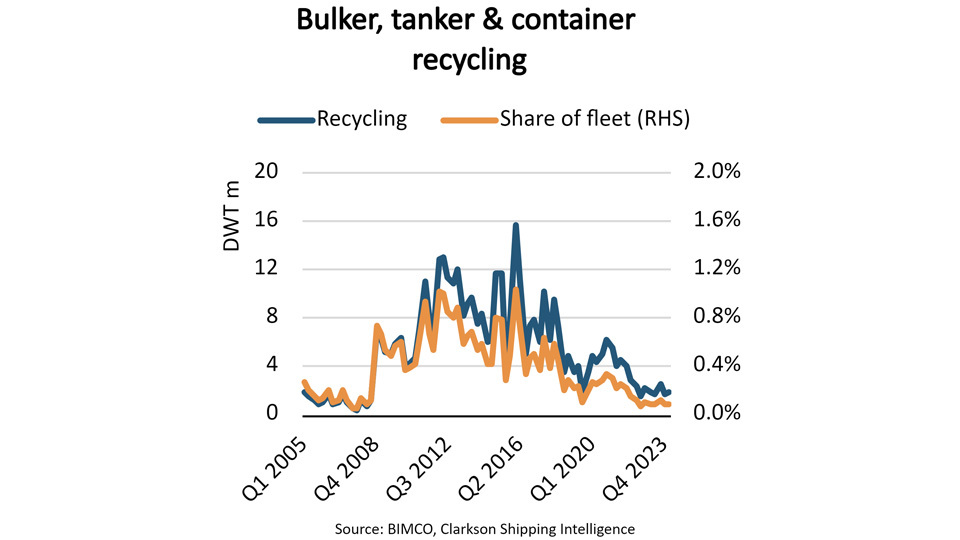

During the first quarter of 2024, only two million deadweight tonnes (DWT) ship capacity were recycled. This marks the ninth consecutive quarter with recycling levels below three million DWT. The last time recycling was this low for a prolonged period was before the 2008 financial crisis.

As the fleet is currently much larger than before the financial crisis, recycling during the past eight quarters has been at the lowest level in 20 years. On average, only 0.1% of the fleet has been recycled during this period compared with 0.45% during the past 20 years.

The current security situation in the Red Sea is the latest in a series of shocks that have boosted demand for ships. A larger number of ships is needed to transport the same amount of cargo as sailing distances increase when ships reroute via the Cape of Good Hope due to the risk of attacks by Houthis. During 2022 and 2023, sanctions on Russian oil and coal exports had a similar and lasting impact on the tanker and bulk sectors. Also, changed consumer behaviours during the COVID-19 pandemic caused a spike in container demand.

While high demand and freight rates kept ship recycling low, the limited tanker and bulker order books seen in recent years have equally contributed to low ship recycling levels. Combined bulker and tanker new building deliveries have also reached the lowest levels in 20 years.

Despite the low level of deliveries seen recently, some indicators point to stronger fleet development in the near future. In the container sector, the new building delivery record from 2023 will be broken in 2024 and supply is expected to grow faster than demand. In the tanker sector, recent increases in new building contracting will cause deliveries to rise significantly in 2025 and 2026 while cargo volume growth could remain low.

Ship recycling will inevitably rebound in the coming years. The ships that would have been recycled if the Cape of Good Hope rerouting had not been necessary, will likely be recycled soon after the situation is resolved. Therefore, despite this short-term lull in recycling, we still expect that more than twice as many ships will be recycled between 2023 and 2033 than were recycled during the past 10 years.

The article was written by Filipe Gouveia, shipping analyst at BIMCO