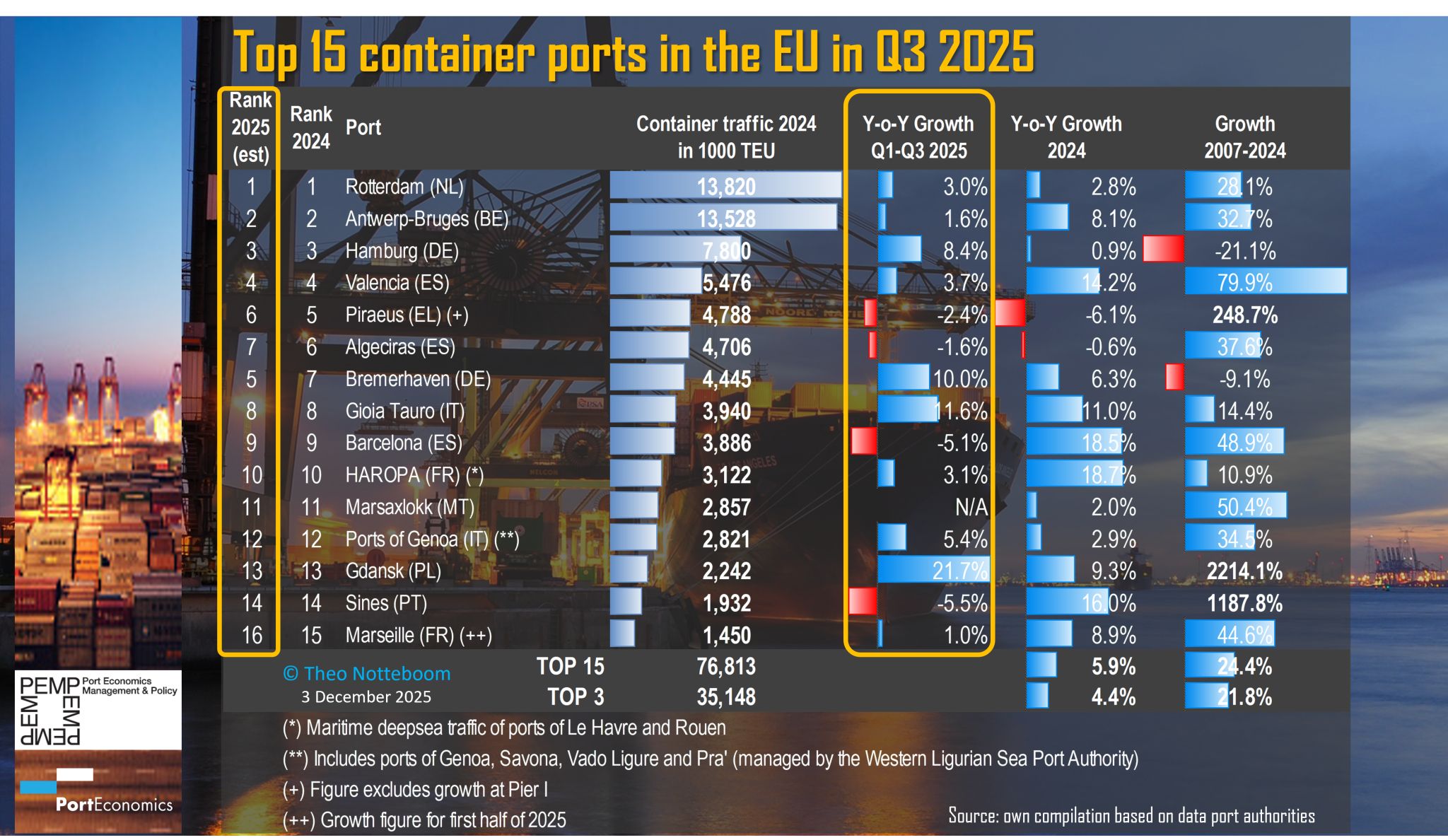

PortEconomics member Theo Notteboom has published a new analysis covering the performance of the top 15 EU container ports during the first nine months of 2025. The report confirms a change in growth patterns after strong recovery in 2024, which had followed a difficult year in 2023.

Gdansk, Gioia Tauro and Bremerhaven show double-digit growth

Only three ports achieved double-digit growth in 2025 so far. Gdansk leads the market with an impressive 21.7% increase, helped by the launch of a new terminal at the Baltic Hub. Gioia Tauro continued to grow thanks to ongoing investment and large-scale operations from MSC. Bremerhaven also passed the 10% mark and is expected to move from seventh to fifth position in the annual ranking by the end of the year.

Hamburg posts strong performance

Hamburg reported 8.4% year-on-year growth, outperforming both Rotterdam and Antwerp-Bruges. This result marks a clear turnaround after several years of slower progress. Growth was supported by more port calls under new alliance structures, especially Gemini, and the arrival of foreign terminal operators.

The positive trend shows renewed strength in the German port system. Wilhelmshaven handled its one-millionth TEU on 18 September 2025, and Bremerhaven also recorded strong results.

Southern Europe slows after a record 2024

Several Southern European ports struggled to match their exceptional 2024 performance. Last year’s results were boosted by vessel rerouting caused by the Red Sea crisis.

Valencia recorded a modest 3.7% increase. Both Algeciras and Barcelona saw declines in container volumes. Sines in Portugal also dropped from its 2024 peak.

French and Italian ports show mixed trends

French ports HAROPA and Marseille reported weaker growth than in 2024. The Ports of Genoa delivered a stronger result, improving from 2.9% growth in 2024 to 5.4% in the first nine months of 2025.

Piraeus in Greece remained negative after a subdued 2024. Red Sea disruptions continued to play a role in its performance.

Las Palmas rises and Marseille exits top rankings

Marseille is expected to fall out of the top 15 EU container ports, with Las Palmas moving ahead. The Canary Islands hub recorded a robust 15.7% increase in container traffic during the first three quarters of 2025, supported by a total throughput of 1.32 million TEU in 2024.

Additional strong performers outside the top 15

Several EU ports outside the official top 15 are expected to surpass one million TEU in 2025. These include Wilhelmshaven, La Spezia, Koper, Klaipeda, Gdynia and Constanta. The trend underlines the wider distribution of container traffic across Europe.