There are several important container hubs in Europe, which are key points for the global supply chain industry. The container sector is increasingly developing in the majority of European ports in the latest years, enhancing the competitiveness between neighboring hubs.

Container News has compiled container volume data for 2022 and presents the list of the busiest container ports in Europe for the last year.

- Port of Rotterdam, The Netherlands – 14.4 million TEUs (-5.5%)

The Port of Rotterdam remains at the first spot of the European container ports for another year, nearing 14.5 million TEUs in 2022. The overall cargo throughput of the Dutch port remained unchanged in the previous year, reaching around 468 million metric tonnes.

Meanwhile, the major European port achieved improved financial results in the last year, with revenue rising by 6.9% to US$876 million, operating results before interest, depreciation and taxes (EBITDA) increasing by 6.1% to US$576 million, but net result remaining unchanged at US$262.3 million.

2. Port of Antwerp-Bruges, Belgium – 13.5 million TEUs (-5.2%)

In second place we find the port Antwerp-Bruges which handled 13.5 million TEUs with its container traffic falling by 5.2% compared to 2021 figures.

It is important to note that the two Belgian ports of Antwerp and Zeebrugge completed their merger in April 2022 with the Port of Antwerp-Bruges officially commencing operations.

3. Port of Hamburg, Germany – 8.3 million TEUs in 2022 (-5.1%)

Germany’s major port is on the podium with 8.3 million TEUs from January to December 2022, despite the 5.1% year-on-year decrease.

There was no such gap between the Hamburg port’s imports and exports in the previous year. The German port reported 4.2 million import TEUs and 4.1 million export TEUs, which fell by 6.1% and 4.1%, respectively.

It is important to note the final recent agreement between the Port of Hamburg and COSCO about a minority stake acquisition in Container Terminal Tollerort GmbH (CTT) by the Chinese shipping giant, which caused some concerns in the German government over China’s impact on the country’s port industry.

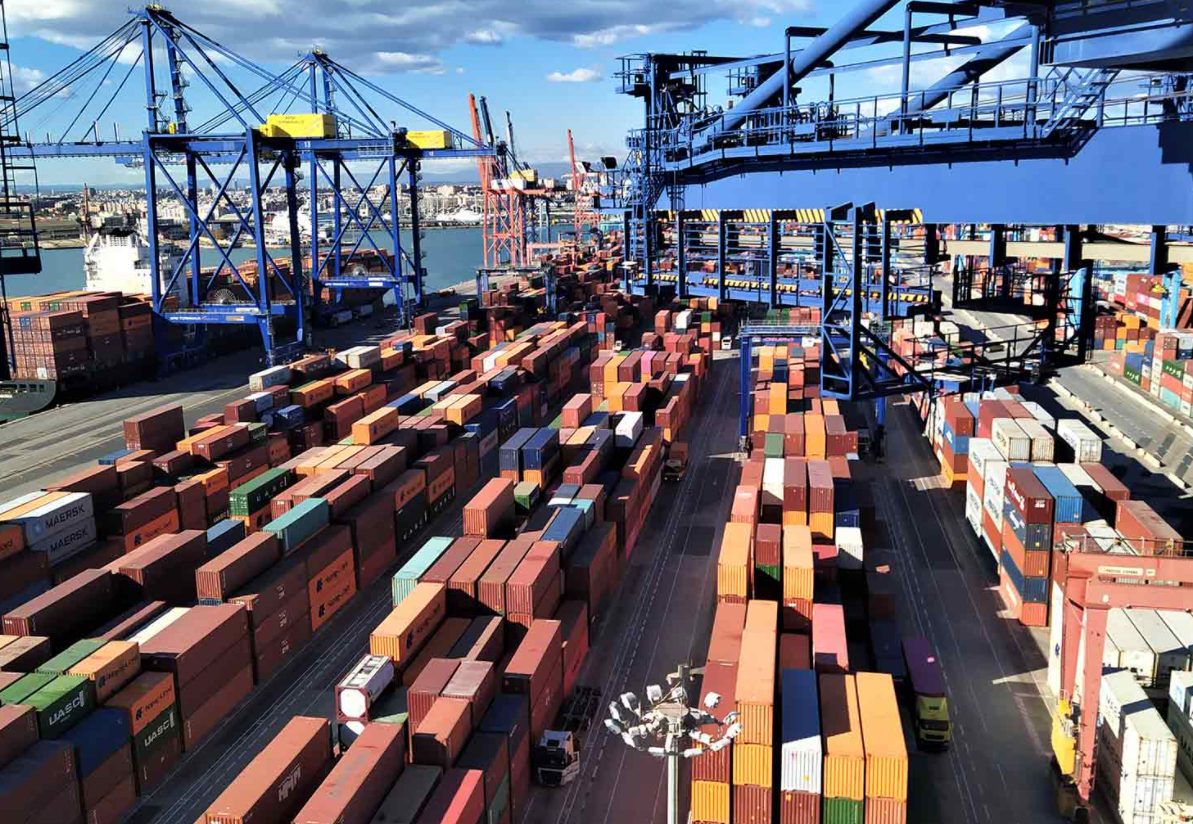

4. Port of Valencia, Spain – 5.1 million TEUs in 2022 (-9.4%)

In fourth place, the Port of Valencia handled 5.1 million TEUs in 2022 seeing its box volumes decreased by 9.4% compared to the previous year’s levels.

The number of transit containers in Valencia in 2022 fell by 16.91% to 2,059,665 units, while the number of empty boxes was down 5.54%.

In the same period, 79,365,321 tonnes of products were shipped via the Spanish port, translating to a 6.92% decline.

5. Port of Piraeus, Greece – 5 million TEUs in 2022 (-6.0%)

The Port of Piraeus handled 5 million TEUs in 2022 and remained in fifth place of the European container port ranking despite the year-on-year 6% decrease.

On the other hand, Piraeus Port Authority (PPA) reported improved financial results for the previous year, reporting a 26.2% rise in its turnover reaching US$208 million.

It is noteworthy that the Greek port has achieved immense growth in the latest years after COSCO’s acquisition of the majority stake in the port back in 2016. In particular, Port of Piraeus has marked an astonishing 264% container growth from 2007 to 2022, but there was an 11.5% container decrease in the last three years, according to PortEconomics.

6. Port of Algeciras, Spain – 4.8 million TEUs in 2022 (-0.8%)

Although the Port of Algeciras reported a relatively steady container throughput in 2022, compared to 2021 figures, the Spanish port gained one spot in the ranking due to the significant drop in container volumes of the Port of Bremerhaven.

Algeciras Port handled 4.8 million TEUs in 2022, which represents a slight 0.8% contraction compared with the previous year’s volumes.

7. Port of Bremerhaven, Germany – 4.6 million TEUs in 2022 (-8.9%)

As we mentioned before, the German port fell to seventh place after an important 8.9% cut in its container volumes. Port of Bremerhaven saw 4.6 million TEUs and 47.3 million tonnes in 2022.

The Port of Bremerhaven, which is the second port of Germany included in the list, has also suffered a container decline over the last three years, as it has seen its box volumes decline by 5.9% over 2019.

8. Port of Barcelona, Spain – 3.5 million TEUs (-0.2%)

In eighth place, the Port of Barcelona handled 3.5 million TEUs in 2022 reporting a steady trend compared to 2021 box numbers.

The Port of Barcelona passed the 70.9 million-tonne mark in total traffic during 2022, representing growth of 6.9%, marking a new record: following the strong recovery of the previous year, this year saw an increase on the previous record figure of 67.8 million tonnes that was achieved in 2018.

9. Port of Gioia Tauro, Italy – 3.4 million TEUs in 2022 (+7.1%)

The Italian port is the first one on the list that has achieved a year-on-year container growth. Port of Gioia Tauro Port handled 3.4 million TEUs in 2022, which translates to a 7.1% increase compared to 2021 box numbers.

Similarly, the Italian container hub has also recorded a huge growth of 33.6% in its container volumes in the period 2019-2022, when the majority of ports reported container volume shrinkage due to the Covid-19 pandemic.

10. HAROPA Port, France – 3.1 million TEUs in 2022 (+1%)

In tenth place, HAROPA Port handled 3.1 million TEUs in 2022, marking a 1% increase over 2021, becoming the second port on the list with higher box throughput compared to the previous year.

HAROPA Port, a port complex in France including the ports of Le Havre, Rouen and Paris, reported a maritime throughput of 85.1 million tonnes for 2022, representing a slight year-on-year increase of 2%.