When we look at the changes in port rotation and service frequency in greater depth, the data reveal a strategic pivot by Ocean Alliance, whereby they are positioning themselves to directly serve the emerging “China +1” market in Southeast Asia.

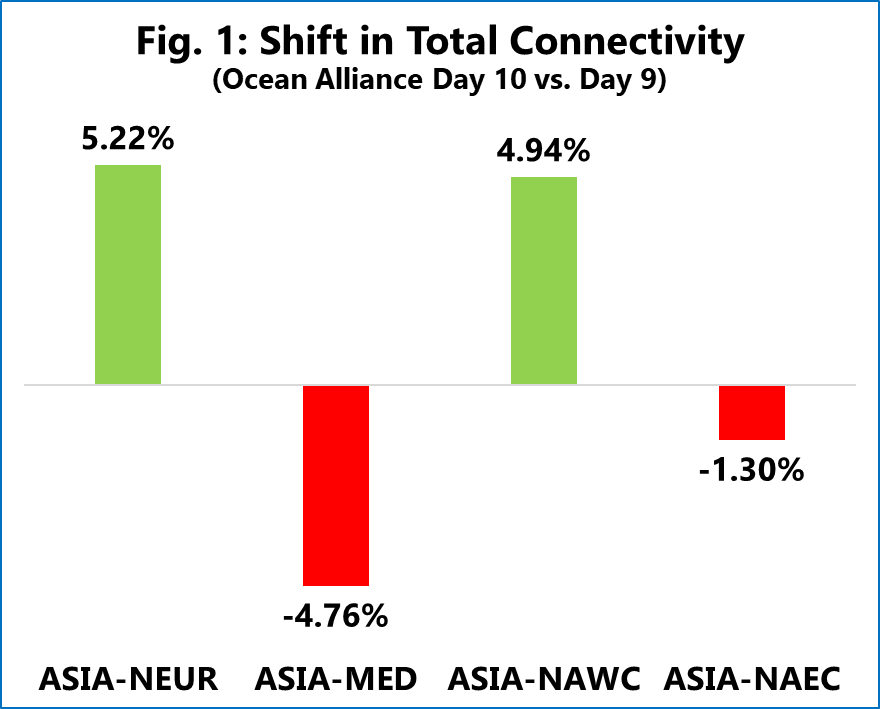

Figure 1 illustrates this divergence in network strategy. While the connectivity on the Asia-Mediterranean trade lane contracts by ‑4.8% and remains flat on the Asia‑North America East Coast trade lane, the Asia‑North America West Coast trade lane sees a +4.9% increase in total connectivity.

This is not a general expansion, but a targeted injection of capacity into Vietnam and Thailand. Ocean Alliance has effectively upgraded these markets into core deep‑sea origins. Haiphong sees a massive 33% increase in direct market reach. This includes the introduction of double‑weekly services to New York and new direct connections to the US West Coast, allowing high‑value goods to bypass traditional transshipment via South China. Laem Chabang sees service frequency to the US West Coast double, moving from one to two weekly sailings.

Crucially, this expansion appears to be a zero‑sum game. The data shows a direct operational swap, where resources were stripped from a transshipment hub like Port Klang to fuel the direct‑call frequency in Laem Chabang. This indicates that Ocean Alliance is betting on the permanence of the sourcing shift, establishing direct, high‑frequency corridors for “China +1” volumes.