“In our Press Release on 8 August, we mentioned how US consumer spending data did not support the notion of a sudden US spending boom, and that the spike in Transpacific volumes in May and June 2024 was likely driven by a front-loading of imports,” stated Alan Murphy, CEO of Sea-Intelligence.

Recent June 2024 US inventory data from the US Census Bureau further supports this view. The data reveals that US retailers have been steadily increasing their inventories, suggesting that the growth in container imports was primarily used to build up inventories rather than reflecting a surge in consumer spending.

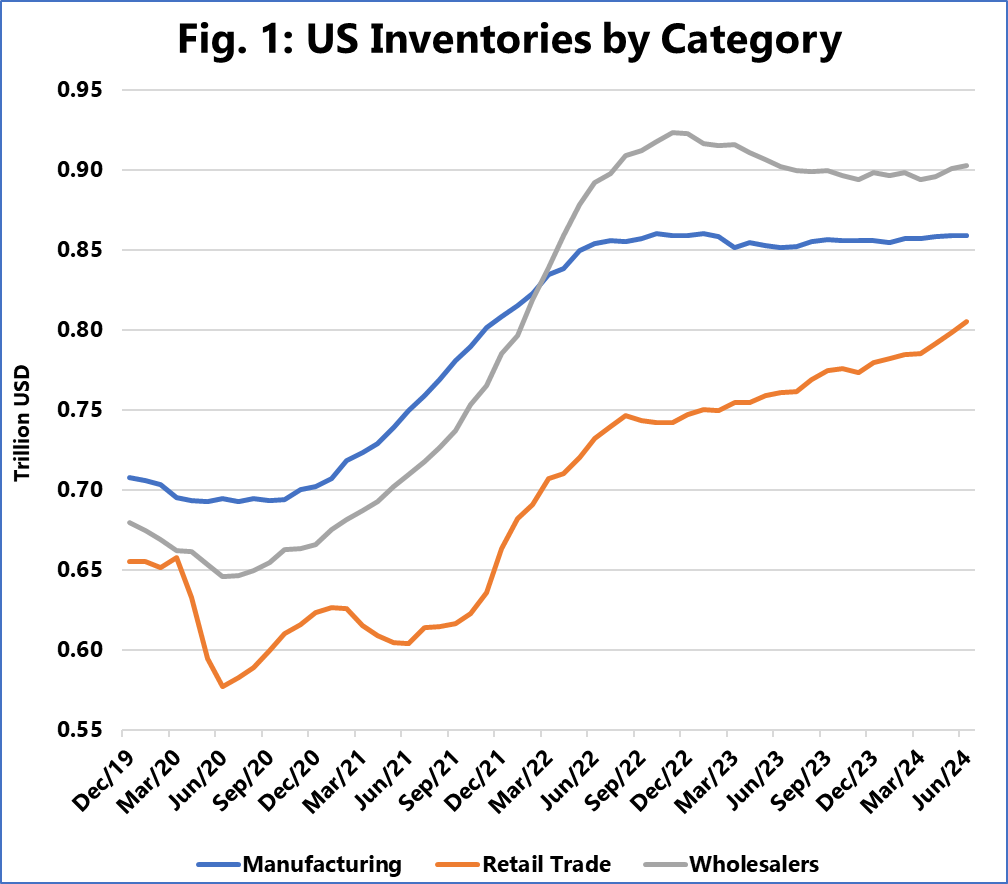

Figure 1 illustrates the inventory levels across three categories defined by the US Census Bureau: Manufacturers, Retailers, and Wholesalers. Retailers, in particular, have been continuously growing their inventories, with a notable acceleration recently.

When compared to the long-term trend that began in 2009 (excluding a temporary drop during the pandemic), the recent months show an upward deviation—approximately US$18 billion more than what would be expected based on the trend.

Additionally, the inventories-to-sales (I/S) ratio indicates that the growth in retailers’ inventories is outpacing actual sales. This ratio has been increasing since late 2022 and is now nearing that of wholesalers.

While this inventory buildup isn’t necessarily a cause for concern, it could be attributed to importers front-loading cargo due to fears of a potential strike at US East Coast ports later this year. Another possibility is that importers are preparing for possible new tariffs, as trade relations with China are expected to be a focal point in the upcoming US presidential election.

“Irrespective of the reasons, if history over the past five years is any guide to go by, we are poised for a significant inventory increase over the last months of 2024,” commented Alan Murphy, CEO, of Sea-Intelligence.