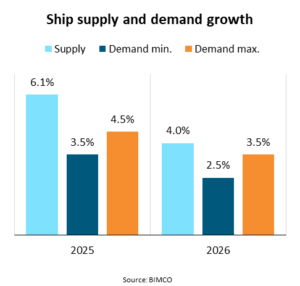

“We forecast a stable demand outlook for the container shipping sector in line with our previous report despite the uncertainties introduced by new US trade policies. We expect the supply/demand balance to weaken only slightly in 2025 and 2026, as our ship demand growth forecast now excludes a return to normal Red Sea and Suez Canal routings,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.

The macroeconomic environment remains uncertain, with significant trade policy changes and geopolitical tensions affecting market conditions. In April, the IMF reduced its global economic growth forecast to 2.8% for 2025 and 3.0% for 2026, a decrease of 0.5 and 0.3 percentage points, respectively.

Particularly the growth outlook for North America has been lowered due to the increase of US import tariffs.

“Despite the weaker economic outlook, cargo volumes during the first four months of the year have been strong and grown 5.1% YoY,” says Rasmussen.

Front-loading of cargo to the US to avoid the higher import tariffs threatened for later in the year has contributed to this growth. However, cargo volumes to four out of seven regions have grown even faster.

For the rest of the year, we have lowered the North America import cargo volume growth forecast as we expect the second half of 2025 to be weaker due to the front-loading of cargo during the first half of the year. We now forecast an average annual growth rate for North American imports of 1.6% during 2025-2026, the lowest among all regions.

On the other hand, we have lifted our 2025 growth forecast for volumes into the Europe & Mediterranean region. Volumes to the region have grown 7.3% during the first four months of the year and economic conditions are improving. Lower inflation, lower interest rates, lower unemployment than before COVID and a stronger euro are all contributing to a brighter outlook.

“Overall, the container shipping market is navigating through a complex landscape of trade policies, economic conditions, and geopolitical tensions. Significant demand uncertainties therefore still exist. As an example, we estimate that a return to normal routings through the Red Sea and Suez Canal would lower ship demand by 10%. In our base case, we expect weakening of the supply/demand balance during the second half of 2025 and expect freight rates to retreat accordingly. In 2026, we anticipate a further, albeit less pronounced, weakening of freight rates and the supply/demand balance,” says Rasmussen.

Highlights: