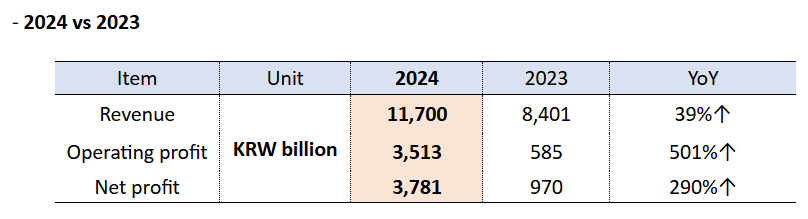

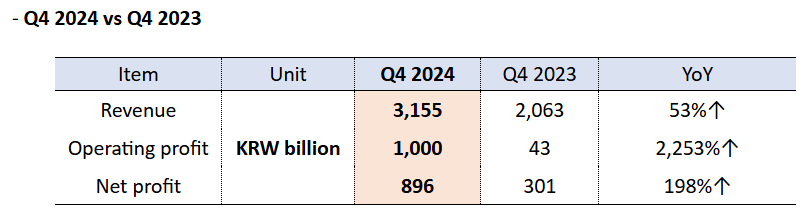

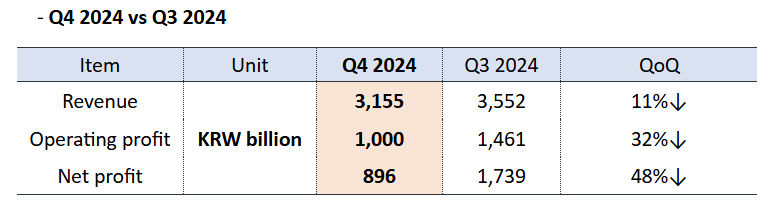

South Korean major ocean carrier HMM has reported revenue of KRW 11,700 billion (US$8 billion), operating profit of KRW 3,513 billion (US$2.42 billion), and net profit of KRW 3,781 billion (US$2.6 billion) in 2024.

All major financial indices of HMM were significantly higher than their corresponding 2023 results, indicating the company’s economic recovery in the previous year.

HMM’s operating margin was 30% in the previous year, “demonstrating its competitiveness in the global shipping market,” according to the company’s announcement. Additionally, HMM’s debt ratio remained at 21%.

“The strong performance was driven by strategic fleet expansion and network optimization deploying twelve 13,000 newbuilds, enhancing transpacific services, and launching the new FLX route—while also benefiting from the Red Sea crisis and rising US-CN trade demand,” commented an HMM official.

“Despite strong financial performance, uncertainties persist due to US tariffs, supply chain shifts, and overcapacity, which may pressure freight rates,” added the company’s representative.

In the meantime, the Seoul-based container shipping company is expanding its low-carbon fleet with nine 9,000 TEU methanol-powered and additional LNG-powered ships. It is also strengthening its global network with new services in the Transatlantic, India, and South America.

Under its mid-to-long-term 2030 strategy, HMM aims to enhance its competitiveness through fleet expansion, portfolio diversification, digitalization and moving toward net-zero ambitions.