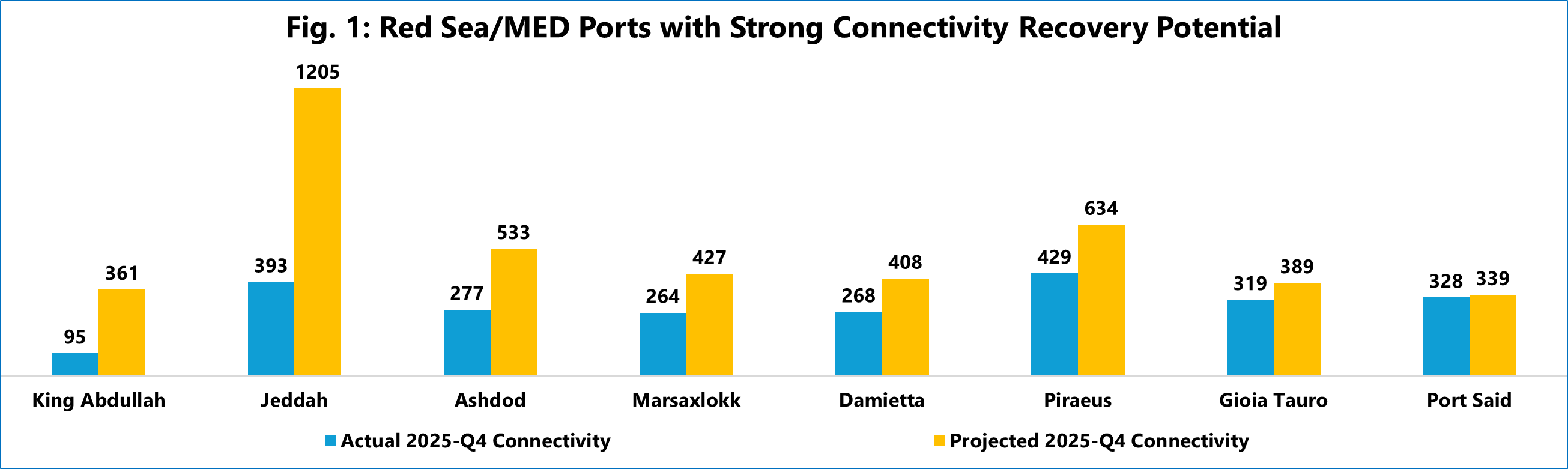

Figure 1 illustrates the “Recovery Potential” for key ports in the region – defined as the gap between their current connectivity (Actual 2025-Q4) and what their connectivity would have been, had the crisis not occurred (Projected 2025-Q4).

The disparity is stark. In the Red Sea, King Abdullah Port currently has a connectivity score of 94.7, far below its projected trend of 361.5. This indicates a massive Recovery Potential of 282%. Jeddah port shows a similar dynamic, with a gap of 206%. This suppression extends into the East Mediterranean as well, where Ashdod trails its projected connectivity by 92.4%, and Damietta by over 50%. This suggests that the initial phase of Suez routing will be characterized by a chaotic rush to reintegrate these ports back into the Asia-Europe network, creating significant risk of terminal congestion, as lines reactivate these service loops.

Furthermore, the post-Red Sea crisis Asia-Europe service network will likely not return entirely to the 2023 status quo. Ports like Dammam and Colombo have achieved structural connectivity gains during the crisis that appear permanent. Unlike the transitory shifts seen elsewhere, these hubs have leveraged infrastructure investments and network integration, to secure a new, elevated baseline that will likely persist even after the Suez routing reopens.