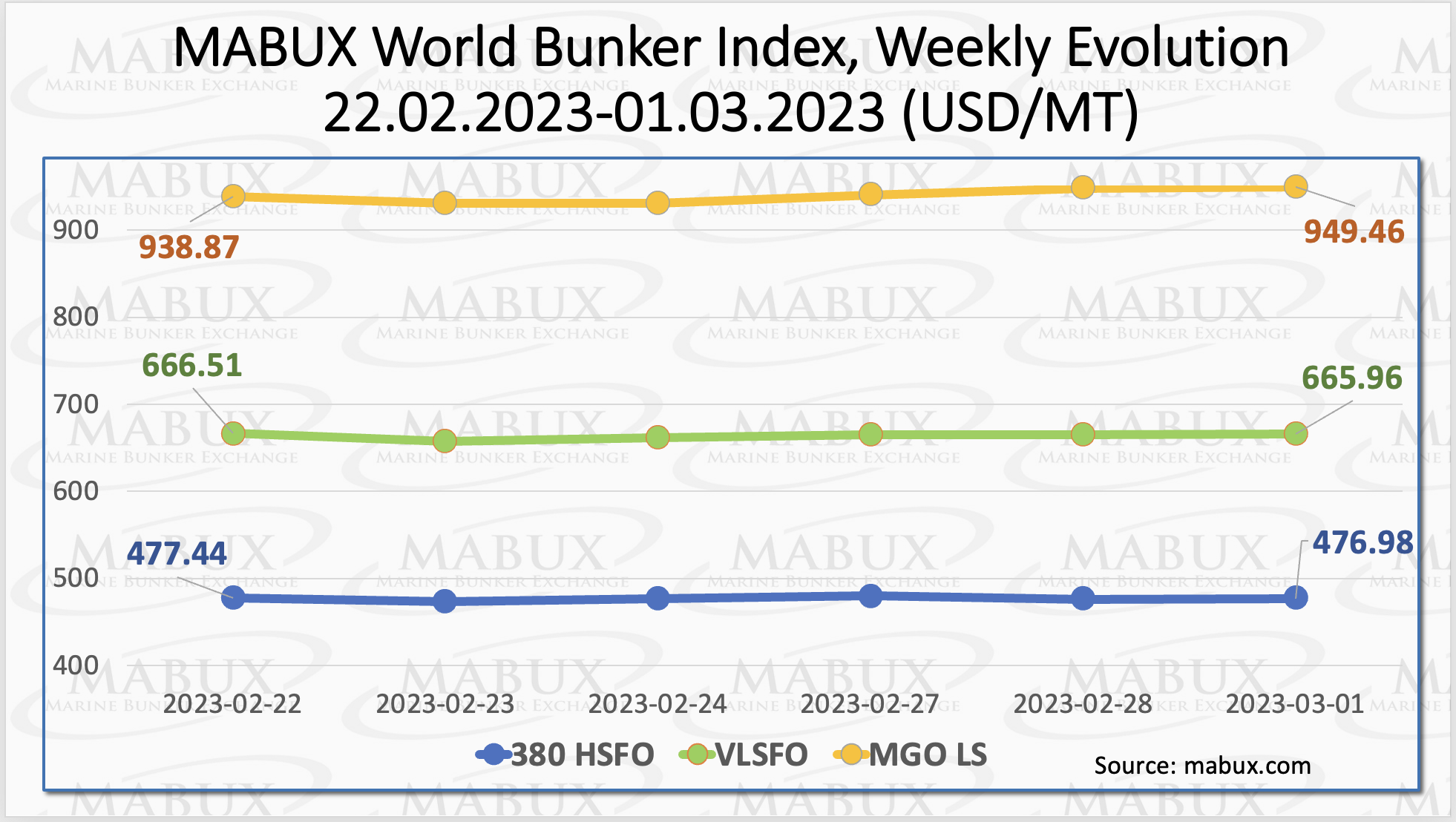

Marine Bunker Exchange (MABUX) worldwide bunker indices did not have a clear pattern and moved sideways during the ninth week of the year. The 380 HSFO index fell by US$0.46 to US$477/MT this week. In turn, the VLSFO index dropped by US$0.55 to US$666/MT, while the MGO index, on the other hand, increased by US$10.59 to US$949/MT.

“The Global bunker market was experiencing erratic changes at the time of writing,” noted a MABUX official.

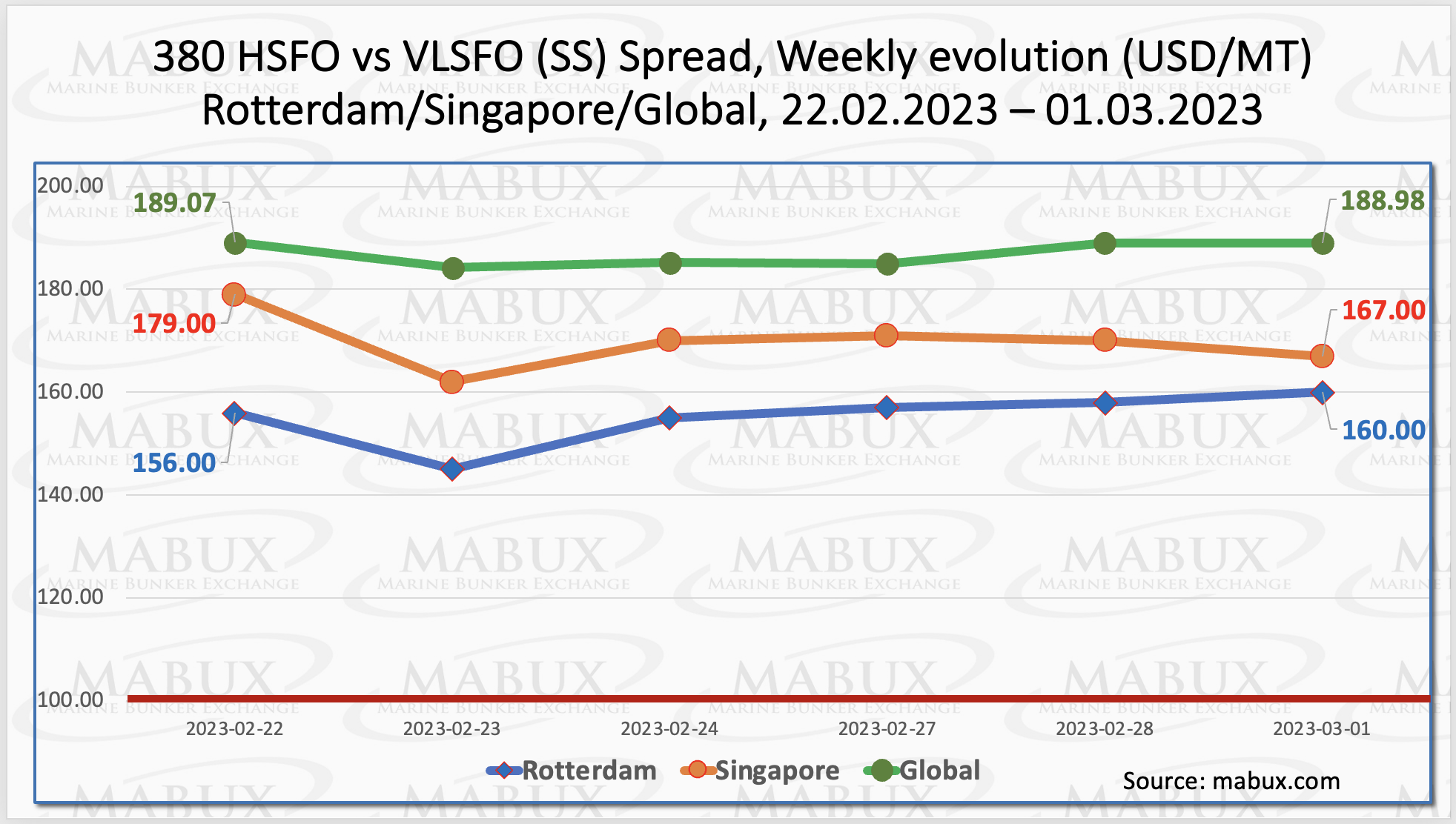

In the meantime, the Global Scrubber Spread (SS), the price differential between 380 HSFO and VLSFO, showed no notable variations in the ninth week, falling by US$0.09. Additionally, the monthly average fell by US$13.52. In Rotterdam, SS Spread increased by US$4 to US$160, but the weekly average was down US$19. The 380 HSFO/VLSFO price differential in Singapore was the most significant: minus US$12, falling to US$167. The monthly average decreased by US$32.

“We expect SS Spread to continue a downward trend next week,” added a MABUX official.

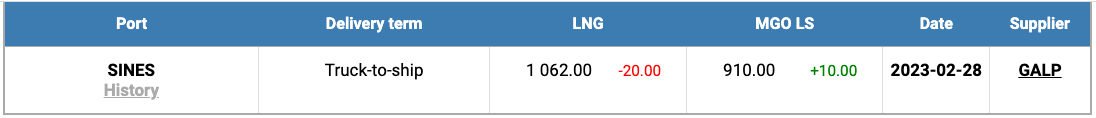

On 28 February, the price of LNG as a bunker fuel at the port of Sines (Portugal) maintained its moderate drop, reaching US$1,062/MT. On 28 February, the price differential between LNG and conventional fuel was US$152: MGO LS at the port of Sines was US$910/MT that day.

“The price difference continues to gradually decrease. We expect this trend to continue next week,” said a MABUX official.

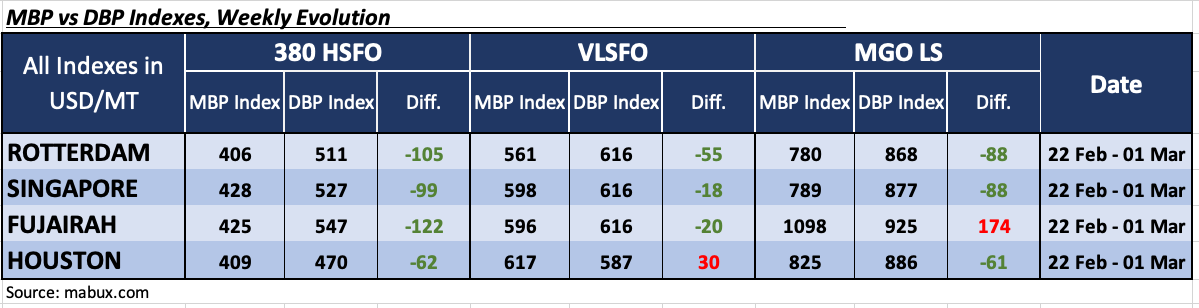

During Week 09, the MDI index recorded a fuel 380 HSFO decline in all four chosen locations. The average estimate ratio continued to fall, reaching US$105 in Rotterdam, US$99 in Singapore, US$122 in Fujairah, and US$62 in Houston. The most substantial narrowing of SS Spread was observed at Fujairah by US$30.

According to MDI, the three chosen locations in the VLSFO segment – Rotterdam, Singapore, and Fujairah – are still underpriced by minus US$55, minus US$18, and minus US$20, respectively. The weekly average of underestimation rose significantly in all three locations. Houston stayed the only overpriced port in this fuel category – an extra US$30 – while the overpricing rate expanded.

In the MGO LS category, three ports are underestimated: Rotterdam, Singapore, and Houston. The weekly average underpricing premium expanded slightly to minus US$88, minus US$88, and minus US$61, respectively. Fujairah stayed the only port that was overpriced – plus US$174. The most notable shift in this bunker fuel segment was a 19-point rise in the average undervaluation ratio at Houston.

“The global bunker market is in the phase of a sustainable trend formation. We expect the global bunker indices to remain rangebound next week,” stated Sergey Ivanov, director of MABUX.