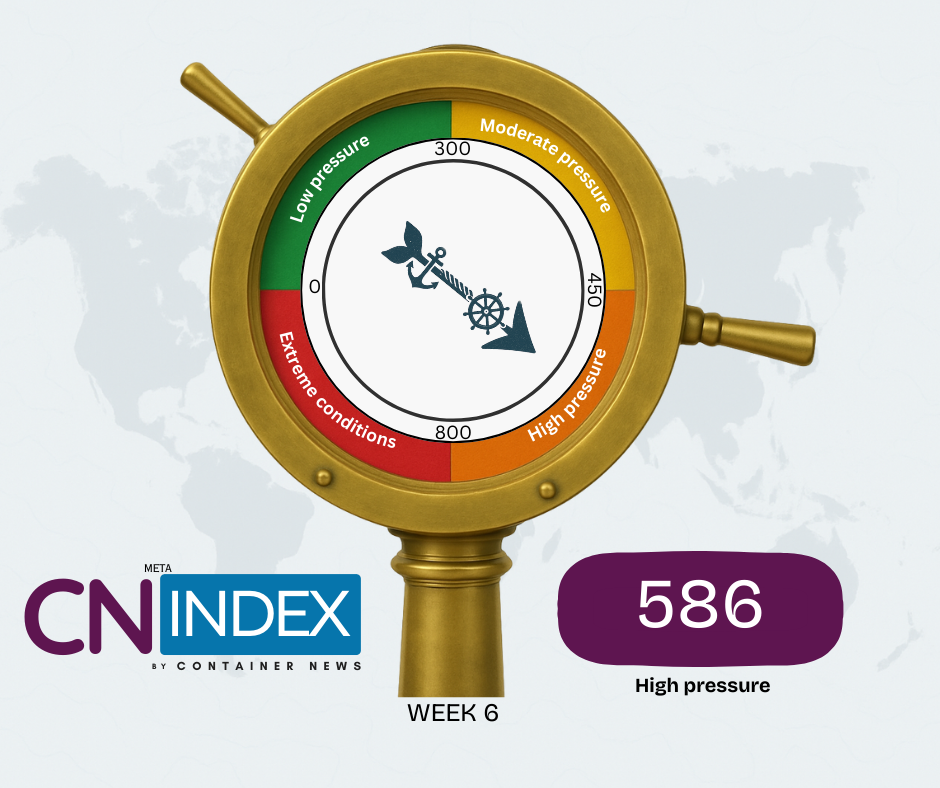

The CN meta Index is a composite measure that captures the overall pressure on global container shipping, combining market conditions, capacity dynamics, and geopolitical or operational risks into a single, easy-to-understand score. It reflects how challenging, risky, or costly it is to move containers worldwide at any given time.

The CN Index reached 586 this week, placing global container shipping firmly in the High Pressure range. The reading reflects continued strain across major trade lanes, driven primarily by elevated freight rates on East–West routes and reinforced by ongoing geopolitical and operational risks.

Freight Market Conditions Remain Tight

Freight rates on the largest global trade corridors remain significantly above long-term averages. The Asia–USEC and Asia–USWC routes continue to show strong pricing, indicating limited capacity flexibility and persistent cost pressure for cargo moving into North America. At the same time, rates on the Far East–North Europe corridor remain elevated, confirming that pressure on the Asia–Europe trade has not materially eased.

Secondary intercontinental routes also contribute to the overall stress. Pricing on services connecting Asia with South America remains firm, while trans-Atlantic westbound rates continue to reflect stable but elevated conditions.

Regional markets show a more mixed picture: intra-Asia pricing remains relatively steady, while Mediterranean and Persian Gulf routes exhibit moderate pressure compared with historical norms. Lower-volume regional routes, including parts of Africa and Australasia, remain subdued but still operate above pre-disruption cost levels.

Overall, the market component continues to dominate this week’s CN Index reading, highlighting that freight pricing, rather than isolated shocks, remains the main source of pressure in container shipping.

Geopolitical and Operational Risk Snapshot

Geopolitical risks remain an important secondary factor. The Red Sea continues to represent the most significant operational concern, with security risks still influencing routing decisions and cost structures. Trade and sanctions-related constraints remain elevated, adding complexity to compliance, insurance, and operational planning.

Other regions, including the Black Sea, Gulf of Guinea, and Gulf of Aden, maintain moderate risk levels due to ongoing conflict or security concerns. Major chokepoints such as the Panama Canal and Suez Canal are operating normally, limiting the likelihood of immediate system-wide disruption.

What the CN Index Is Indicating

At 586, the CN Index suggests that global container shipping remains under high but manageable pressure. Costs are elevated, capacity remains tight, and risk premiums persist across key trade lanes. While conditions have not escalated into extreme territory, the index indicates limited near-term relief and underscores the need for continued caution in freight planning and supply-chain decision-making.

Disclaimer: The CN Index is an informational indicator intended solely for general analysis and monitoring. It does not constitute financial advice, operational guidance, or any form of guarantee regarding future market performance. Users should supplement the index with independent research and professional judgment when making business or strategic decisions.