U.S. container imports declined in November as shipments from China dropped sharply and seasonal slowdowns took hold, according to Descartes’ December Global Shipping Report.

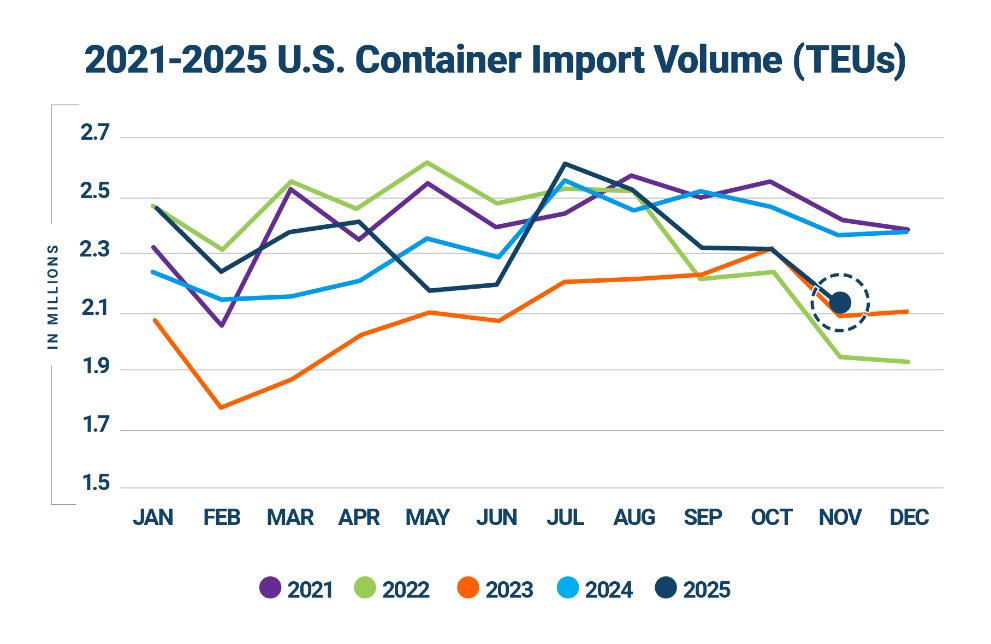

Imports totaled 2.18 million TEUs in November. That figure was 5.4% lower than October and 7.8% below the same month last year. Despite the decline, November ranked as the fourth-strongest November on record, pointing to steady underlying demand.

Source: Descartes Datamyne™

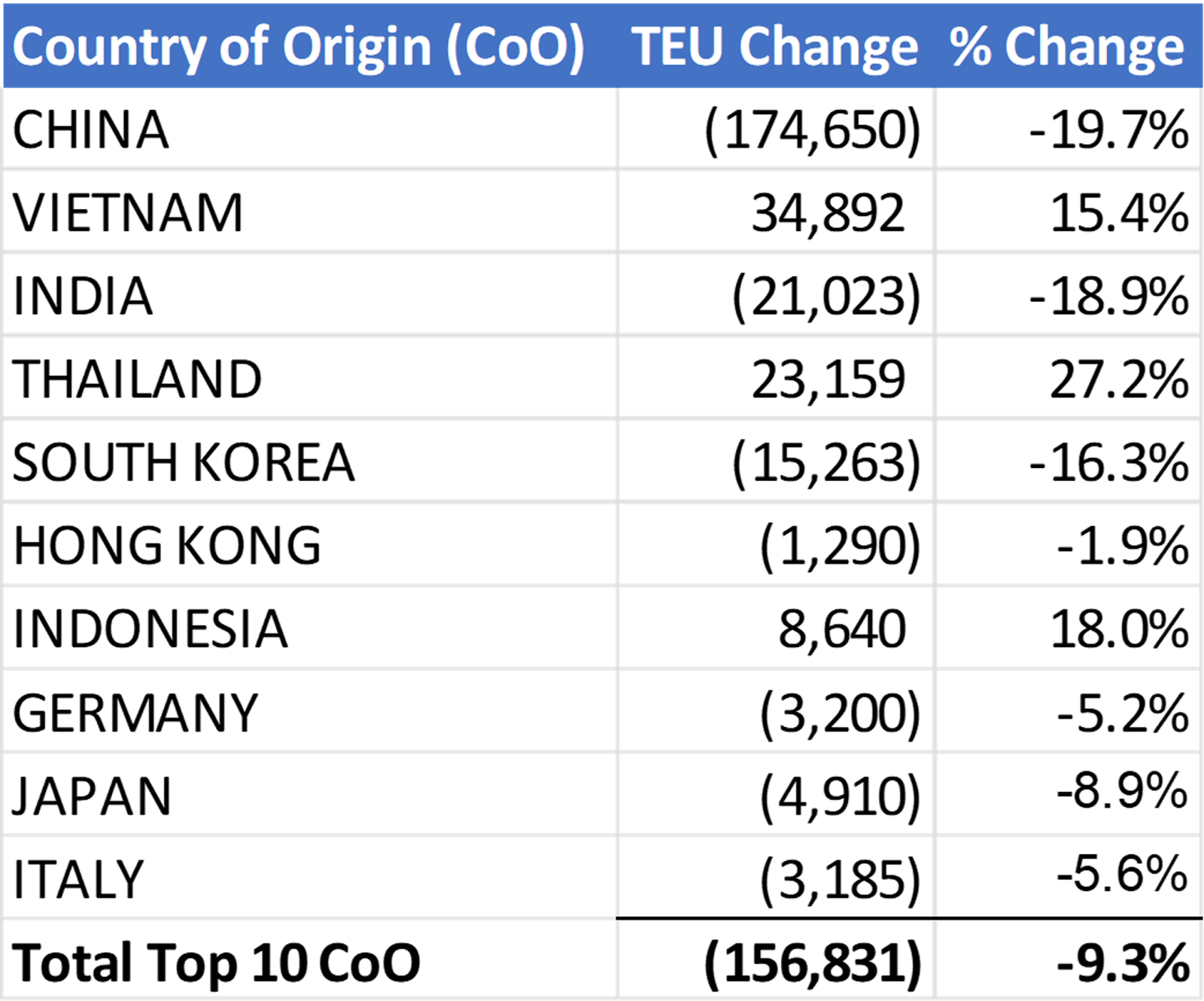

China was the main driver of the national slowdown. Imports from China fell 11.3% month over month and 19.7% year over year. The drop accounted for the majority of the overall decline.

Shipments from several other key sourcing countries also fell compared with last year. Volumes from India, South Korea, Japan, Germany, Italy, and Hong Kong all declined in November.

Source: Descartes Datamyne™

In contrast, Southeast Asia showed strong growth. U.S. imports from Vietnam increased 15.4%, while Thailand jumped 27.2% and Indonesia rose 18%. Still, the gains did not offset the sharp fall in China volumes.

Port performance softened slightly in November. Transit times rose for the second straight month at most major U.S. ports. However, Descartes said there were no signs of widespread congestion.

For the first eleven months of 2025, U.S. container imports were just 0.1% higher than last year. That compares with growth rates near 10% at the start of the year. The narrowing gap points to cooling demand and the fading impact of early-year frontloading.

Descartes said importers remain cautious as uncertainty continues to shape trade flows. Ongoing legal challenges to U.S. tariffs, geopolitical tensions, and carrier avoidance of the Red Sea are adding time and cost to supply chains.

“While recent U.S.-China agreements eased short-term pressure, long-term uncertainty remains,” said Jackson Wood, Director of Industry Strategy at Descartes. “Geopolitical risk, trade policy questions, and Red Sea disruptions continue to influence importer behavior as the year ends.”