In issue 750 of the Sunday Spotlight, Sea‑Intelligence analysed the latest World Economic Outlook (WEO) report published by the International Monetary Fund (IMF). While the headline figures depict a “steady” global economy, with global GDP growth at 3.3% for both 2025 and 2026, an in‑depth review of the report reveals that this stability masks critical disconnects that could mislead container shipping stakeholders.

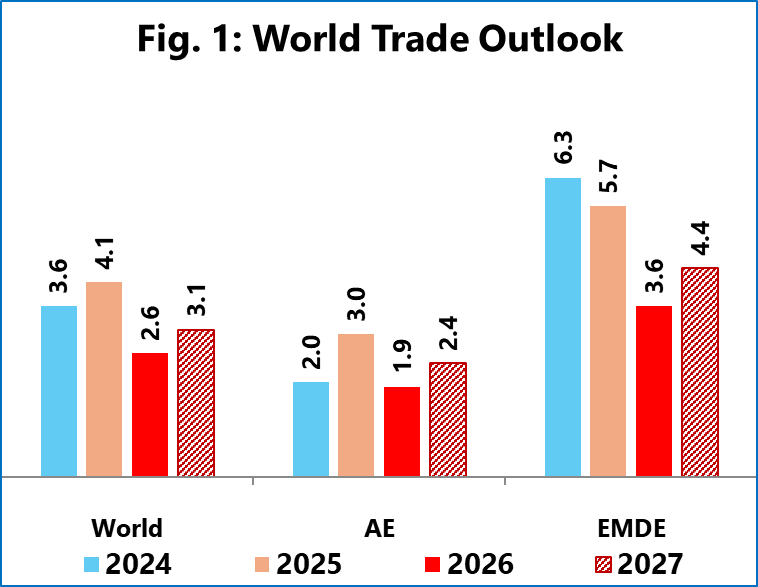

World trade growth is expected to slow down significantly from 4.1% in 2025 to 2.6% in 2026. This decrease appears to be a direct consequence of the “front-loading” phenomenon seen throughout 2025, where shippers accelerated imports to pre‑empt anticipated trade policy shifts. This 2026 outlook suggests that volume growth may struggle to absorb new vessel capacity, potentially putting renewed pressure on freight rates.

Not only is this projected trade growth weak, but it is also heavily reliant on the technology sector. For example, export growth from Asia (excluding China), of 13.2%, had a roughly 70% reliance on technology exports, while China’s export growth was similarly fuelled by technology exports to the Rest of the World. Since technology exports are high in value but low in volume, and because IMF’s trade projections are based on monetary value rather than TEU, this creates a challenging scenario for container shipping stakeholders.

For shipping lines, this implies that the “steady” global economic outlook is effectively a mirage in terms of actual cargo volume. The headline growth is largely value‑driven by the technology sector, obscuring the reality of weaker physical demand for volume‑dense goods. Consequently, lines are entering 2026 facing a “double‑squeeze”: a “payback” period of suppressed volumes following 2025’s front-loading, combined with the reality that trade policy shifts have normalised into a structurally higher US tariff cost base of approximately 18.5%. In this environment, a “steady” economy will not provide the booming consumer demand required to absorb these higher costs.