They analysis shows that despite significant market consolidation, the spread between the most and least reliable carriers has increased substantially since 2016, offering cargo owners a wider range of service levels.

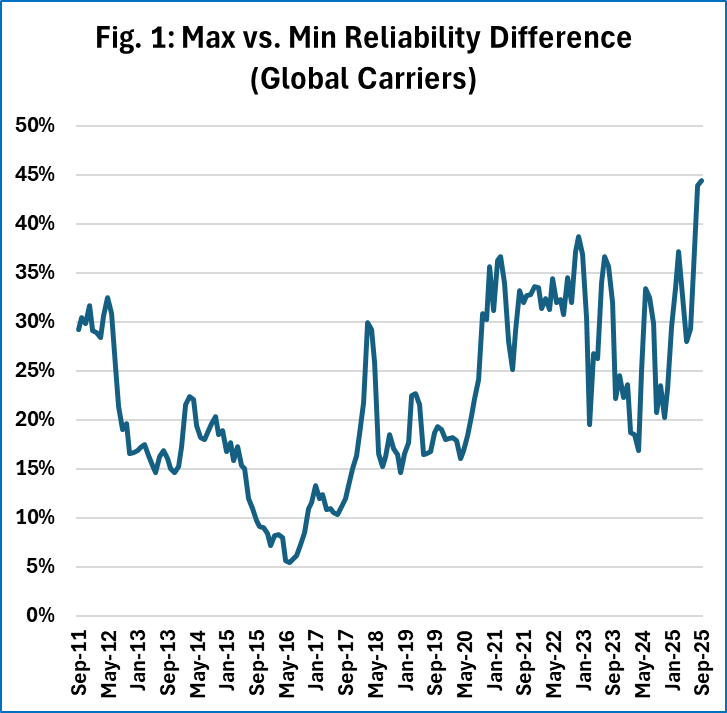

To measure this diversification, Sea-Intelligence calculated the difference between the highest and lowest global carrier schedule reliability scores recorded among the top 20 carriers each month, using a 3-month rolling average to smooth out volatility.

As shown in Figure 1, the performance gap between the top and bottom carriers narrowed significantly from 2011 to a low point in 2016, suggesting reliability was becoming less of a competitive differentiator during that period, where the industry was dominated by endemic overcapacity and internecine price wars. However, since 2016, the trend has reversed dramatically. The spread in reliability performance has widened considerably, reaching new highs during the pandemic disruptions and remaining significantly elevated in 2024-2025.

This sustained increase in performance diversification means that shippers currently face a wider spectrum of reliability levels across the major carriers, than they did pre-pandemic. Furthermore, Sea-Intelligence’s analysis indicates that this increased diversification in on-time performance has occurred even as the number of global carriers has declined due to consolidation, suggesting that mergers and acquisitions have not led to a homogenisation of service levels, in terms of schedule reliability and vessel delays.