Introduction to the Rankings

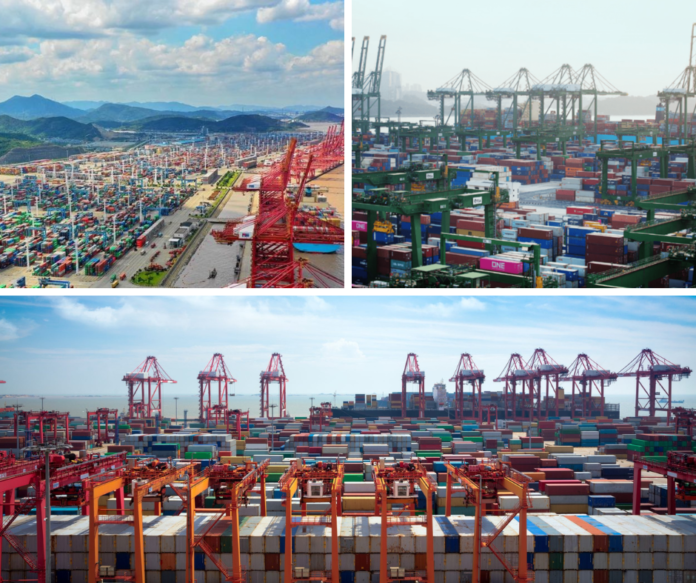

The world’s top container ports continue to drive global trade, with Asian hubs leading the way, according to DynaLiners Millionaires report, that spotlights 157 ports. Each of them handled over one million TEU. These “millionaire” ports account for 88% of global container throughput. The total volume reached 820.6 million TEU, marking an 8% increase from 2023.

Asian ports dominate the rankings. China secures six of the top 10 spots. Data includes TEU handled in 2024, growth rates, and comparisons to prior years.

The Top 10 Ports

- Shanghai, China – 51.5 million TEU (5% growth from 49.2 million in 2023; 47.3 million in 2022). Shanghai holds the crown again. It drives massive export flows.

- Singapore – 41.1 million TEU (5% growth from 39.0 million in 2023; 37.3 million in 2022). Singapore thrives as a transshipment hub. Strategic location boosts its edge.

- Ningbo, China – 39.3 million TEU (11% growth from 35.3 million in 2023; 33.4 million in 2022). Ningbo surges ahead. Investments in tech fuel its rise.

- Shenzhen, China – 33.4 million TEU (12% growth from 29.9 million in 2023; 30.0 million in 2022). Shenzhen excels in high-tech exports. Rapid expansion continues.

- Qingdao, China – 30.9 million TEU (7% growth from 28.8 million in 2023; 25.7 million in 2022). Qingdao focuses on sustainability. Rail links enhance efficiency.

- Guangzhou, China – 26.1 million TEU (4% growth from 25.1 million in 2023; 24.6 million in 2022). Guangzhou serves the Pearl River Delta. Steady performance marks its year.

- Busan, South Korea – 24.4 million TEU (6% growth from 23.0 million in 2023; 21.8 million in 2022). Busan connects Asia to the world. Non-Chinese leader in the region.

- Tianjin, China – 23.3 million TEU (5% growth from 22.2 million in 2023; 21.0 million in 2022). Tianjin supports Beijing’s imports. Resource handling stands out.

- Jebel Ali Port, Dubai, UAE – 15.5 million TEU (7% growth from 14.5 million in 2023; 14.0 million in 2022). Dubai breaks the Asian streak. Gateway for Middle East trade.

- Port Kelang, Malaysia – 14.6 million TEU (4% growth from 14.1 million in 2023; 13.2 million in 2022). Port Klang aids Southeast Asia. Consistent growth noted.

Global Trends and Insights

Global throughput reached 937 million TEU in 2024. That’s a 7% increase. Newcomers like Djibouti enter the millionaire club. Some ports, like Jeddah, see drops from tensions.

China’s dominance shows its trade strength. Ports push tech and green efforts.