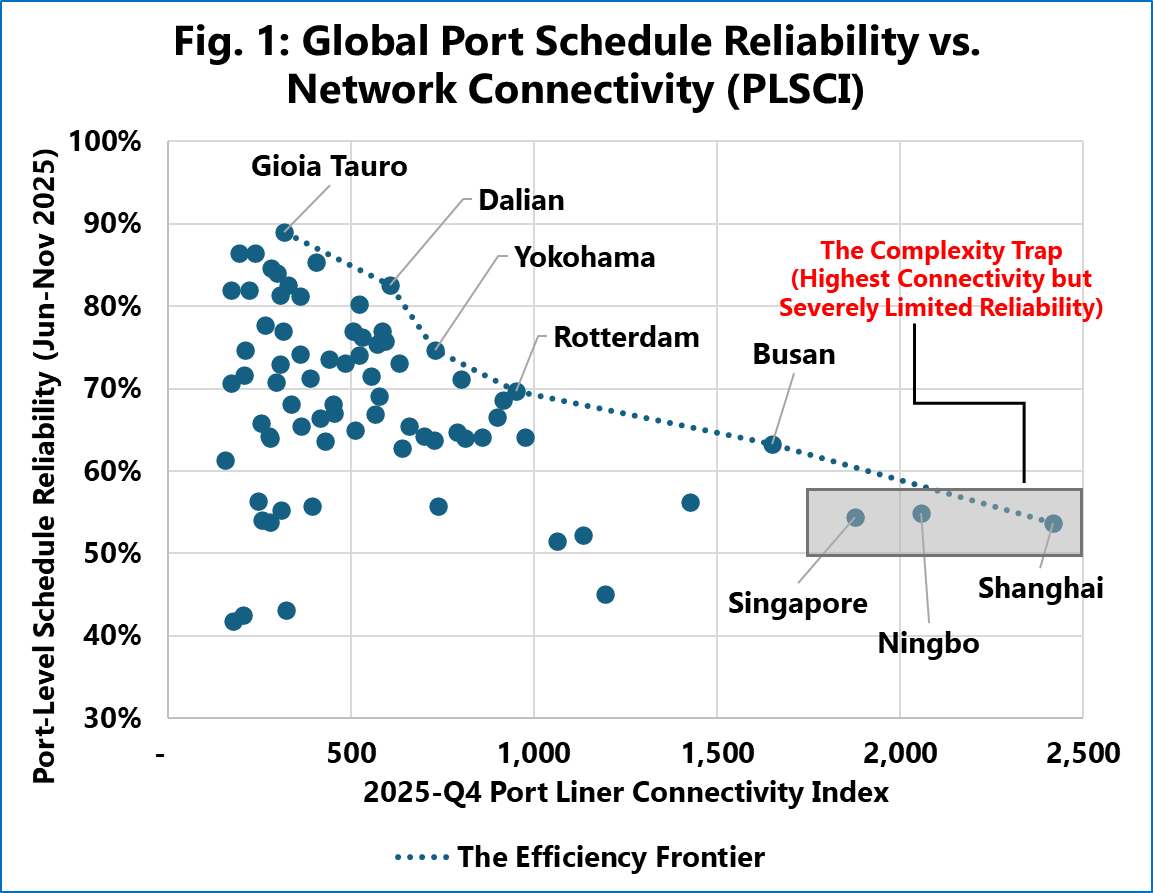

Figure 1 plots the 2025-Q4 UNCTAD connectivity score (PLSCI) against schedule reliability for June to November 2025. The results show a clear non-linear trade-off. At the far right of the spectrum, the “Mega-Hubs” – such as Shanghai, Singapore, and Ningbo – have hit a reliability wall, so-to-speak. Despite their geographic differences, these massive hubs are clustered tightly in the mid-50% reliability range. This suggests that once network complexity exceeds a certain threshold, the sheer volume of connections creates a systemic drag on performance that makes it difficult to break through the 60% reliability barrier.

However, the data also identifies an operational “sweet spot.” A group of “Tier 1.5” ports, with connectivity scores between 500 and 1,000, which currently define the “Efficiency Frontier”. Ports like Dalian (83% reliability) and Rotterdam (70%) offer substantial global reach, while delivering reliability scores 15-20 percentage points higher than the mega-hubs.

Sea-Intelligence also examined “Diversion Hubs” in regions like Vietnam, India, and Mexico, which have gained prominence due to shifting trade patterns because of the US-China trade war. While ports like Vung Tau (67%) and Mundra (63%) outperform the mega-hubs, they still trail the efficiency leaders. This indicates that while they have managed rapid growth without collapsing, they have yet to fully optimize operations to reach the “reliability frontier”.

For cargo owners, this presents a quantifiable strategic choice: By shifting volume from a mega-hub to a high-efficiency gateway, it is possible to sacrifice a degree of network breadth, to gain a substantial increase in on-time performance.