In issue 728, Sea-Intelligence analyses the performance of US ports during the sharp contraction of laden imports in 2025-Q2. Their analysis revealed that as the market turned, the major US West Coast gateways followed starkly different paths, with the Port of Los Angeles gaining a major 2.8 percentage points of West Coast market share, primarily at the expense of its neighbour, the Port of Long Beach.

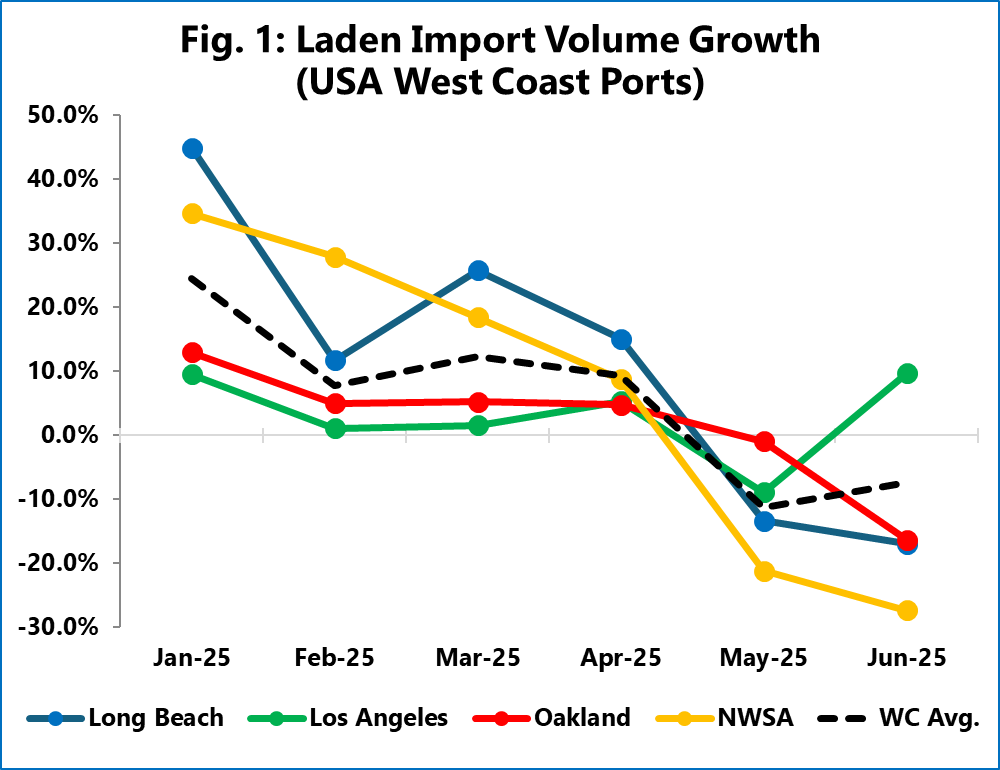

The US West Coast ports experienced an intense front-loading boom in 2025-Q1, which then reversed sharply into a severe contraction in May and June. However, the downturn was not experienced uniformly, with the neighbouring ports of Los Angeles and Long Beach showing a clear divergence in port volumes.

As shown in Figure 1, the Port of Long Beach led the import surge with a very strong Y/Y growth of +45.0% in January, but then suffered a severe reversal, contracting sharply in June. In contrast, the Port of Los Angeles bucked the negative trend entirely, posting a strong +9.7% Y/Y increase in laden inbound volumes in June, a month when every other major West Coast port was deep in negative territory. The Northwest Seaport Alliance (NWSA) of Seattle and Tacoma experienced the most extreme “whiplash” effect, dropping significantly from a +34.7% surge in January to a -27.3% contraction in June.

This divergence in operational performance during the downturn directly translated into a strong market share shift between the two San Pedro Bay ports. The Port of Los Angeles was the only West Coast port to grow its share in 2025-Q2, capturing an additional +2.8 percentage points of the laden import market. This gain came almost entirely at the expense of the Port of Long Beach, which saw its share of West Coast laden imports fall by -2.2 percentage points from Q1 to Q2.