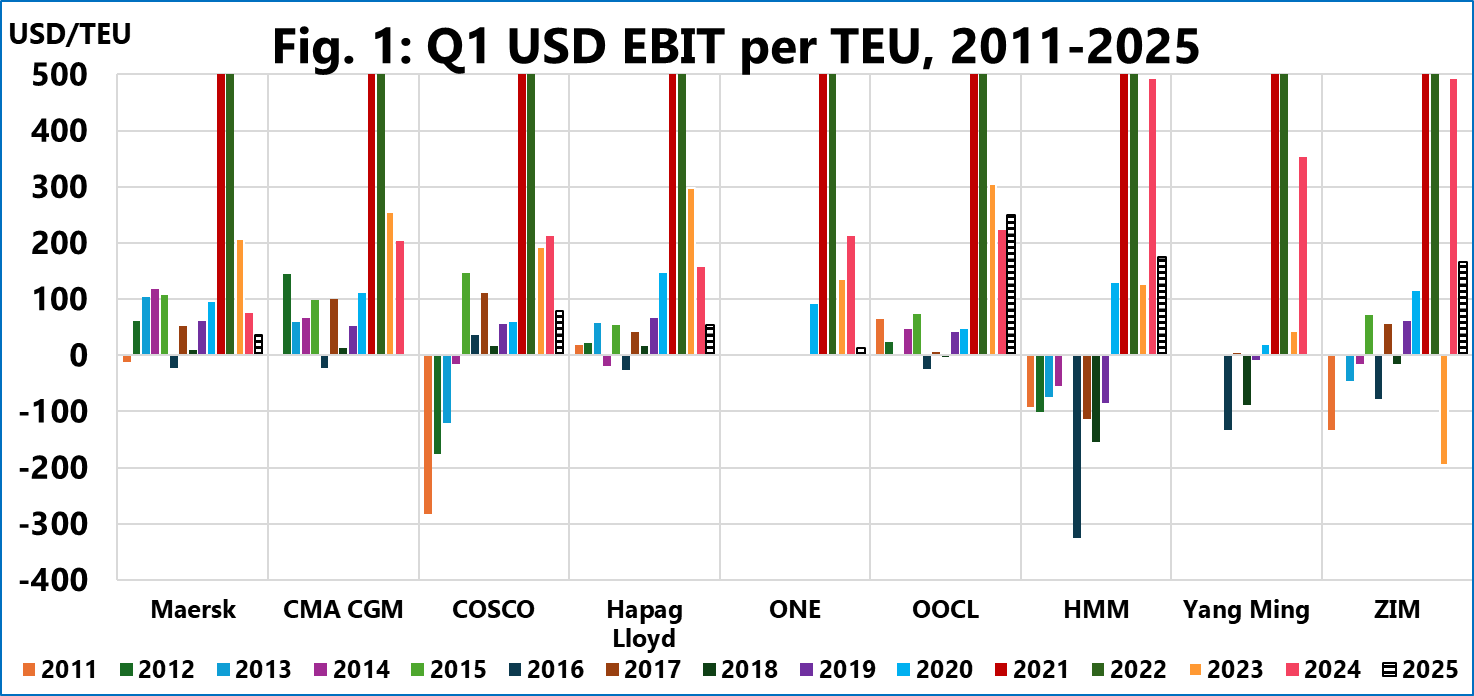

To show operational profitability in container shipping, Sea-Intelligence uses the EBIT/TEU figure. Figure 1 shows this metric for the major lines for each Q2 since 2011. They are missing a 2025-Q2 figure for Yang Ming as they have not published their volumes for this period, and CMA CGM as they have not published a publicly available EBIT for this period. Furthermore, the y-axis is cut-off at 500 USD/TEU so that current figures are not obscured by the pandemic highs.

All major shipping lines reported positive EBIT/TEU, ranging from 12 US$/TEU (ONE) to 249 US$/TEU (OOCL). There were 3 more shipping lines with an EBIT/TEU of under 100 US$/TEU: Maersk (35 US$/TEU), Hapag-Lloyd (53 US$/TEU), and COSCO (79 US$/TEU), while there were two shipping lines with an EBIT/TEU of 100-200 US$/TEU: HMM (176 US$/TEU) and ZIM (167 US$/TEU).

The 2025-Q2 financial reports also showed a divided Transpacific and Asia-Europe market. The Asia‑Europe trade recorded strong volume growth, with 3 of the 6 shipping lines that report on Asia-Europe volumes recording double‑digit Y/Y increases. Conversely, the Transpacific trade experienced widespread volume contractions.