Any expectation that capacity will be removed from the market over the coming year is being scotched by market analysts who say that the age profile of vessels points to depressed scrapping over the coming year.

Only 82 boxships have been scrapped to date in 2023, amounting to just 145,50 TEUs, which has been more than offset with 40 ships of 247,441 TEUs delivered over the last 30 days alone, according to an analysis by Linerlytica.

This is a significant increase on the 23 ships demolished in 2021 and 2022 combined with an aggregate capacity of just 18,000 TEUs, according to Jonathan Roach of the UK-based broker Braemar.

“The absence of demolition was hardly surprising considering that in 2021/2022, the average charter rate for a 1,700 TEUs vessel was US$40,000/day, a 2,800 TEU unit averaged US$62,000/day, and a traditional-Panamax averaged US$85,000/day. Demolition was not an option in this high earnings environment,” said Roach.

The broker added that Braemar’s charter index remained at 23% above its pre-covid average of 79 points and is, therefore, unlikely to spark a rush of vessels to the junk yard, before the index loses another 15-20%.

The average age of container ships demolished so far this year is 28.5 years and the average size is 1,444 TEUs. A large proportion of the vessels sold for scrap was approaching their fifth annual class survey.

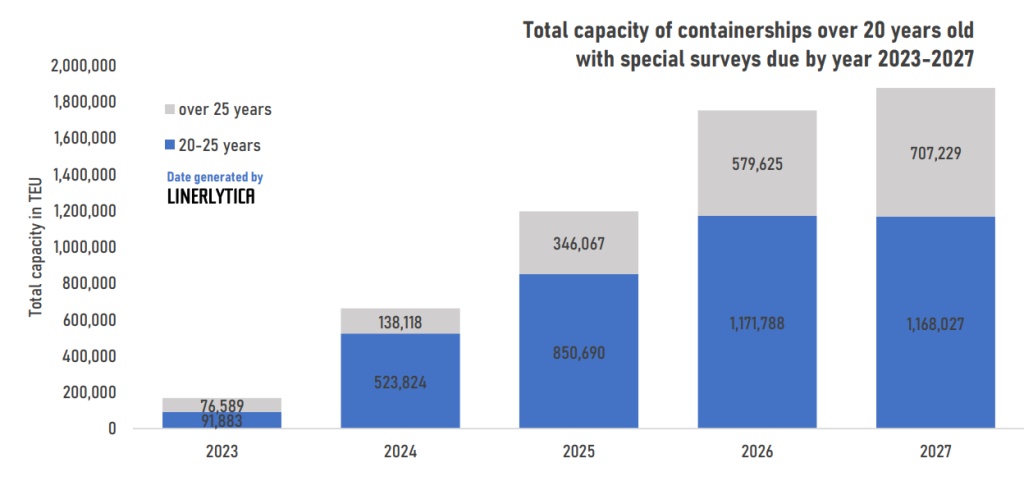

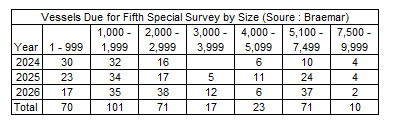

With net fleet growth set for 9% during 2024, there is an expectation that demolition will see an increase, particularly if Braemar’s estimates of 140 ships needing a fifth or sixth special survey, that number could increase to 180 vessels in the following year, but the majority of these vessels will be in the smaller, sub-panamax sector.

Braemar estimates that there are around 175 ships of over 5,100 TEUs, that are aged 20 years or more.

“We feel these larger vessels will be under increasing pressure by the significant newbuilding orderbook of vessels in the size range 6,000-16,000 TEUs. Swathes of neo-Panamax and mid-sized newbuildings will pressure aging traditional and post-Panamax tonnage coming up for class renewal aged 20 years plus,” explained Roach.

There will be few observers who are surprised to hear that MSC has the largest fleet of older tonnage, given the company’s persistent forays into the second-hand market over the past few years.

The average age of the ships MSC has scrapped this year is 32 years old, and Linerlytica claims this, “Far exceeds the market average of 27 years. MSC has continued to extend the lifespan of its fleet with an extensive drydocking programme that will continue keep most of its aging fleet in active service.”

Macro-economic indications are that global trade will remain muted in 2024, while the “trickle” of demolitions is expected to become a “steady stream”, but that will mean prices come down as demolition yards will have work, but there will be little demand for steel as construction work around the globe stutters.

Demolition prices, currently at around US$550/ldt, are expected to slip significantly due to the lack of demand for steel and the falling prices for this metal. Braemar estimates that demolition prices could fall to as little as US$550/ldt, well below the April 2022 high of US$710/ldt.

Mary Ann Evans

Correspondent at Large