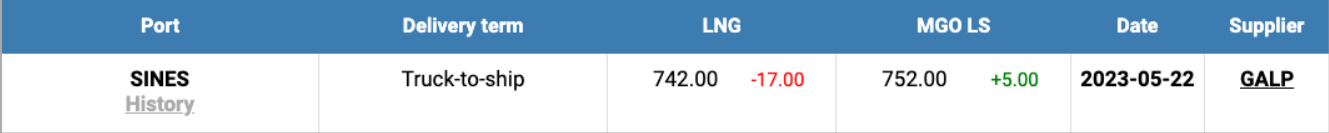

The price of LNG as bunker fuel in the port of Sines (Portugal) has continued its decline and as of 22 May, it reached US$742/MT. This represents a decrease of US$17 compared to the previous week. LNG is now priced at US$10 cheaper than conventional fuel, marking the first time this has occurred since October 2022.

On the same day, MGO LS in the port of Sines was quoted at US$752/MT. “This downward trend in LNG prices creates favorable conditions for the further expansion of the LNG fleet,” pointed out a MABUX official.

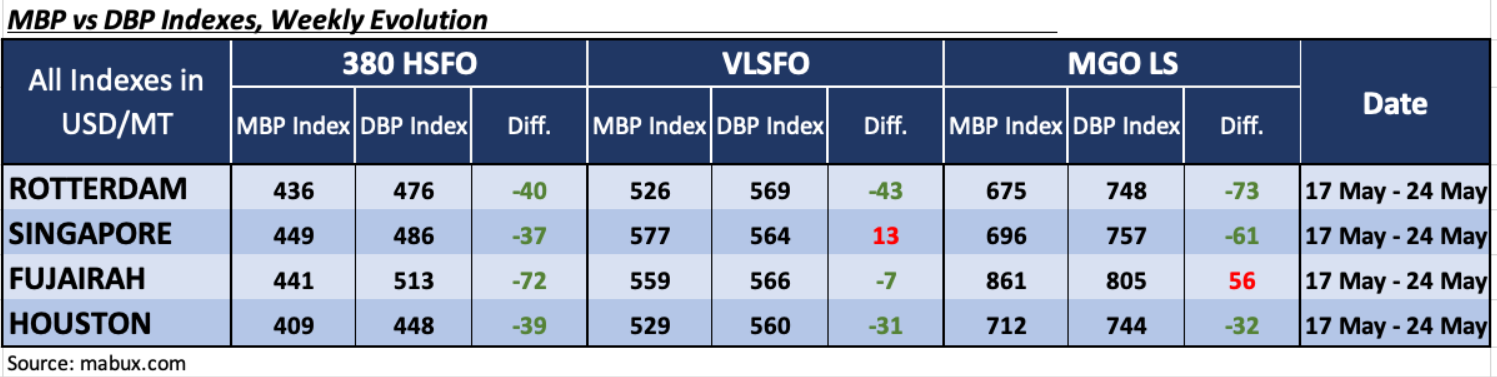

Throughout Week 21, the MDI index, which measures the correlation between market bunker prices (MABUX MBP Index) and the digital bunker benchmark MABUX (MABUX DBP Index), indicated that 380 HSFO fuel was undervalued in all four selected ports.

The average weekly underprice ratio decreased by 1 point in Rotterdam and Houston, while it increased by the same 1 point in Singapore and Fujairah. Regarding the VLSFO segment, according to MDI, Singapore is the only overcharged port.

The average overprice level increased by 7 points. The remaining three ports were undervalued, with average levels up 3 points in Rotterdam and 8 points in Houston, and down 7 points in Fujairah.

In the MGO LS segment, Rotterdam, Singapore, and Houston continued to be undervalued. Rotterdam’s average weekly undercharge margin increased by 3 points, while Singapore and Houston saw decreases of 9 and 2 points respectively. Fujairah remained the only overvalued port, although the overprice premium decreased further by US$22.

“We expect the global bunker market still retains the potential for further downtrend,

while irregular fluctuations in bunker indices may prevail in the upcoming week,” commented Sergey Ivanov, director of MABUX.