Weekly container vessel capacity departing a region often exhibits significant variability, as vessel capacities can differ even within a single-liner service.

“These weekly fluctuations can be quite drastic, especially during Chinese New Year and Golden Week, which makes seeing the underlying trends quite challenging,” stated Alan Murphy, CEO of Sea-Intelligence.

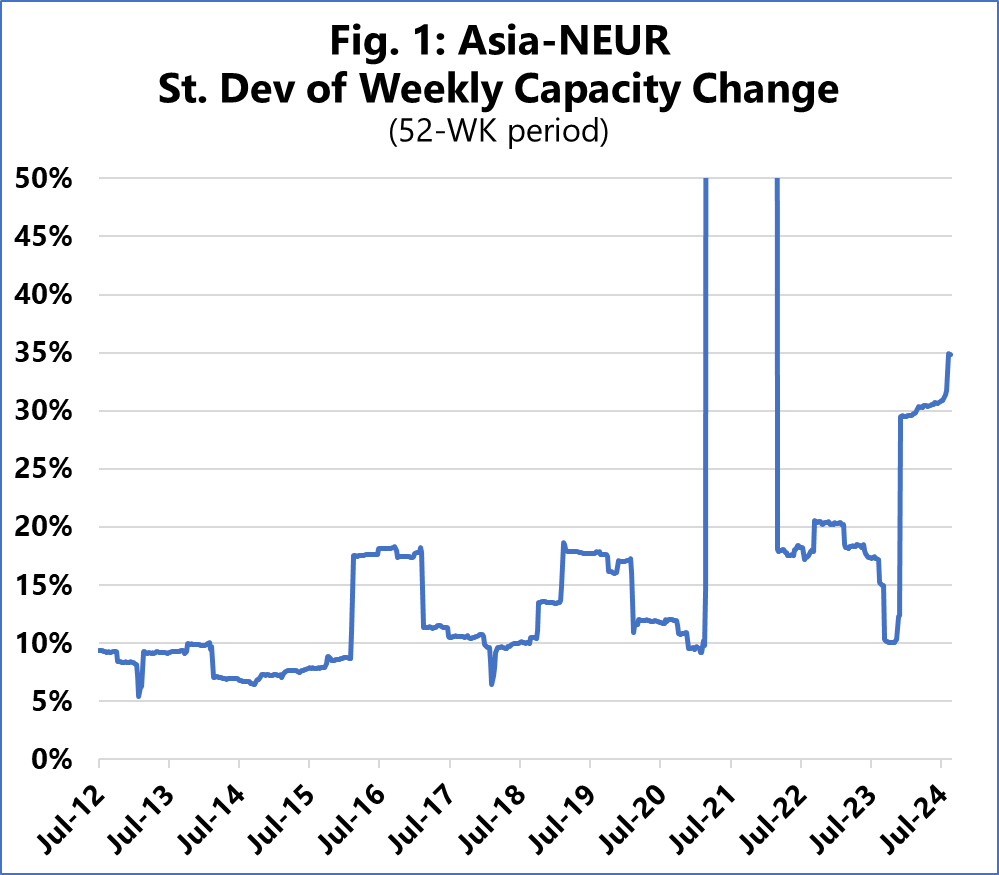

To mitigate these seasonal effects and better understand the true extent of weekly capacity fluctuations, we calculated the standard deviation of the weekly changes in capacity over a rolling 52-week period. For the Asia-North Europe route, this is illustrated in Figure 1.

“We have truncated the y-axis, so the longer-term data does not get dwarfed by the pandemic-induced spike,” noted Murphy.

The data reveals that volatility in vessel capacity on the Asia-North Europe trade has significantly increased over the past decade. Previously, the fluctuation was relatively stable at around 10% before the pandemic, but it has now tripled in magnitude. This suggests that shippers can no longer rely on a consistent level of capacity in the Asia-North Europe trade, emphasizing the need for enhanced contingency planning even when scheduled capacity appears sufficient.

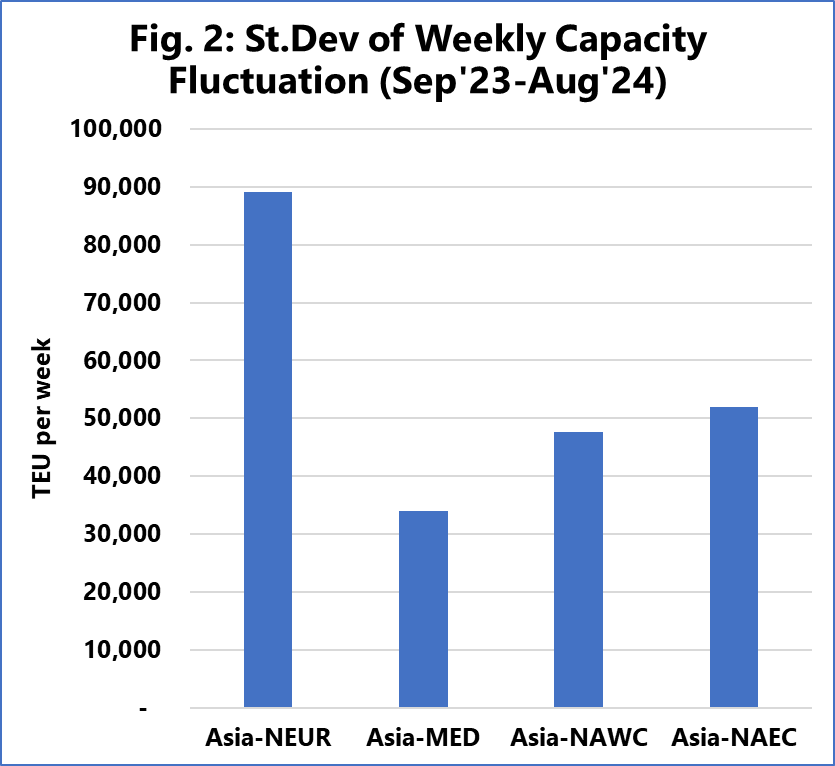

In contrast, the Transpacific trades have not experienced fluctuations as severe as those in Asia-North Europe. Specifically, the Asia-North America West Coast route currently exhibits greater stability in the weekly capacity offered to shippers, as shown in Figure 2.

Over 52 weeks from September 2023 to August 2024, the standard deviation of weekly capacity on the Asia-North Europe route is nearly 90,000 TEUs.

Meanwhile, the two Transpacific routes have a standard deviation of around 50,000 TEUs per week, and the Asia-Mediterranean route sees a standard deviation of 34,000 TEUs per week.