Danish shipping data analysis firm Sea Intelligence discovered that carriers face an urgent need to reverse course and ramp up capacity to accommodate an anticipated surge in cargo volumes, due to the pause of tariffs.

The US continues to impose a baseline tariff of 30% (down from a previous 145%), in addition to specific levies such as a 25% tariff on steel and aluminum. On the Chinese side, tariffs have been reduced from 125% to 10%.

Over the past month, ocean carriers have been actively scaling back capacity on Transpacific routes, responding to a slump in bookings directly linked to the previous tariff burdens.

Importers aiming to beat the new tariff deadline of August 14 must have peak-season goods shipped by mid-July at the latest.

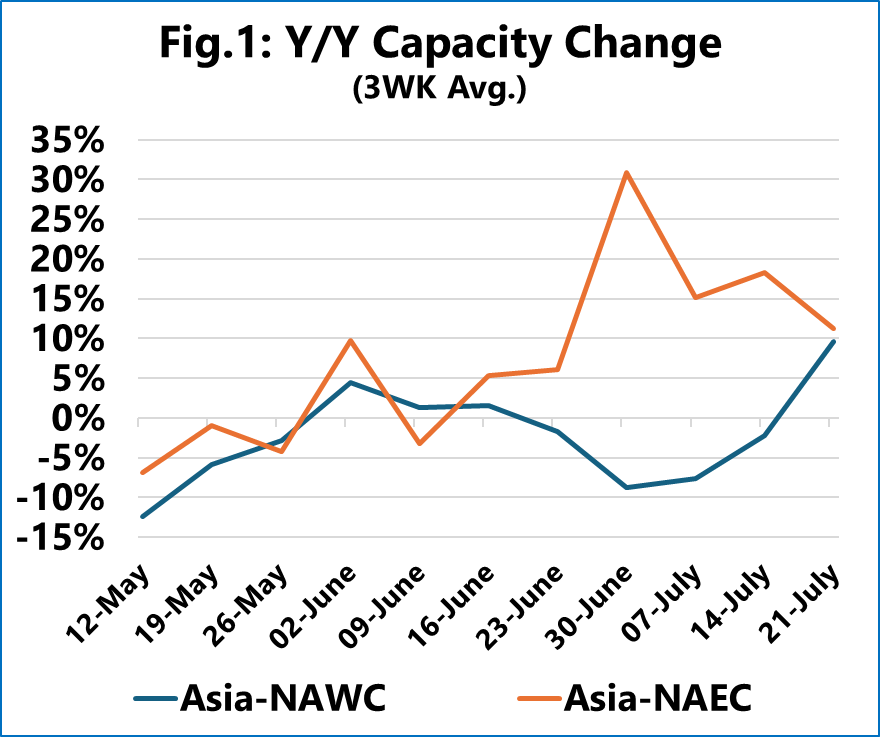

As illustrated in Figure 1, year-on-year (Y/Y) capacity across Transpacific trade lanes—measured as a rolling three-week average from May 12 to July 21 continues to trend below 2024 levels.

Capacity to both US coasts remains reduced for the coming weeks.

Notably, a substantial capacity increase to the West Coast is only projected from mid-July, while the East Coast begins to see significant growth starting in late June.

However, even this expansion may come too late to accommodate a near-term surge in demand, should shippers rush to capitalize on the temporary tariff relief.

This scenario could lead to a sharp spike in spot freight rates as space becomes limited.

Carriers may be forced to rapidly redeploy vessels to Transpacific routes, potentially at the expense of blank sailings and reduced capacity on other Asia export trades.

To assess immediate developments, Issue 715 of the Sunday Spotlight compared capacity levels for the May 12–July 21 period, using snapshots from May 9 and May 16.

As of the latest update, there is no significant injection of capacity on the Transpacific route to the US West Coast.

In contrast, some incremental capacity increases are already visible on services to the East Coast, suggesting a more responsive adjustment to demand expectations on that trade.