In 2023, all ocean carriers saw sharp year-on-year declines in their revenues, ranging between 46.6% and 62.6%, according to the latest Sea-Intelligence report.

The Danish maritime data analysis firm noted that the annualised revenue growth rate in 2023 is in line with 2018-2019, which suggests that the sharp Y/Y revenue decline in 2023 is an artefact of the abnormal revenue growth of 2021-2022, rather than a fundamental revenue loss in 2023.

Sea-Intelligence examined the cases of ZIM, Yang Ming and Wan Hai which all recorded EBIT losses in 2023. “While four shipping lines had an EBIT of over US$1 billion, what is clear is that profitability levels are nowhere near those in 2021-2022,” pointed out the Danish analysts.

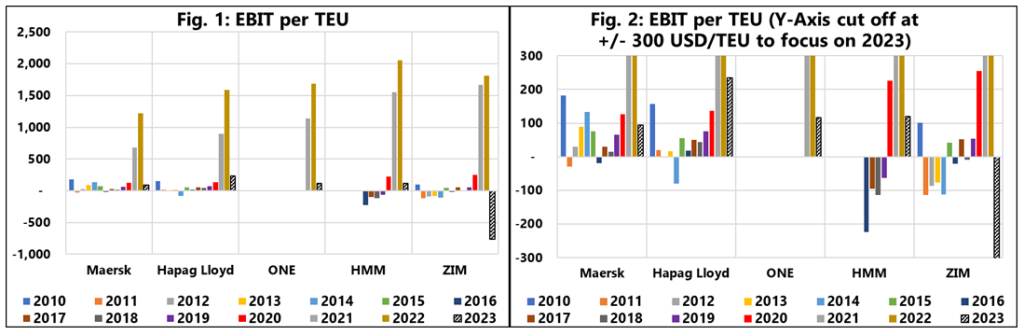

The following Figure 1 shows EBIT for 2010-2023 and shows the unprecedented levels of the 2021-2022 pandemic period, whereas Figure 2 cuts off the y-axis at +/- US$300/TEU, to show the developments in 2023.

In its analysis, Sea-Intelligence noted that although Maersk’s EBIT/TEU of US$94 is significantly lower than in 2021-2022, it is still higher than most of the pre-pandemic years, whereas, for Hapag-Lloyd (US$235/TEU), it is the highest outside of 2021-2022.

The Danish company added that for Ocean Network Express (ONE), which reported an EBIT/TEU of US$116, we do not have a pre-pandemic reference point, while for HMM, their 2023-FY EBIT/TEU of US$119/TEU is lower than in 2020 but is still better than in 2011-2019, where the company was not profitable at all.

Furthermore, Sea-Intelligence highlighted that ZIM’s EBIT/TEU loss of US$765 has been driven by a non-cash impairment loss of US$2.06 billion recorded in the third quarter of 2023.