A tectonic shift is underway in global shipping as South-South trade grows three times faster than the global average, while the maritime industry is witnessing nothing less than a wholesale redrawing of the world’s cargo map one that threatens to leave Western hubs watching from the sidelines.

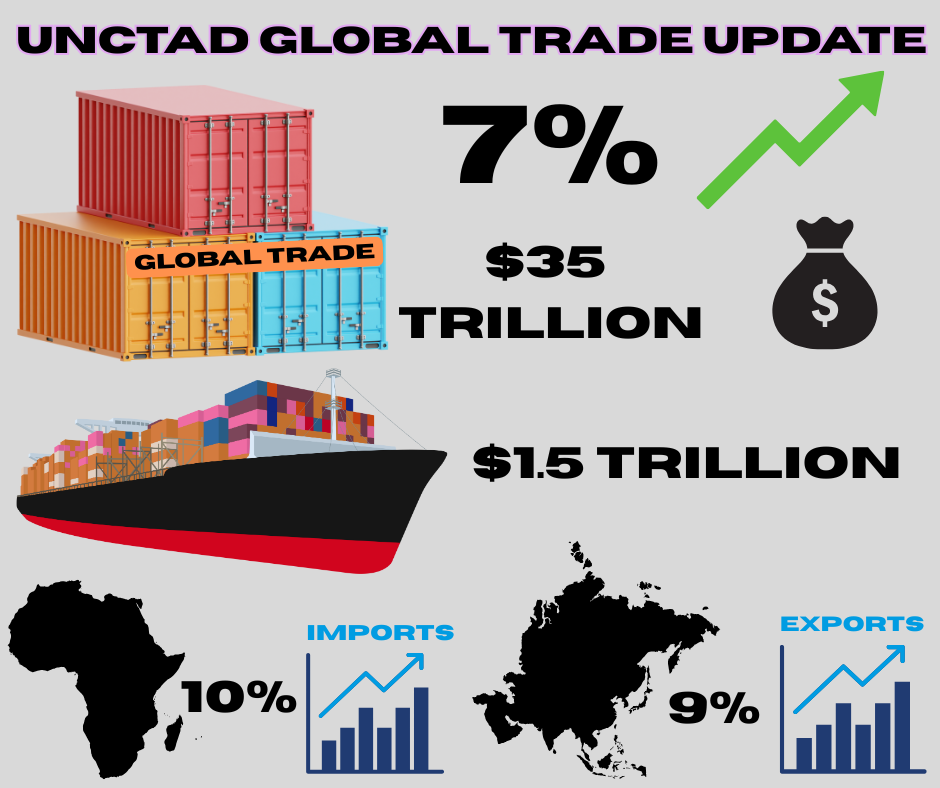

South-South trade surged 8% in 2024-2025, dwarfing the 2.4% global average, according to UNCTAD’s latest Review of Maritime Transport. East Asia’s intra-regional flows jumped 10%, while African imports from developing economies climbed at the same blistering pace.

The data validates what shipping professionals have suspected since the Red Sea crisis forced 80-90% of Suez-dependent cargo around the Cape of Good Hope: temporary disruptions are accelerating permanent realignments.

But the South-South boom isn’t just about avoiding Houthi attacks. It reflects something deeper, the maturation of China’s Belt and Road Initiative from diplomatic theater into operational infrastructure.

Certain ports have emerged as anchors of this reshuffled network. Durban and Lagos posted 9-11% TEU growth despite chronic congestion. Malaysia’s Tanjung Pelepas surged 14%, capitalizing on shorter intra-Asian hauls and high-value manufacturing loops.

On the Pacific side, Mexico’s Lázaro Cárdenas recorded a 16% spike, fueled by nearshoring away from China.

The operational improvements are tangible. Average crane productivity across South-South hubs is up 5-10%. Vessel turnaround times run 10-15% faster than global benchmarks. Automation, shore power, LNG bunkering, and solar-powered cranes are rolling out at speeds that make legacy Western terminals look sclerotic.

Yet bottlenecks persist as truck dwell times in Lagos and Mombasa still exceed one week, and labor or security disruptions flare periodically.

UNCTAD’s concurrent Global Trade Update adds crucial context. Friend-shoring and near-shoring indicators strengthened in Q3 2025, reversing earlier declines and approaching 2021 levels. Trade concentration among major economies increased, meaning a larger share of global cargo flows through a smaller group of key players.

Geopolitical fragmentation isn’t theoretical anymore but a reality.

North America and Europe, meanwhile, showed modest expansion North American exports rose just 2% over four quarters, European exports 6% annually but slowing to 2% in Q3. The contrast with East Asia’s 9% export surge couldn’t be sharper.

The shift from price-driven to volume-driven growth in late 2025 explains another puzzle: why carriers like MSC are ordering massive feeder fleets despite industry overcapacity.

Shipping lines recognize that fragmented trade patterns demand distributed networks more routes, more frequent services, smaller cargo parcels spread across geopolitical allies.

The old model optimized for cost per TEU but the new one optimizes for route redundancy.

That strategic pivot is why shipping alliances are launching “Belt and Road”-aligned services, why slot-swap agreements are proliferating, and why secondary ports from Santos to Callao to Busan are suddenly attracting direct calls from ultra-large container vessels.