Sea-Intelligence Sunday Spotlight, in issue 735, analysed a key factor behind shippers’ perception of poor service levels: Service instability. Fundamentally, liner shipping is not just the ability to move cargo from one place to another, but the provision of a fixed scheduled weekly service to do so.

While vessel schedule reliability measures on-time arrivals, shippers still often face disruptions that may have been scheduled well in advance, and such disruptions will – by definition – not be captured in a measure of vessel schedule reliability.

To quantify some such disruptions, Sea-Intelligence developed a new metric that tracks service instability, calculating the percentage of liner services on a trade that have seen a non-standard missing or added sailing. Their analysis reveals a fundamental shift, with the frequency of these weekly disruptions in 2024-2025 increasing by a factor of 2.5-3.5 compared to the pre-pandemic period.

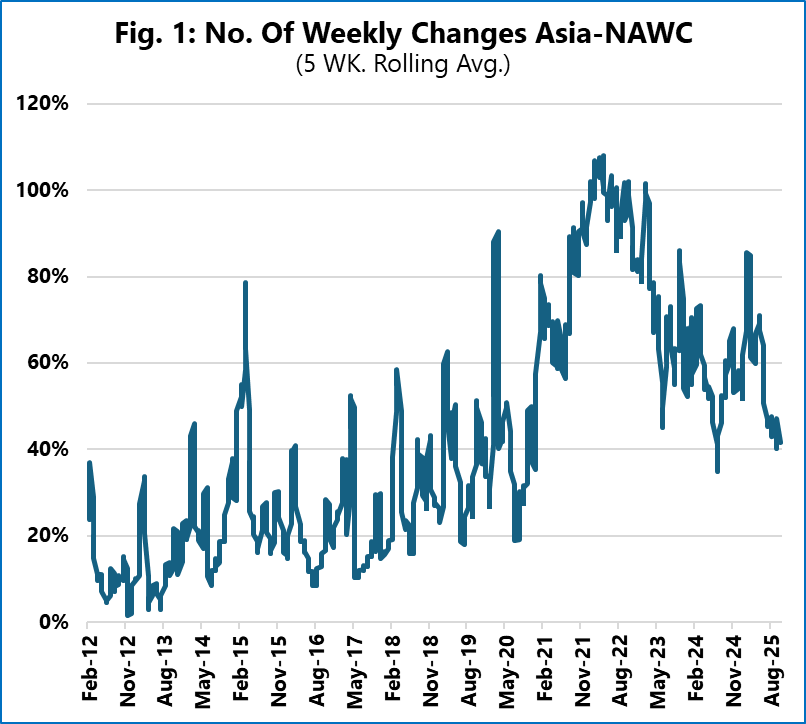

The Asia-North America West Coast trade, shown in Figure 1, clearly illustrates this structural shift. After the extreme volatility of the pandemic, which saw instability peak above 100%, the post-pandemic period of 2024-2025 has settled into a “new normal” of service instability averaging 56%. This is in stark contrast to the pre-pandemic (2012-2019) period, where the average was just 23%. This means that the instability in the service provision has increased by a factor of 2.5 on this trade.

This is not an isolated trend; Asia-North America East Coast has seen instability increase by a factor of 2.9, while the Asia-North Europe and Asia-Mediterranean trades have seen even more dramatic shifts, with instability increasing by factors of 3.3 and 3.4 respectively.

This fundamental operational change means shippers face far more frequent disruptions, where scheduled weekly services are either cancelled or delayed so severely that they slide into the next week, effectively leaving the planned week without a sailing.