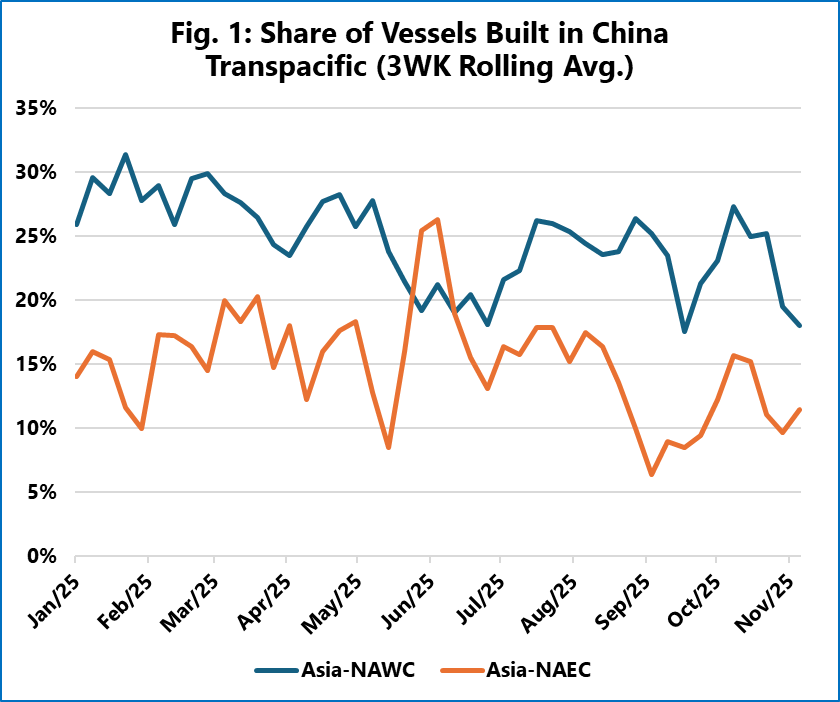

To measure any potential changes, they tracked the vessels deployed on two trades on a weekly basis throughout 2025 and mapped each vessel to its shipyard of origin. They calculated the share of Chinese-built vessels over a 3-week rolling average to reduce volatility, so they can identify any underlying trends as they approach the implementation date for the new fees.

On the Transpacific, there are early signs of a reduction in the deployment of Chinese-built vessels. As shown in Figure 1, for the Asia-North America West Coast trade, the share of Chinese-built vessels has trended downwards from a level of 25-30% in the first half of 2025 to a range of 20-25% in recent weeks. A similar, though less pronounced, trend is visible on the Asia-North America East Coast trade.

In contrast, on the Transatlantic trade, there does not yet seem to be any such development. The data for liner services, from both North Europe and the Mediterranean to North America, does not currently support the notion that a widespread removal of Chinese-built vessels is underway on the Transatlantic. While individual vessel redeployments are occurring, they have not yet reached a level that creates a material statistical impact on this trade lane.