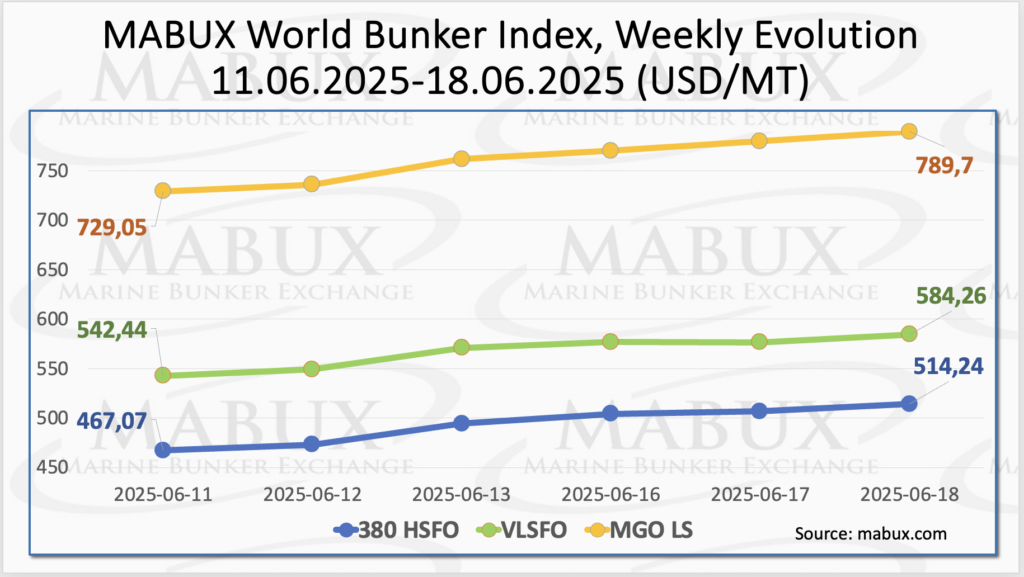

At the close of the 25th week of the year, the global bunker indices published by Marine Bunker Exchange (MABUX) recorded a sharp increase, driven by the escalating conflict in the Middle East.

The 380 HSFO index surged to US$514.24/MT, the VLSFO index rose to US$584.26/MT and the MGO index increased to US$789.70/MT.

“As of this writing, the upward trend continues to dominate the global bunker market,” commented Sergey Ivanov, Director of MABUX.

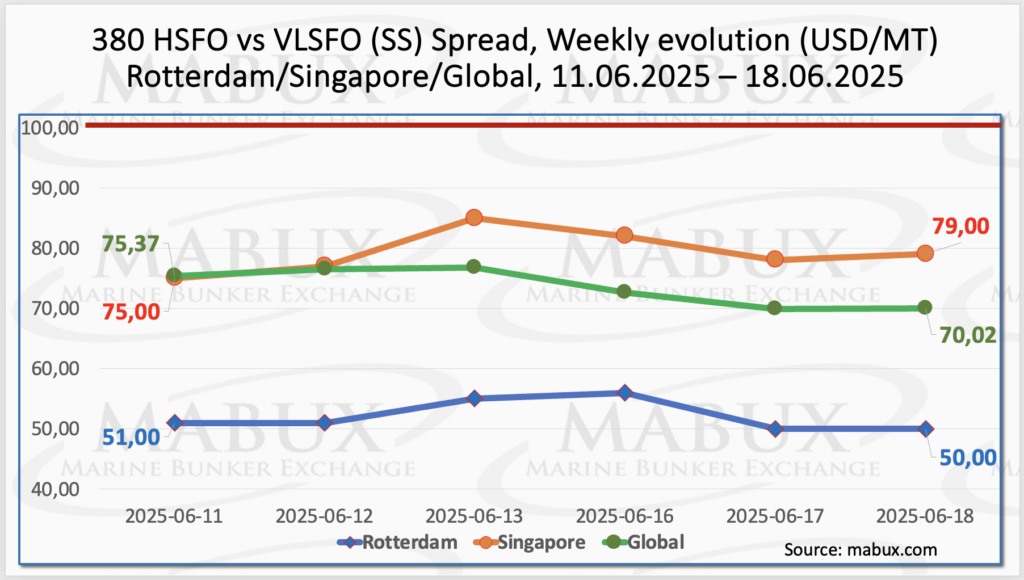

The MABUX Global Scrubber Spread (SS)—the price difference between 380 HSFO and VLSFO—narrowed by US$5.35, declining to US$70.02. The weekly average also fell slightly, down US$1.64.

In Rotterdam, the SS Spread decreased by US$1 to US$50, although the weekly average at the port rose by US$4.67. Conversely, in Singapore, the SS Spread widened by US$4 to US$79.00, with the weekly average gaining US$9.83.

“Minor and multidirectional fluctuations—without a clear upward or downward trend—continue to define the global and port-level SS Spread dynamics,” noted Ivanov.

At current levels, conventional VLSFO remains the most cost-effective option compared to 380 HSFO combined with a scrubber, with SS Spread values consistently below the breakeven threshold of US$100, while no significant changes in SS Spread dynamics are expected in the coming week.

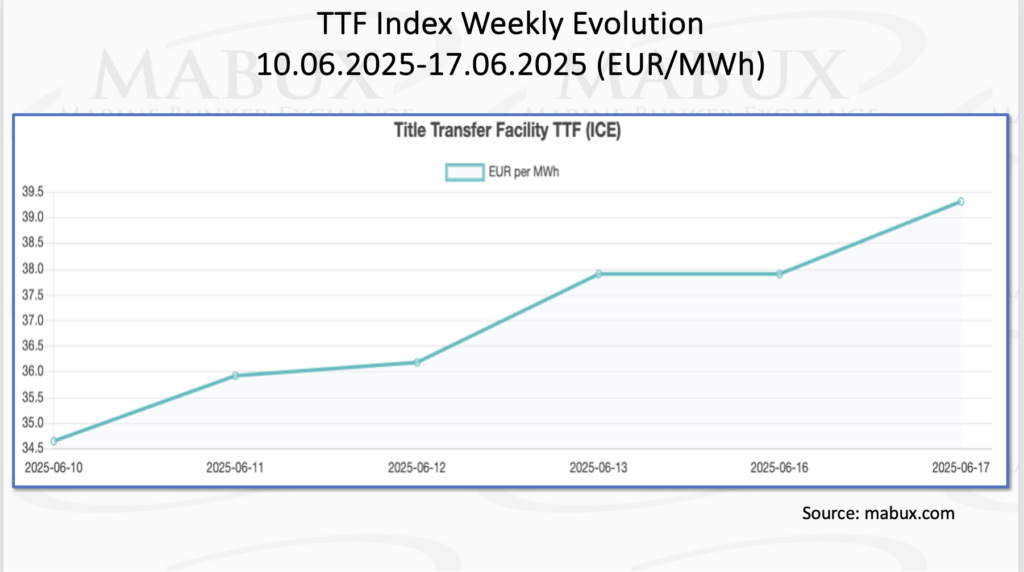

The European Parliament and European Union (EU) member states have tentatively agreed to ease natural gas storage requirements, permitting a 10-percentage-point deviation from the 90% fill target. The move addresses concerns from several major gas-consuming countries, which warned they may need to subsidise storage in unfavourable market conditions or miss the targets altogether. Additionally, EU countries are proposing to make the mandatory 90% storage target applicable at any point between 1 October and 1 December, rather than by the current 1 November deadline.

As of June 17, European regional gas storage facilities were 54.05% full—an increase of 2.26% compared to the previous week, but 17.28% lower than at the start of the year (71.33%). The gradual refilling of storage sites continues.

By the end of Week 25, the European gas benchmark TTF showed a clear upward movement, rising by €4.671/MWh to €39.309/MWh, compared to €34.638/MWh the previous week.

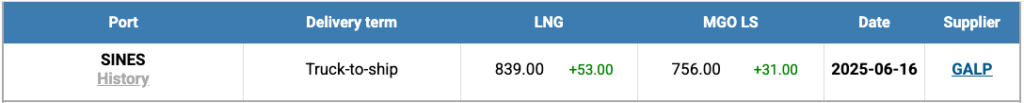

The price of LNG as a bunker fuel at the port of Sines in Portugal resumed its upward trend by the end of the week, increasing by US$53 to reach US$839/MT, compared to US$786/MT the previous week. At the same time, the price gap between LNG and conventional fuel narrowed to US$83 in favor of conventional fuel, down from US$91 the week before. On June 16, MGO LS was quoted at US$756/MT at the port of Sines.

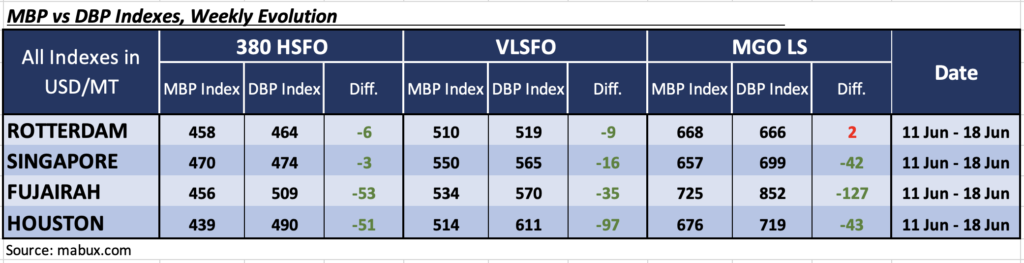

At the end of Week 25, the MABUX Market Differential Index (MDI)—which reflects the correlation between market bunker prices (MBP) and the MABUX Digital Bunker Benchmark (DBP)—showed the following trends across the 380 HSFO, VLSFO, and MGO LS segments:

- 380 HSFO segment: Rotterdam and Singapore moved into the undervalued zone, resulting in all four key ports—Rotterdam, Singapore, Fujairah, and Houston—being assessed as undervalued. Weekly average MDI values rose by 9 points in Rotterdam, 12 points in Singapore, and 3 points in Houston, while decreasing by 1 point in Fujairah. The MDI readings for Rotterdam and Singapore remained close to the 100% correlation level between MBP and DBP.

- VLSFO segment: All four ports—Rotterdam, Singapore, Fujairah, and Houston—continued to be undervalued. Weekly average MDI values increased by 8 points in Rotterdam, 10 in Singapore, 9 in Fujairah, and 10 in Houston. Notably, Rotterdam reached a 100% correlation between MBP and DBP.

- MGO LS segment: Rotterdam returned to the overvalued zone, becoming the only overvalued port in this segment. Its average MDI rose by 7 points. The other three ports remained undervalued, with weekly average MDI increases of 11 points in Singapore, 26 in Fujairah, and 1 in Houston. Rotterdam’s MDI held at 100% correlation, while Fujairah continued to record an MDI value consistently above $100.00.

Overall Market Trend: The balance continues to tilt toward undervaluation. In the 380 HSFO segment, both Rotterdam and Singapore shifted into the undervalued zone, while in the MGO LS segment, Rotterdam re-entered the overvalued category. Despite this, the overall trend of undervaluation remains dominant in the global bunker market and is expected to persist into the following week.

“We expect the steady uptrend in the global bunker market to persist, driven by continued volatility stemming from the escalating conflict in the Middle East,” said Sergey Ivanov, Director of MABUX.