Danish research and analysis firm, Sea-Intelligence has conducted an investigation to examine whether the ongoing container demand boom in North America is sustainable, or whether and when it might come to an end.

“Historically, the rate of growth in spending in services has consistently exceeded that of goods,” said Sea-Intelligence, which used data from the US Bureau of Economic Analysis (BEA) to carry out the analysis.

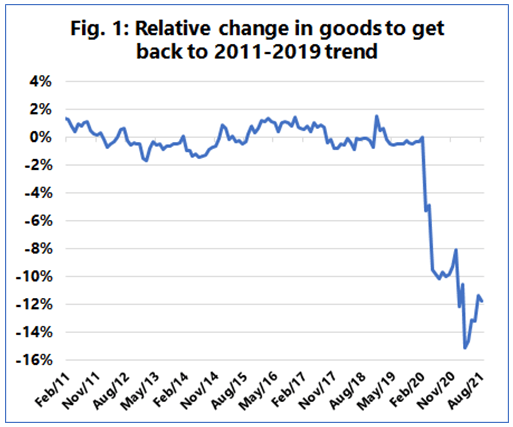

This change started in the spring of the previous year, due to the initial impact of the pandemic, where the deviation from the 60-year trend line was very quick, followed by a brief period of stagnation, and an even higher peak, touching nearly 8%, according to Sea-Intelligence.

“To see the level of decline in consumer spend needed to bring it back in line with the trend, we need to factor in the relative share of goods and services,” explained the company’s analysts.

When looking at the 60-year long term trend, the sale of goods would need to see a downwards correction of some 20% compared to the present level. However, as seen in the figure above, compared to the past decade, the sale of goods needs to decline by 15% over the peak impact in March 2021.

“There has already been some correction taking place until August 2021, where the ‘gap’ has been reduced to 12%,” stated Alan Murphy, CEO of Sea-Intelligence.

Indeed, over the past few months, the growth rate on spending on goods has been slowly declining. In the meantime, the spending on services has shown slow but consistent growth since the early pandemic shock, suggesting signs of consumer behaviour shifting towards services.

“The baseline assumption going forward must be that consumer spending patterns will normalise and the timing is much more difficult to ascertain, as this depends in part on the development of the pandemic itself,” noted Murphy, who went on to add, “However, that it might be instructive to look at the period after the financial crisis, where it took a little over two years from peak impact, until full reversal to the long-term trend.”

According to the analysis, the reversal might therefore not appear as a sudden shock to the container flows, but potentially as a more gradual correction taking place over a couple of years.

“There is no guarantee of this, as the current impact is caused by a forced pandemic imposition on behaviour, in which case, the transition might come faster,” noted Sea-Intelligence analysts.