Blank sailings data, when put into the context of container demand data, can be useful in calculating the underlying capacity utilisation on the major East/West trades, according to Danish maritime data analysis company Sea-Intelligence.

A caveat with this simplistic approach, is that this is not necessarily the “true” capacity utilisation, as e.g. vessels from Asia to Europe would also be carrying capacity/cargo allocated to other trades, such as the Asia to West Africa or Asia to Middle East trades, say the Danish analysts.

“However, relative changes in time would be representative, given the same constraints apply throughout,” they add.

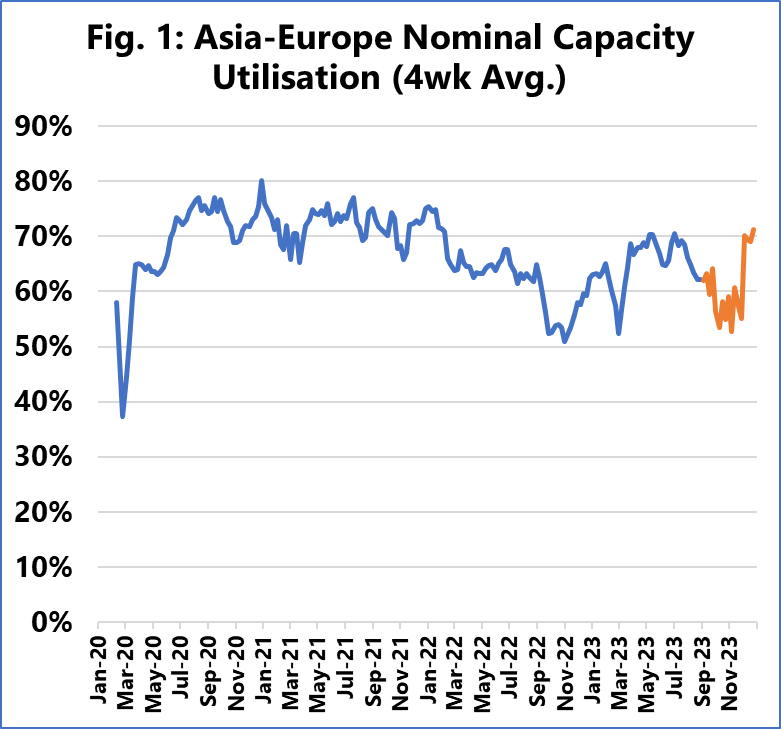

Source: Sea-Intelligence.com, Sunday Spotlight, issue 638The aboive figure shows the underlying capacity utilisation, with the blue line showing the actual utilisation, and the orange line denoting Sea-Intelligence’s projection for the rest of the year.

The supply projection is based on carriers’ vessel deployment schedules until the end of 2023. For the demand projection, the analysts of Sea-Intelligence took the June-August 2023 demand growth (compared to the pre-pandemic period of 2019) and assumed the same trend for the rest of 2023.

“As we can see here, utilisation has been quite poor in recent months,” pointed out Alan Murphy, CEO of Sea-Intelligence.

In recent weeks, carriers have announced a host of blank sailings. Even then, there has been significant year-over-year growth in the capacity being offered in the market.

“If the intention of these blank sailings was to revert capacity growth, that hasn’t happened. As a result, we will continue to see very low utilisation in November 2023,” concludes Murphy.