Danish maritime data company Sea-Intelligence analysed container handling statistics in the second quarter of the year for major North American West Coast ports (Los Angeles, Long Beach, Oakland, Prince Rupert, Vancouver and Seattle/Tacoma).

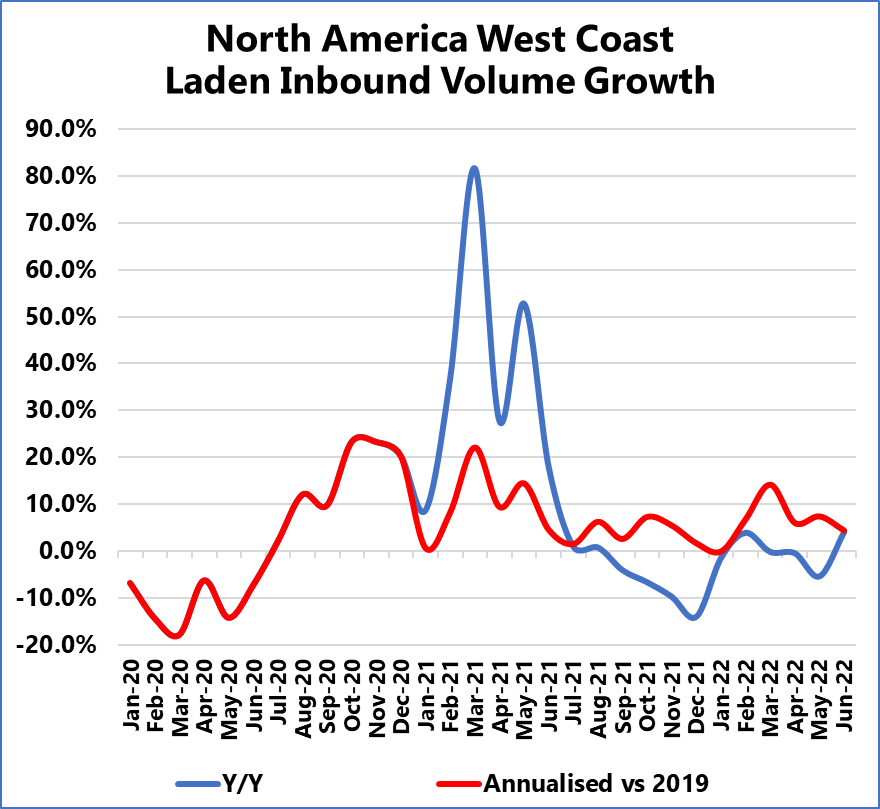

Sea-Intelligence analysts pointed out that “while we normally use a Y/Y growth metric in our analyses, because of the volatile nature of the pandemic years, the Y/Y growth in 2021-first half becomes distorted and overly inflated (due to the contraction in 2020-first half).”

Hence, they have also used an annualised growth rate with 2019 as its base, which was the last “normal” year pre-Covid.

“On a Y/Y basis, North America West Coast laden inbound volumes contracted heavily in the second half of 2021, but the annualised growth over 2019 shows that this is more an artefact of strong 2020-2H growth,” said Alan Murphy, CEO of Sea-Intelligence.

“Rather, what we have seen is that when compared to 2019, there has been continued growth since July 2020, although it has slowed from the highs of 20% in 2020-second half, to most in the 0-5% range through second-half 2021,” he added.

In 2022, the Y/Y change has been negative in four out of the six months, although the June 2022 growth was 4%, according to the report, while on an annualised basis, however, the growth rate has largely been under 6% since the second half of 2021, although there was a sharp increase to 14.2% in March 2022.

In the last few months, however, the annualised growth rate has slightly level-shifted upwards slightly to 4%-8%, although the overall trend in 2022-Q2 has been downwards, according to Sea-Intelligence.

“Another point of note is that carriers are continuing to prioritise empty container exports out of North America West Coast,” noted Murphy.

“However, with demand growth slowing down, carriers might be looking at a lower utilization on the head-haul, and we might start to see an increase in laden exports out of North America West Coast. The laden to empty container export ratio, which is at 0.5 right now (favour empty exports), will then also start to increase,” concluded CEO of Sea-Intelligence.