In issue 745 of Sunday Spotlight, Sea-Intelligence analysed the operational stability of the Asia-North America and Asia-Europe trade lanes, by measuring “operational capacity churn” – the sum of the total capacity entering and exiting a trade lane.

This metric serves as a proxy for volatility, quantifying the scale of changes in carriers’ vessel deployments. The data for 2025 shows a significant structural shift, where carriers have moved from stable vessel deployments to a model of high-frequency capacity adjustment.

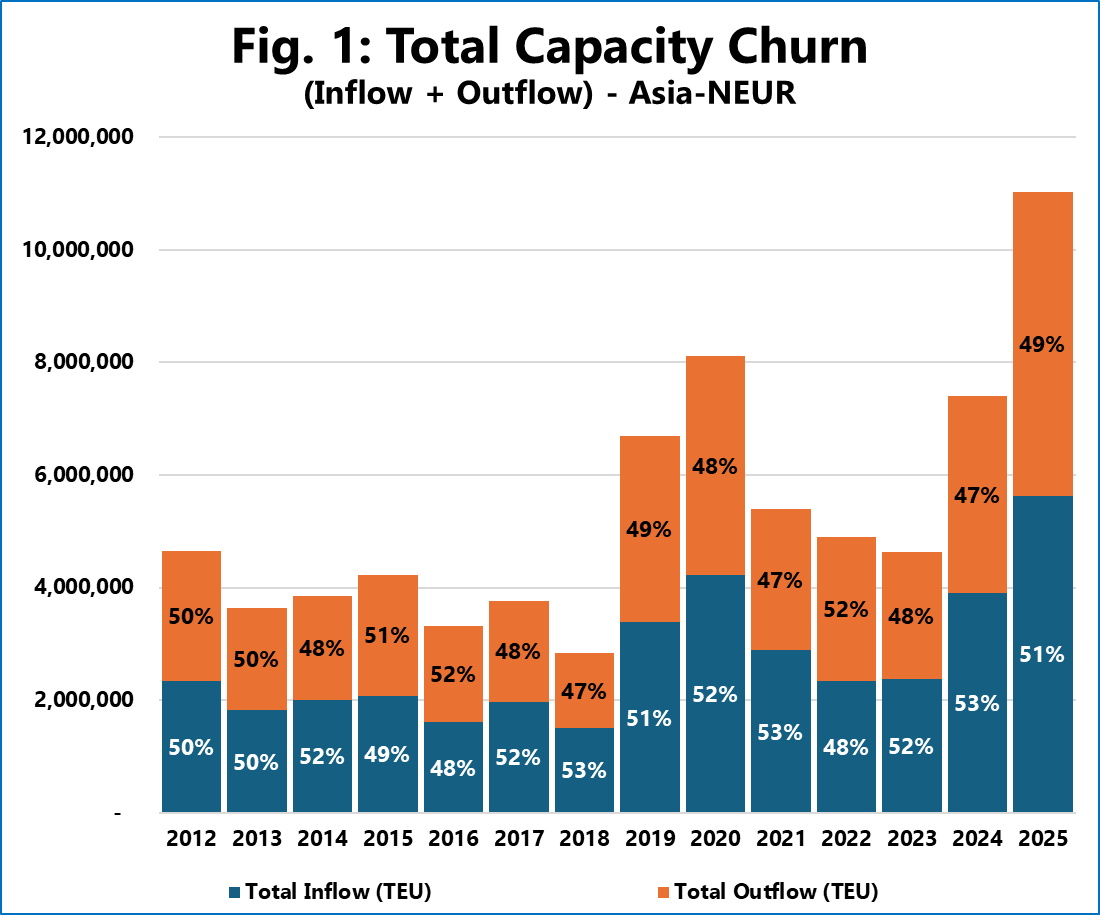

This trend is most pronounced on the Asia-North Europe trade lane. As shown in Figure 1, capacity churn on this trade reached 11.0 million TEU in 2025. This represents a substantial deviation from the historical norm of 3-5 million TEU seen between 2012 and 2019. The 2025 figure is 138% higher than 2023, indicating that carriers are actively injecting and withdrawing tonnage at a rate never previously recorded.

While Asia-North Europe illustrates the extreme, high volatility is also evident across both Asia-North America trade lanes, as well as on Asia-Mediterranean. Asia-North America West Coast churn hit a record 10.4 million TEU in 2025, a 32% increase from 2024. Asia-Mediterranean churn reached 6.9 million TEU in 2025, an 80% increase over 2023 and a 21% increase of 2024. Asia-North America East Coast remained elevated at 6.6 million TEU, albeit with a relatively more gradual increase in 2025 than the other trade lanes.

Collectively, these figures indicate that the relative vessel deployment stability of the pre-pandemic era has disappeared. The simultaneous record-high churn across these key trades suggests that the “cascading buffer” – where capacity flows predictably from primary to secondary trades – has been replaced by a dynamic system, where vessels are frequently swapped in and out to match short-term demand fluctuations and navigate operational disruptions.