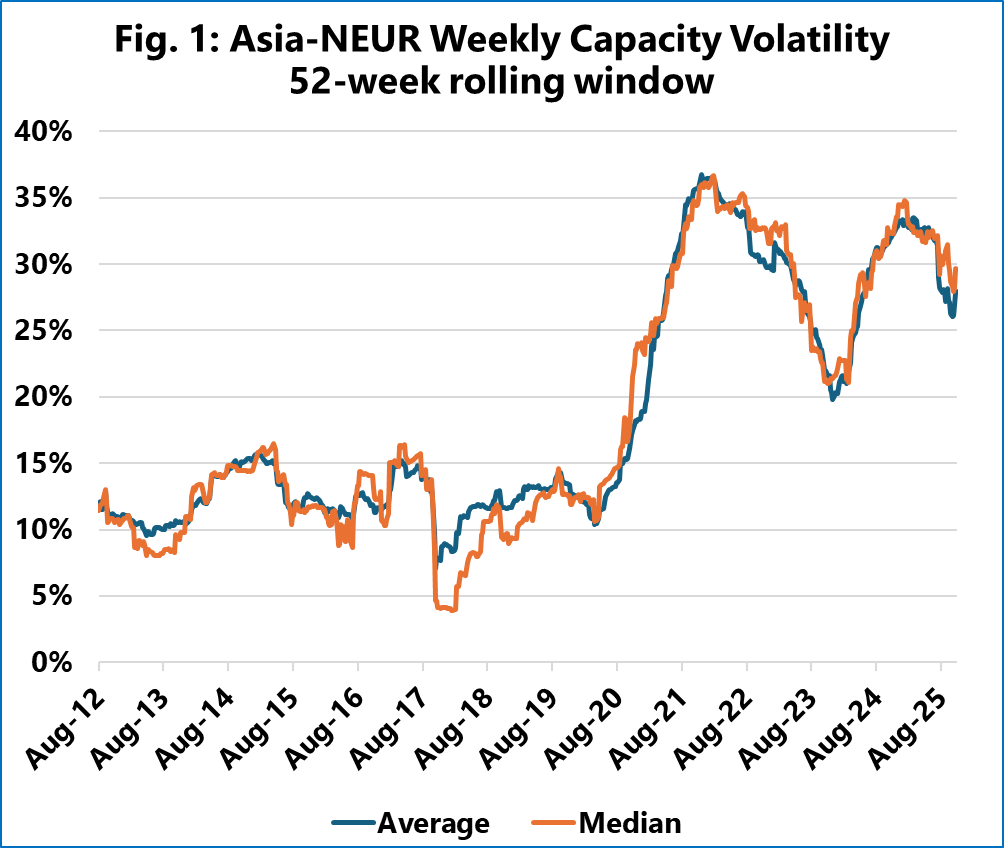

While a liner service ideally offers stable and predictable capacity each week, practical realities – such as using different-sized vessels, blank sailings, or schedule delays – cause the actual weekly TEU on individual services to fluctuate. To capture this volatility, we calculated the standard deviation in vessel capacity, seen over a 52-week rolling window to eliminate any seasonality effects. The data reveals a sharp structural shift since 2020.

On the Asia-North Europe trade lane, as shown in Figure 1, we can see this dramatic shift. In the pre-pandemic period of 2011-2019, the average volatility in weekly capacity on a service was a stable 12.3%, mainly fluctuating between 10%-15%. In the 2021-2025 period, this average volatility more than doubled to 29.6%. The Asia-Mediterranean trade experienced a nearly identical increase.

While the Transpacific trades also saw an increase in capacity volatility, the effect was less severe. Both the Asia-North America West Coast and Asia-North America East Coast trades saw their pre-pandemic volatility increase by approximately 50%, from around 20% to 30% — a significant rise, but less than the doubling seen on Asia-Europe liner services.

This increased “lumpiness” in cargo flows creates operational challenges for ports and terminals, which are designed to handle a smooth and predictable flow of vessels and cargo. The data indicates that the large increase in weekly capacity volatility on Asia-Europe is a significant underlying factor contributing to the ongoing port congestion problems in Europe.