The deal that would transfer ownership of more than 40 seaports, including two crucial terminals at the Panama Canal, to Western investors is facing unexpected turbulence from Beijing.

At the heart of the dispute is China’s demand that state-owned shipping giant COSCO be granted a significant stake in the transaction, a move that has turned a commercial port sale into a high-stakes geopolitical flashpoint.

The deal, currently under negotiation between Hong Kong-based CK Hutchison, BlackRock, and Mediterranean Shipping Company, would reshape port ownership in key global trade corridors.

But China has threatened to derail the agreement if COSCO is excluded, citing strategic interests and economic leverage.

According to Wall Street Journal report, Beijing has informed the involved parties that it may block Hutchison’s proposed sale through regulatory review unless COSCO is brought in as an equal shareholder. The pressure campaign underscores China’s increasing use of economic statecraft to defend the interests of its global port operators.

This is about more than just a business transaction. It’s about influence at one of the world’s most critical chokepoints and China does not want to be left out.

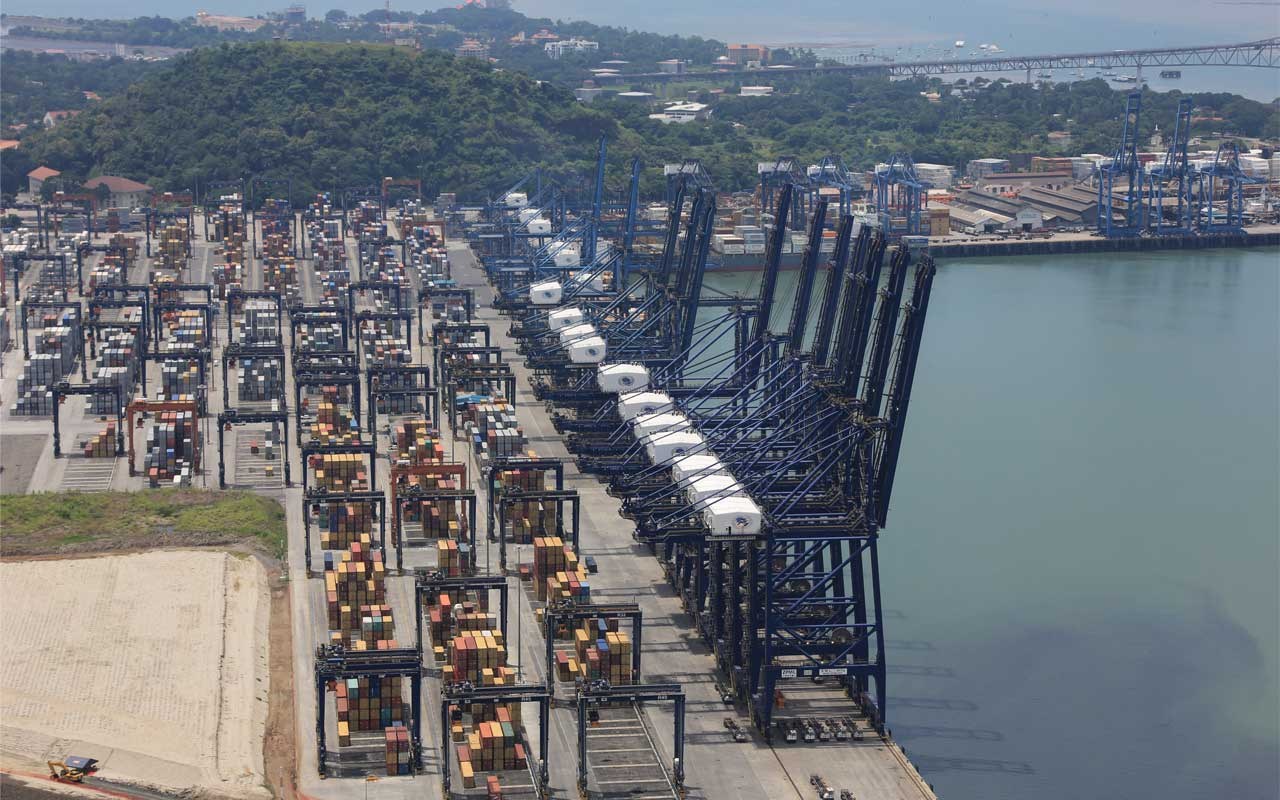

The Panama Canal handles over 5% of global trade and is a cornerstone of maritime connectivity between the Atlantic and Pacific Oceans. COSCO’s presence at either end of this bottleneck would align with China’s broader strategy of controlling critical nodes in global shipping, complementing its investments in ports along the Suez Canal, the Indian Ocean, and the South Pacific.

If COSCO were to gain a stake in the Panama Canal terminals, it would strengthen China’s grip on global logistics. This could raise national security concerns for the United States and its allies, especially given the dual-use nature of port infrastructure.

US lawmakers are already reacting. Rep. John Moolenaar (R-Mich.), chairman of the House Select Committee on China, wrote to Panamanian officials cautioning that COSCO’s participation would represent an unacceptable risk to the national security of both our nations, as WSJ reported.

China’s leverage is not theoretical.

BlackRock and Hutchison have significant business footprints in China, while MSC is deeply reliant on Chinese exports. Beijing’s implicit threat to use regulatory tools or economic pressure is a reminder of the power it wields in global supply chains.

This kind of intervention is not new. China’s Commerce Ministry has previously stepped into global mergers, citing antitrust or national security grounds often forcing changes that reflect Beijing’s strategic interests.

WSJ mentions that BlackRock, MSC, and Hutchison are now open to COSCO’s participation, underscoring how China’s geopolitical weight can shape even cross-continental commercial deals.

The standoff in Panama could have ripple effects across global shipping networks.

If COSCO is brought into the deal, China will deepen its already expansive port network, enhancing coordination and possibly influencing port operations to favor Chinese cargo movement. Conversely, excluding COSCO could prompt China to retaliate economically or block the transaction, delaying or derailing a sale that could reshape port ownership across the Americas, Europe, and Asia.

There are also risks of wider fragmentation.

Western nations may reevaluate port acquisitions and operational partnerships involving Chinese entities, accelerating a global trend of economic decoupling and strategic port diversification.

The Panama Canal dispute is emblematic of a broader shift: maritime infrastructure is no longer just about trade, but about power.

As the US and China compete for influence over strategic corridors, commercial transactions are increasingly filtered through a geopolitical lens.