As of mid-2025, the trade lane connecting North Europe and the West Coast of South America remains remarkably stable, with six active services, the same number and structure as in 2024, according to DynaLiners.

Despite broader volatility in global shipping, this corridor has seen only marginal shifts in ship size and annual trade capacity.

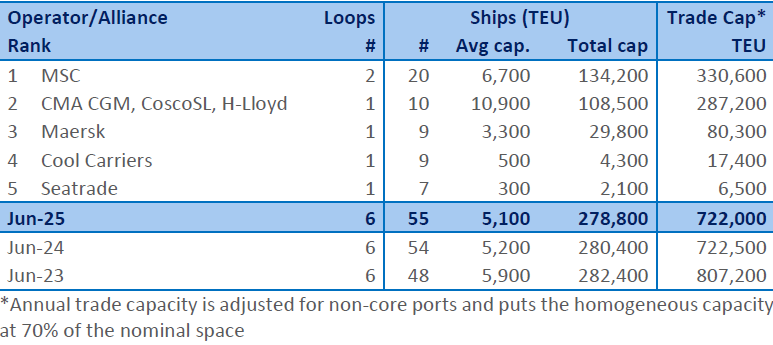

MSC leads the market with a total annual trade capacity of 330,600 TEU across two services, followed by a joint operation from CMA CGM, Cosco Shipping Lines, and Hapag-Lloyd. Maersk holds the third position.

Two niche services are also maintained by Seatrade and Cool Carriers, both conventional reefer operators transporting containers on deck. Notably, Cool Carriers continues to run its specialized service between Ecuador and St. Petersburg.

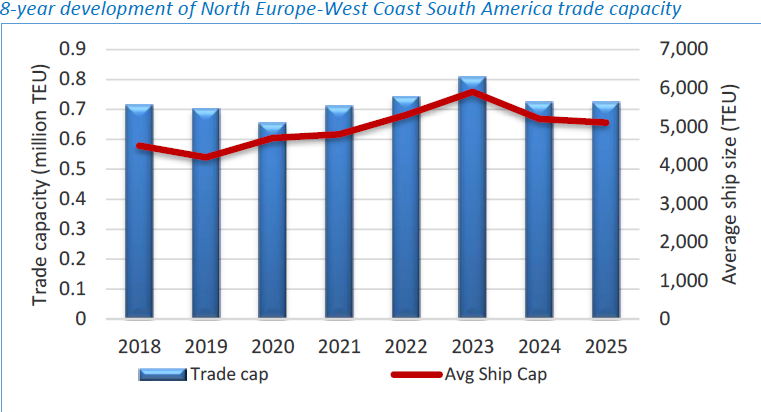

A look at the data in historical context reveals that after peaking at 807,200 TEU in 2023, total annual trade capacity has declined and stabilized at 722,000 TEU. Concurrently, average vessel size has dipped from 5,900 TEU to 5,100 TEU, reflecting cautious adjustments in fleet deployment amid softening demand.

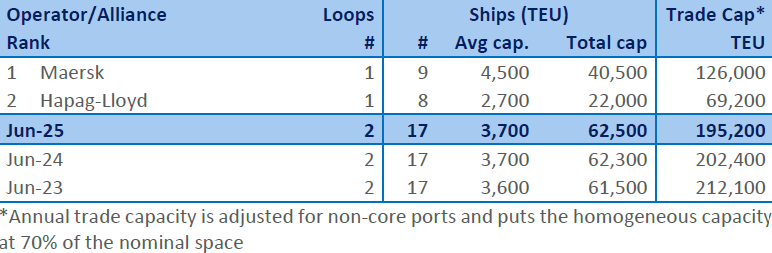

Additionally, two services continue to operate between the West Coast of South America and the Mediterranean, consistent with the previous year. However, trade capacity on this segment has slightly contracted, falling from 202,400 TEU in 2024 to 195,200 TEU in 2025, while average ship size remains unchanged.

The overall picture underscores a trade route characterized more by operational consistency than growth, with shipping lines maintaining a steady course despite global shifts in container trade dynamics.