During the first months of the Covid-19 outbreak, ocean carriers were able to cut capacity in line with the massive demand contraction, according to Danish maritime data analysis firm Sea-Intelligence, which, however, noted that the same degree of commitment has not been seen with the container volume crash in the last four months of 2022.

The container lines were either not able to, or possibly not willing to make the same move, according to the Danish analysts.

Instead, there has been a wait-and-see approach, where carriers are seemingly waiting for their competitors to blank sailings, before finally blanking themselves. This strategy has led to scheduled capacity that changes drastically the closer we get to actual deployment, according to Alan Murphy, CEO of Sea-Intelligence.

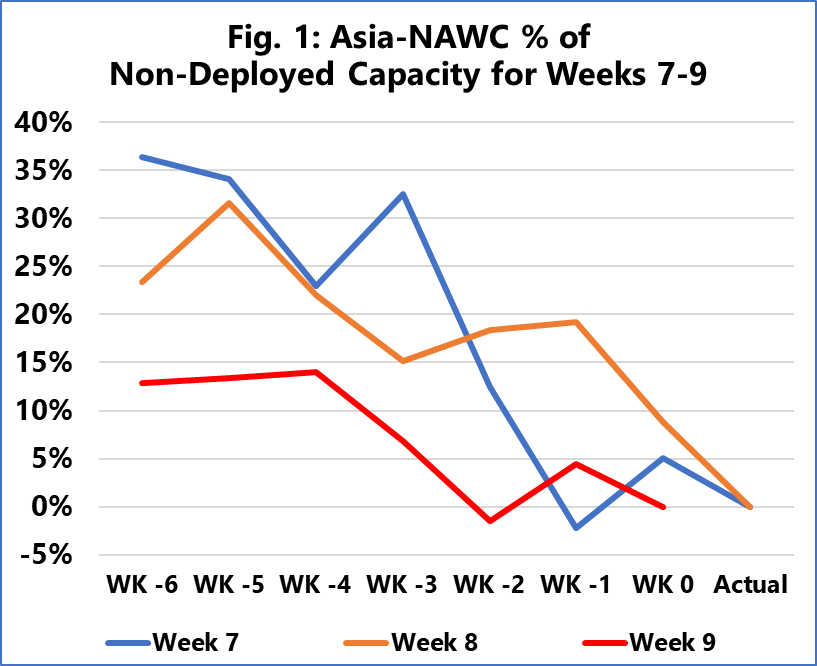

Sea-Intelligence said that in the following figure, we can see scheduled deployment on Asia – North America West Coast for Week 7-9 2023, as they were at different points in time.

The analysts explain that “Actual” refers to the actual deployment, “Week 0” refers to the scheduled deployment recorded in the same week as the week being measured i.e. scheduled capacity for Week 7 as recorded in Week 7 etc., “-1” refers to the scheduled deployment one week prior to the week being measured i.e. scheduled capacity for Week 7 as recorded in Week 6, and so on.

Schedules that were only two weeks out were somewhat reflective of what the actual deployment eventually turned out to be, whereas schedules even three weeks out had roughly 10%-20% of “extra” capacity that did not get deployed, according to the analysts.

Sea-Intelligence analysts went on to point out that “six weeks out, we are looking at an excess scheduled deployment of 20%-40%, except for in Week 9 where it was in excess of 10%-15%.”

Alan Murphy noted that “this means that in the three most-recent weeks, carriers have corrected significant amounts of capacity.”

“The same trend was also seen at the end of 2022 after Golden Week, where there was an excess of 60%-80% of capacity that was scheduled but not deployed. On Asia-North America East Coast, however, the capacity correction is less frequent, and when it does happen, it is not to the same extent as seen on the West Coast,” concluded CEO of Sea-Intelligence.