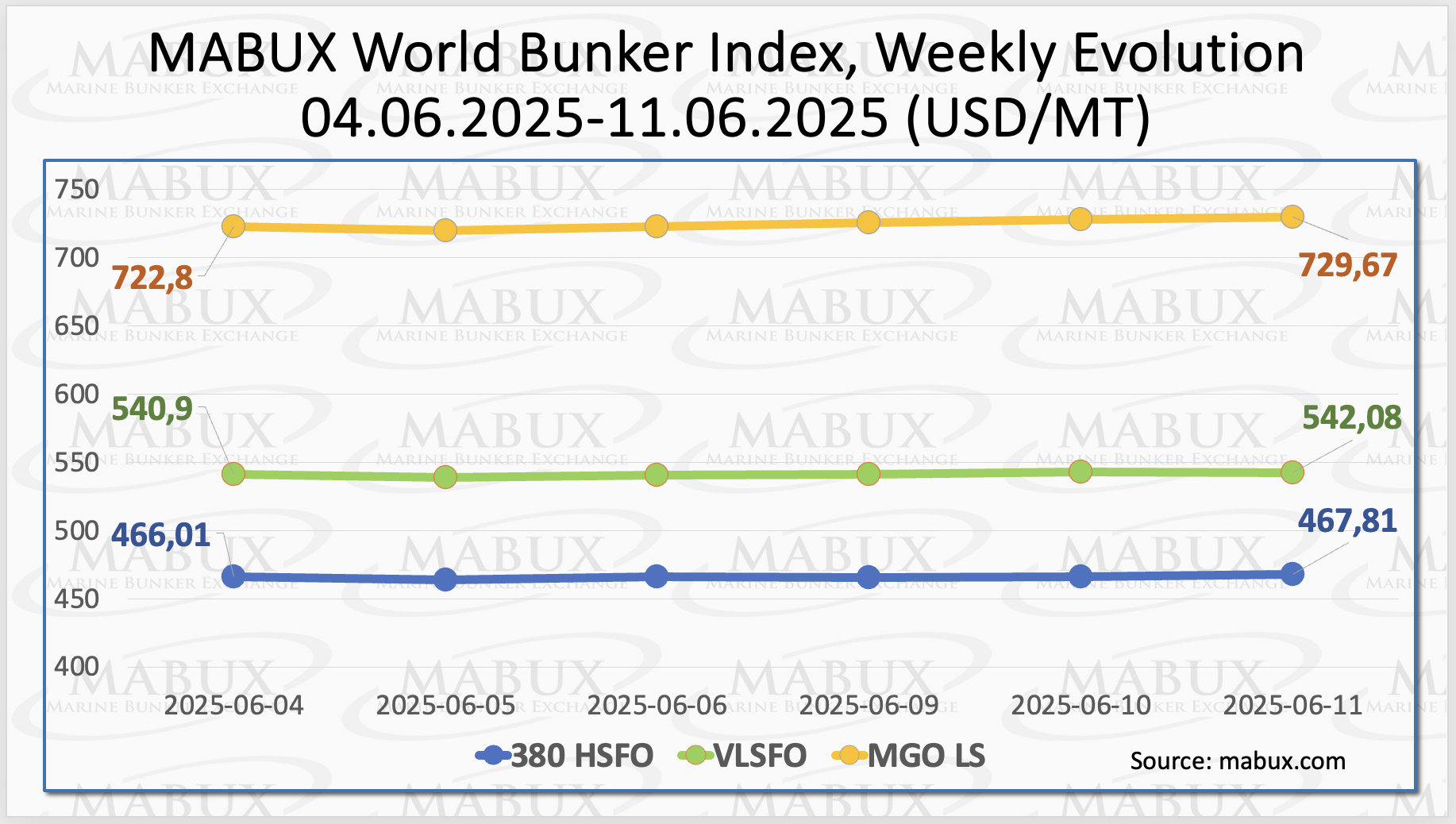

At the end of the 24th week of the year, the global bunker indices published by Marine Bunker Exchange (MABUX) continued their moderate upward trend.

The 380 HSFO index rose by US$1.80 to US$467.81/MT. The VLSFO index increased by US$1.18, reaching US$542.08/MT. The MGO index saw a larger gain, reaching US$729.67/MT.

“At the time of writing, the market was experiencing minor, multidirectional fluctuations,” said a MABUX representative.

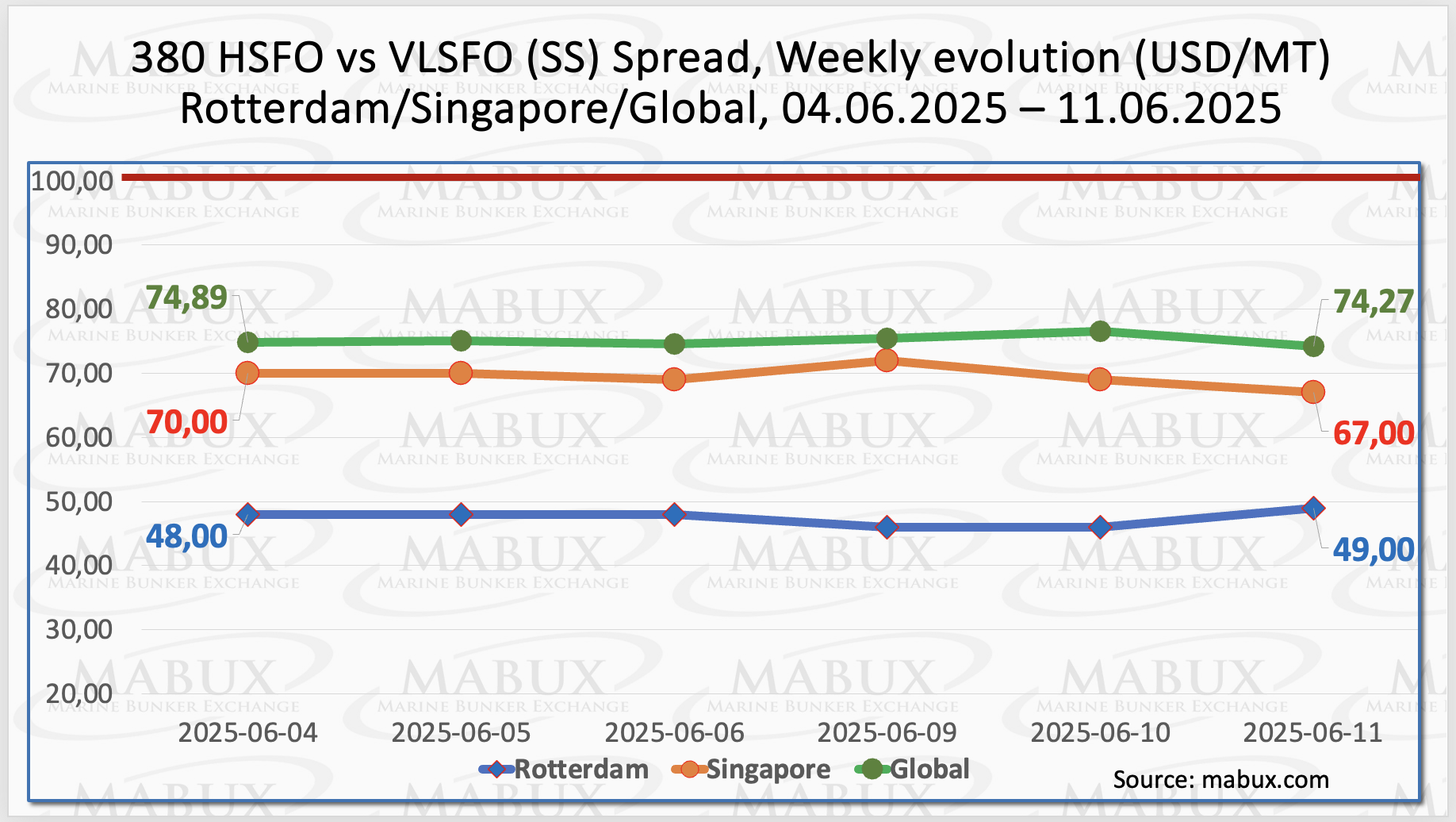

The MABUX Global Scrubber Spread (SS)—the price difference between 380 HSFO and VLSFO—decreased slightly by US$0.62 to US$74.27. However, the average weekly value of the index increased by US$2.45.

In Rotterdam, the SS Spread rose by US$1, reaching US$49. The port’s average weekly value also increased, up by US$2.67.

In Singapore, the 380 HSFO/VLSFO price difference declined by US$3 to US$67, while the average weekly value in the Asian port rose by US$4.17.

Overall, the dynamics of the global and port-specific SS Spread indices remain characterized by minor, multidirectional movements without a clear trend, according to the MABUX report.

VLSFO continues to offer greater cost-effectiveness compared to the 380 HSFO + Scrubber combination, as SS Spread values consistently remain below the US$100 breakeven mark.

Sergey Ivanov, Director of MABUX, commented that no significant changes in SS Spread dynamics are expected in the next week.

Europe’s heavy reliance on spot LNG is expected to continue through 2030. Although import volumes declined by 17% last year (22 bcm), the European Union (EU) has remained the world’s largest LNG importer since 2022, surpassing China and Japan.

Efforts are underway to diversify and expand LNG imports from Qatar and various African projects—moves that would boost demand for seaborne transport and support higher freight rates. Additionally, recent agreements between European buyers and Australian producers suggest that LNG shipments from Australia to Europe could begin in the near future.

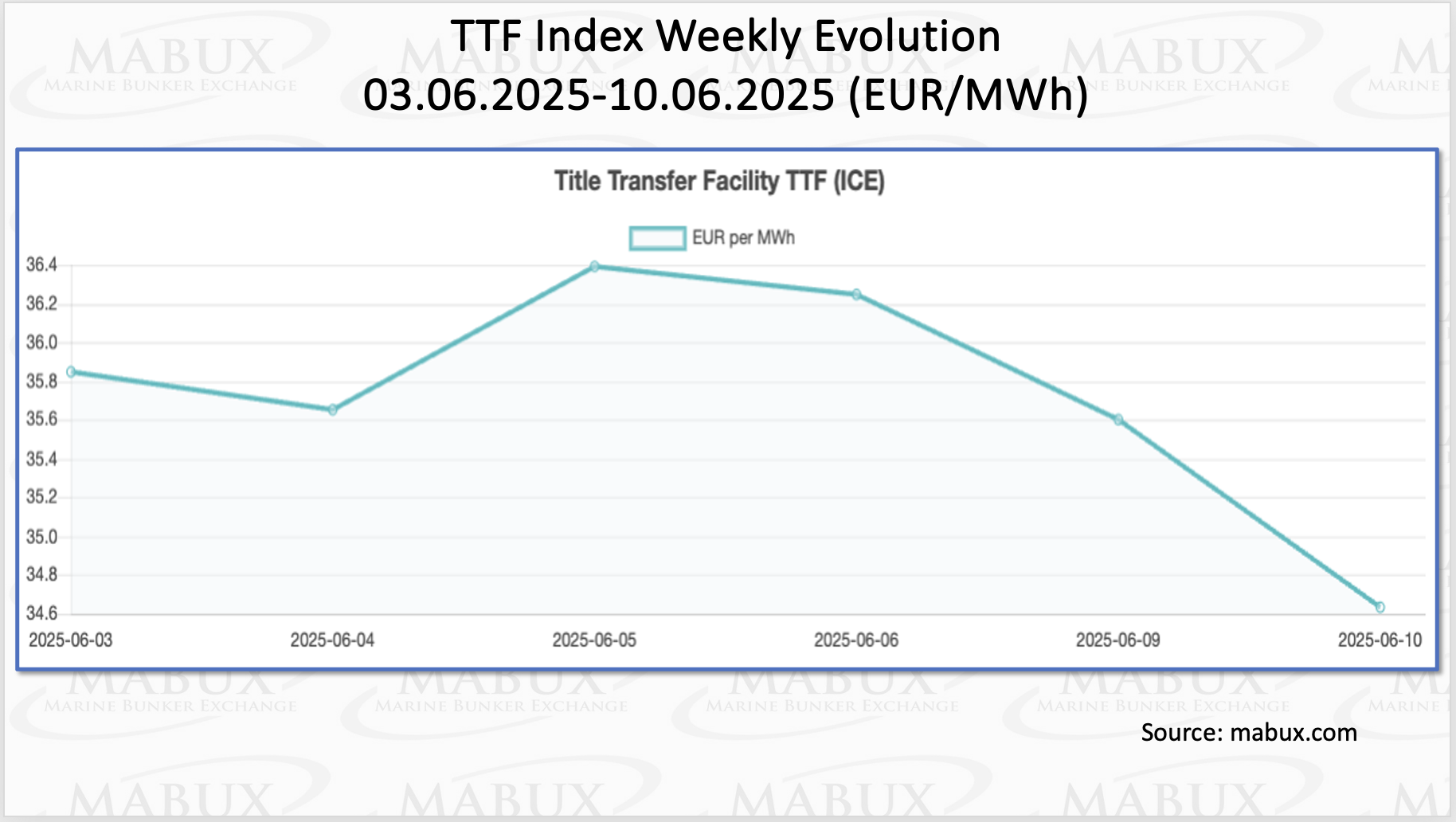

As of June 10, European regional gas storage facilities were 51.79% full—an increase of 2.59% from the previous week but a decrease of 19.54% compared to the beginning of the year (71.33%). The gradual replenishment of storage continues. By the end of Week 24, the European gas benchmark TTF continued its moderate decline, falling by €1.210/MWh to €34.638/MWh, down from €35.848/MWh the previous week.

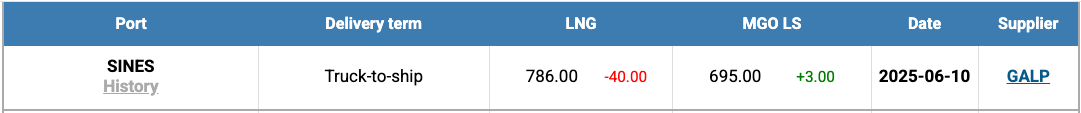

The price of LNG as a bunker fuel at the port of Sines in Portugal resumed its decline, dropping to US$786/MT by the end of the week. At the same time, the price gap between LNG and conventional fuel narrowed to US$91 in favor of conventional fuel. On June 10, MGO LS was quoted at US$695/MT in the port of Sines.

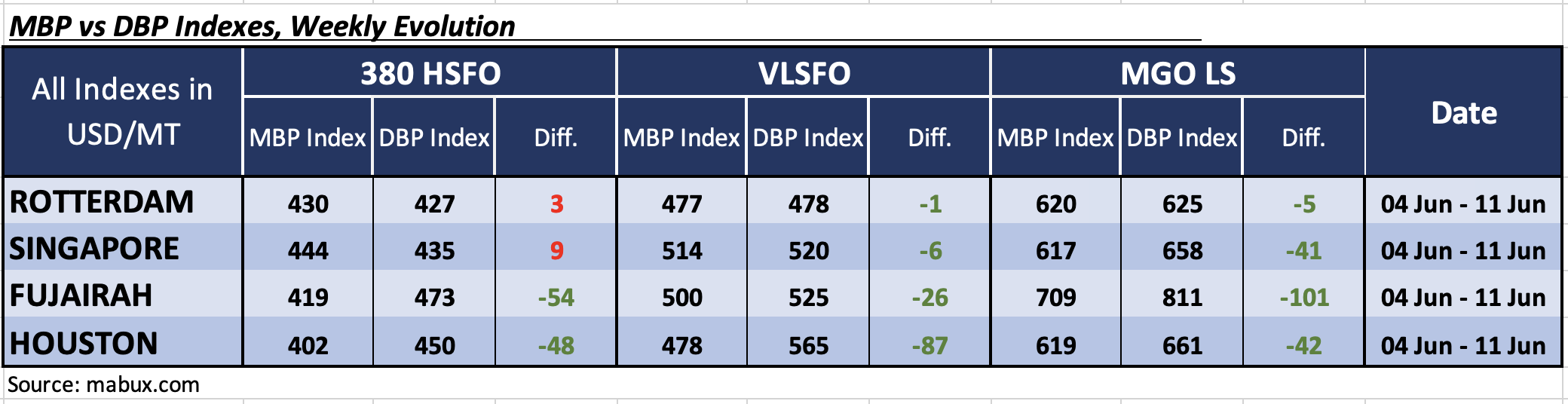

Over the week, the MABUX Market Differential Index (MDI)—which reflects the correlation between market bunker prices (MBP) and the MABUX Digital Bunker Benchmark (DBP)—revealed the following trends across the 380 HSFO and VLSFO segments:

- 380 HSFO segment: Rotterdam and Singapore remained in the overvalued zone, with the average weekly MDI values declining by 8 and 6 points, respectively. In contrast, Fujairah and Houston remained undervalued, with average MDI values increasing by 8 and 18 points, respectively. Notably, Rotterdam and Singapore MDIs are now close to the 100% correlation level between MBP and DBP.

- VLSFO segment: Rotterdam moved into the undervalued zone, meaning all four ports are now undervalued. The average MDI values rose by 5 points in Rotterdam, 3 points in Singapore, 11 points in Fujairah, and 10 points in Houston. Both Rotterdam and Singapore are approaching 100% correlation between MBP and DBP.

- MGO LS segment: Rotterdam also transitioned to the undervalued zone, joining Singapore, Fujairah, and Houston. The average weekly MDI values increased by 15 points in Rotterdam, 7 in Singapore, 19 in Fujairah, and 12 in Houston. Rotterdam’s MDI remains close to the 100% correlation mark, while Fujairah’s MDI has surpassed US$100.00.

Sergey Ivanov, Director of MABUX, said: “The overall market structure has shifted further toward undervaluation. Rotterdam moved into the undervalued zone in both the VLSFO and MGO LS segments, reinforcing the prevailing trend. The dominance of undervalued bunker fuel in the global market is expected to persist into the coming week.”

Ivanov added: “We expect the global bunker market to maintain a moderate upward trend, with no significant sharp fluctuations anticipated.”