Sea-Intelligence reports that the number of blank sailings announced so far for the upcoming 2025 Chinese Golden Week holiday remains significantly below historical benchmarks, particularly on the Transpacific trade lanes, suggesting that a wave of last-minute capacity reductions is likely in the weeks ahead.

Blank sailings are traditionally used by carriers to balance vessel supply with the predictable slowdown in export volumes during Golden Week.

This year, however, the adjustments come amid softening demand and volatile freight rates, making effective capacity management critical for maintaining market stability.

Despite this, with just five weeks until the holiday, announced reductions remain far lower than in recent years.

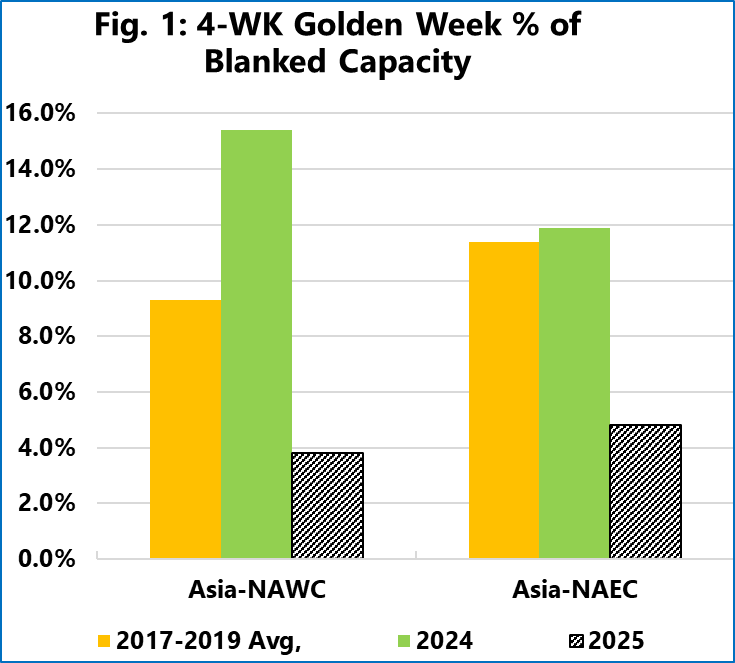

On the Asia–North America West Coast trade lane, shipping lines have currently scheduled capacity cuts of only 3.8 percent for the four-week Golden Week period.

This is well below the 15.4 percent reduction recorded in 2024, and also falls short of the pre-pandemic average of 9.3 percent between 2017 and 2019. To match 2024 levels, carriers would need to announce roughly 21 additional blank sailings.

The Asia–North America East Coast trade lane shows a similar pattern, though less pronounced. Capacity reductions currently stand at 4.8 percent, compared with 11.9 percent in 2024 and the 11.4 percent pre-pandemic average.

To reach those historical levels, carriers would need to blank around seven additional sailings.

Sea-Intelligence notes that in recent periods of market uncertainty, carriers have increasingly waited until close to departure to announce cancellations.

Given these trends, analysts believe it is highly likely that more blank sailings will be scheduled for Golden Week 2025, and shippers are advised to plan for potential last-minute adjustments.