While financial results softened, operational data points to resilience. Global transported volumes grew for 6 of the 7 reporting carriers, suggesting that the influx of new vessel deliveries and reworked service networks have allowed shipping lines to absorb the longer Red Sea transit times without the panic-pricing seen last year.

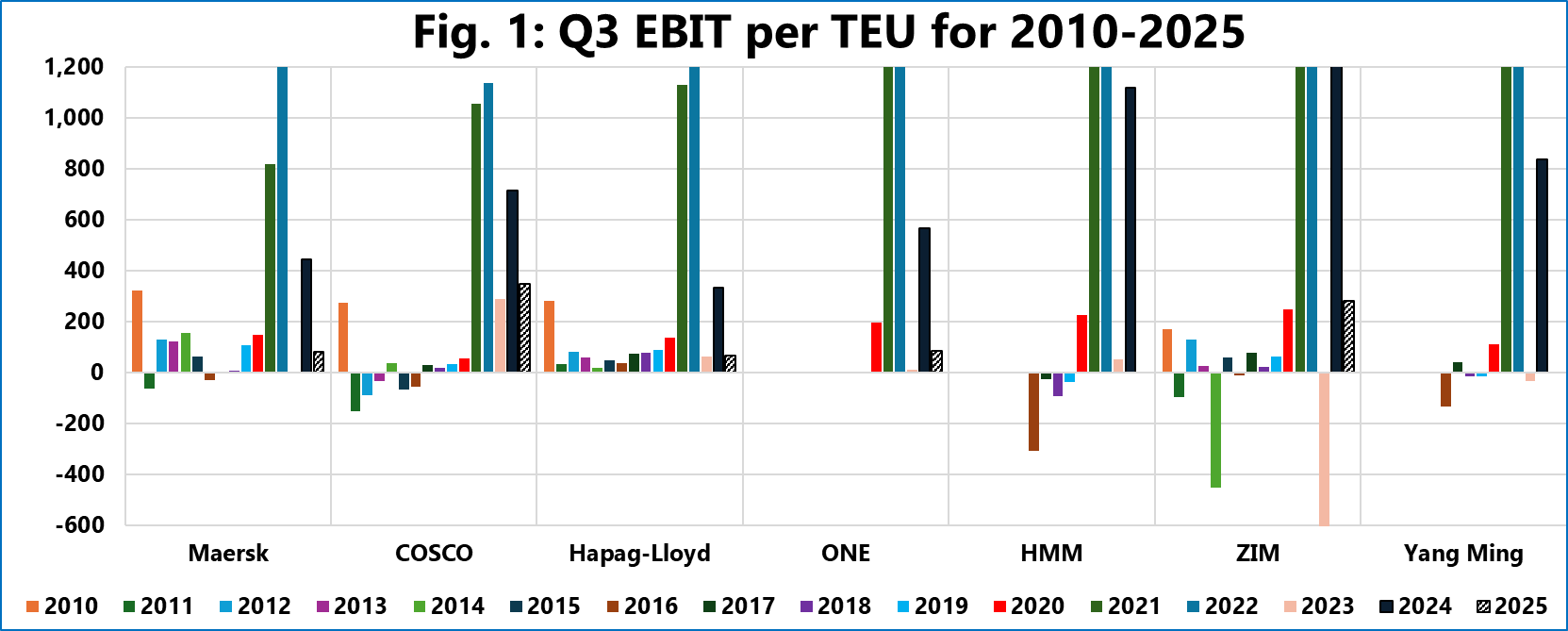

Figure 1 illustrates the development in unit profitability (EBIT per TEU). COSCO recorded the highest EBIT/TEU in 2025-Q3 at 350 USD/TEU, followed by ZIM at 280 USD/TEU. These were the only two carriers to maintain unit profitability above 200 USD/TEU.

The remaining major carriers – ONE (85 USD/TEU), Maersk (83 USD/TEU), and Hapag-Lloyd (65 USD/TEU) – saw their margins compress significantly, dropping below the 100 USD/TEU mark. This stands in sharp contrast to the same period last year, where the lowest EBIT/TEU in this group was 335 USD/TEU, highlighting the extent of the post-peak market correction.