The Danish research and analysis firm Sea-Intelligence has conducted a study for the consumption of goods in the United States, showing that it continues to grow.

According to data released by the US Bureau of Economic Analysis (BEA), the increase in personal consumption reversed back to the pre-pandemic level in September 2021.

“However, when we look at a breakdown, we see that growth in consumption of goods is still fast outpacing that of services. Breaking it down further, we see a gradual increase in growth levels for nondurable goods,” stated Alan Murphy, CEO of Sea-Intelligence.

On the other hand, there is a spike in early 2021 followed by declining growth levels for durable goods, albeit to only a little under 10%, according to the Danish company.

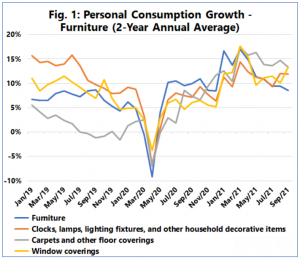

One of the major demand drivers and the highest growing subcategories is furniture, as shown below.

The furniture component is a slightly leading indicator for the three other components, according to data. It appears that the average consumer first procures new furniture and only thereafter, with a slight time delay, augments the new purchase with products such as carpets, lamps and window coverings.

These components take up a significant portion of container volumes, and the persisted high level of growth in all these categories is one of the major drivers of the continued boom in North American import volumes.

“If this link continues going forward, it means that we should now begin to see growth rates for these other furniture components decline, as the furniture category itself has indeed seen a declining growth trend over 2021,” noted Sea-Intelligence.

The consumption boom driving container volumes showed no signs of abating in September. Whilst there was some element of decline in the growth rate, this was to a large degree driven by motor vehicles and not by typically containerised consumer commodities, according to the analysis.

“There is a trend of shifting from durable to non-durable goods though, but that does not materially alter the boom in container volumes either,” commented Murphy and pointed out that this means “we should not expect a decline in demand to ‘rescue’ the congestion and bottleneck situation, in the short to medium term.”