![]()

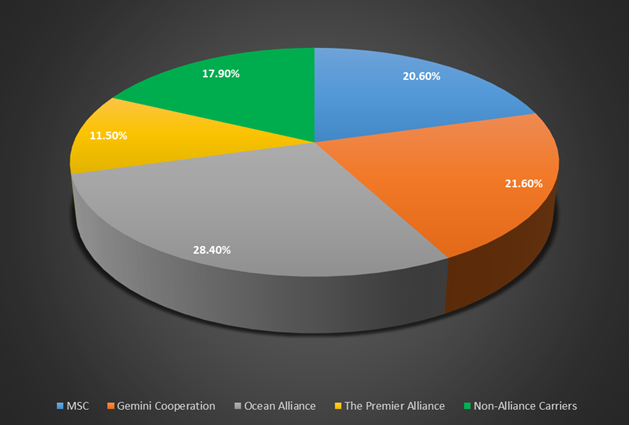

As the container shipping industry continues its transformation, strategic cooperation among carriers remains a key force shaping global trade. According to updated Alphaliner data, the dominance of shipping alliances carriers, along with MSC, the industry’s largest standalone liner operator, has reached unprecedented levels.

Even though they don’t deploy their entire fleet to alliance services, carriers that are members of shipping alliances, control a staggering 82.1% of global container shipping capacity.

The Breakdown: Who Owns What?

Let’s take a closer look at how the container shipping landscape is divided:

-

MSC (Mediterranean Shipping Company):

Although MSC operates independently, its size and global reach position it as a league of its own. As of June 2025, MSC commands a 20.6% share of the global box capacity. For analytical purposes, MSC is often grouped alongside major alliances due to its market weight. -

Gemini Cooperation (Maersk, Hapag-Lloyd):

The newly formed Gemini Cooperation members, Maersk and Hapag-Lloyd hold a combined 21.6% share. The partnership aims to streamline operations and offer consistent, sustainable services across key trade lanes. -

Ocean Alliance (CMA CGM, COSCO, Evergreen, OOCL):

Long a heavyweight in global trade, the Ocean Alliance members collectively controls 28.4% of market capacity, creating the largest shipping alliance in terms of scale and fleet deployment. -

The Premier Alliance (ONE, HMM, Yang Ming):

With a combined share of 11.5%, the Premier Alliance remains a crucial player in the trans-Pacific and intra-Asia trades, especially following recent strategic investments in newbuild tonnage and digital platforms.

Alliance vs. Non-Alliance Carriers

The collective capacity of the above, including MSC, brings the total market share of alliance-affiliated carriers to 82.1%. That leaves just 17.9% of global capacity in the hands of non-alliance carriers.

This divide illustrates not only the operational efficiency gained through collaboration, but also the increasingly limited space for non-aligned carriers to compete on the major trades.

With over 80% of container shipping capacity now controlled by shipping alliances carriers and MSC, the industry’s consolidation trend shows no sign of slowing down. For shippers, regulators, and stakeholders alike, understanding this dynamic is crucial.

As competition narrows and networks converge, questions around service quality, freight rates, and long-term sustainability will remain at the forefront of global supply chain discussions.