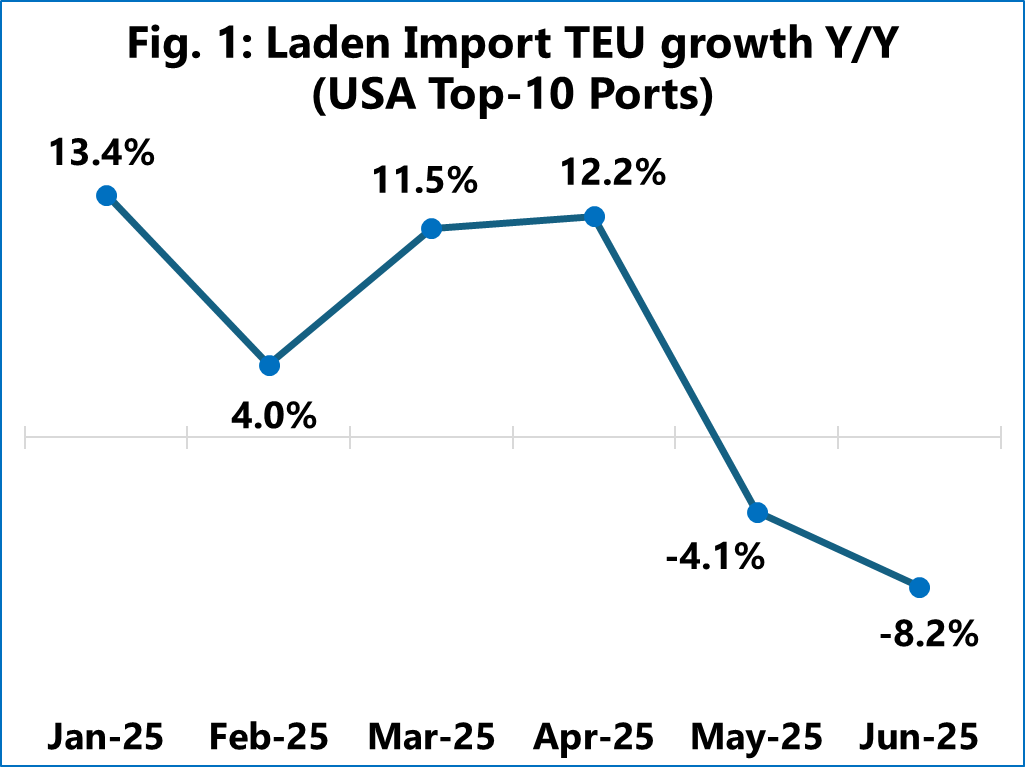

Sea-Intelligence’s analysis first established that the whiplash effect is already underway. Driven by an artificial boom from importers front-loading cargo to avoid tariffs, US ports experienced exceptionally strong growth in early 2025, which was immediately followed by a sharp bust, as shown in Figure 1.

Total laden imports through the top 10 US ports were up +15.6% Y/Y in the first four months (Jan-April) of 2025, compared to a pre-pandemic (2015-2019) high of 8.0% growth, and a pre-pandemic average of 4.8% Y/Y growth.

This boom was quickly followed with a bust, as laden inbound volumes contracted sharply by -4.1% Y/Y in May and by -8.2% Y/Y in June. To put this into context, the average May-June growth pre-pandemic (2015-2019) was +4.0%, while the June 2025 contraction is -7.5%.

The IMF, in their latest WEO report stated that global GDP would contract by -0.2 percentage points if trade escalations continue. To quantify this, Sea-Intelligence calculated a “TEU/GDP” multiplier based on historical data, which shows the sensitivity of container demand to economic growth.

Applying this multiplier translates the IMF’s warning into a tangible figure for the container industry: a -0.23% reduction in container volume growth. Based on 2024’s global volume of 184.4M TEU, this seemingly small percentage results in a loss of approximately 424,000 TEU from the global market in 2025.