The current competitive landscape among the Arabian Sea ports is in the spotlight, as the Red Sea crisis continues hampering shipping operations, affecting all the major regional players.

The ports are also part of larger geopolitical strategies, involving not only the host countries but also global shipping powerhouses like China and the United States. The partnerships and alliances formed through these port developments can influence regional political dynamics and control over critical maritime chokepoints like the Strait of Hormuz and the Bab-el-Mandeb Strait.

The competition among the Arabian Sea ports is not merely for direct shipping business but also for becoming regional hubs for re-export and transshipment to neighboring regions, including Africa, Asia, and Europe. The development of these ports is closely linked to broader economic reforms and initiatives aimed at attracting foreign investment, boosting trade, and developing non-oil sectors such as manufacturing and logistics.

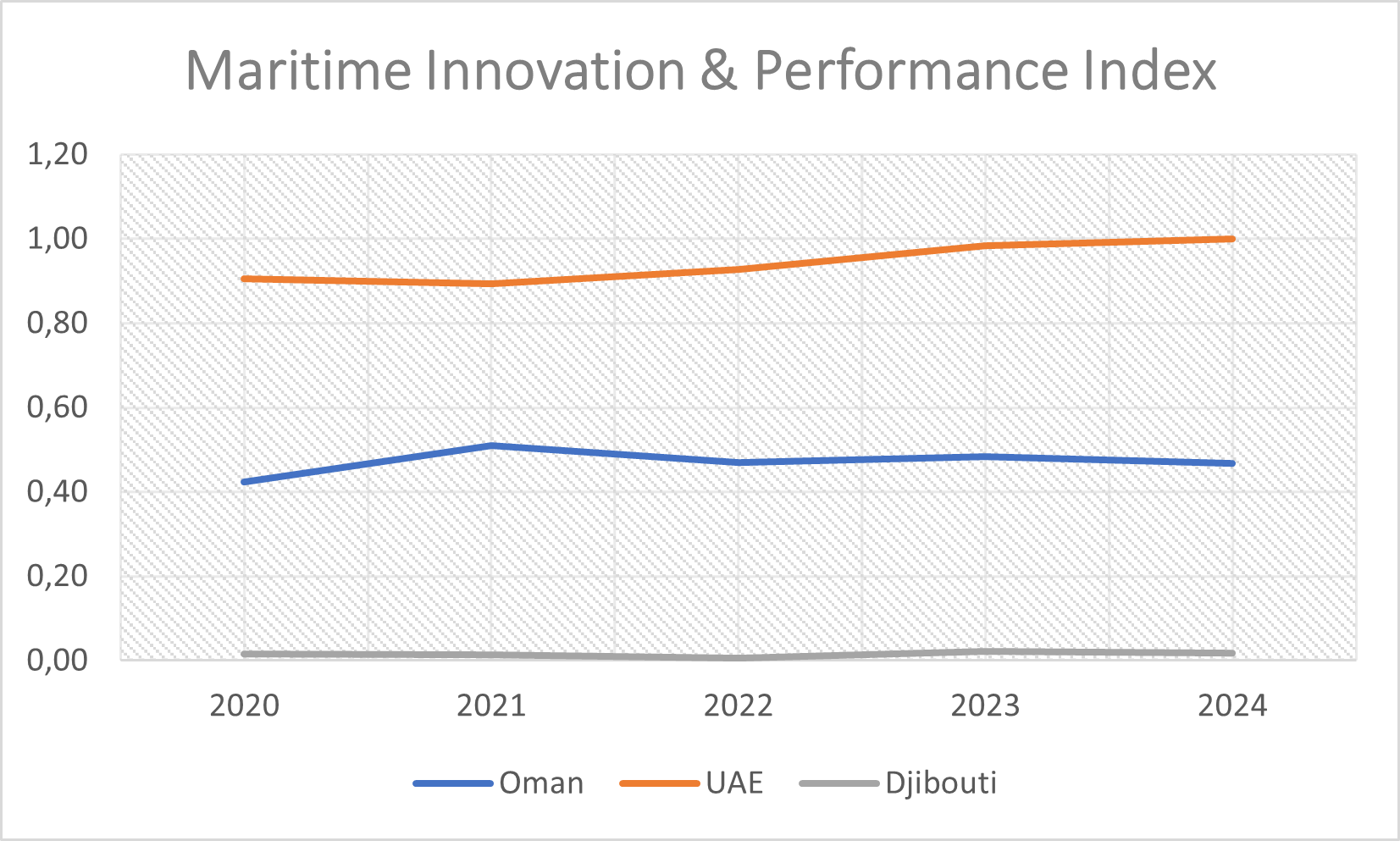

Container News carried out a competition analysis between the key ports of UAE’s Jebel Ali, Oman’s Salalah and Djibouti, in order to gain valuable insights about the performance in tactical (ports) and operational level (country’s maritime performance).

For this purpose, we used a compound indicator named Maritime Innovation & Performance Index, consisting of Frontier Technology Index, Linear Connectivity and Port Throughput. Also, the Port Connectivity index was used for conducting a correlation analysis between them.

The provided graphs illustrate two distinct aspects of maritime operations in the Arabian Sea region:

UAE exhibits a steadily high performance across the years, which can be attributed to high levels of technological readiness, consistent port throughput, and superior linear connectivity. Oman shows a gradual decrease in its performance index, particularly noticeable from 2022 to 2024. Djibouti has a relatively flat trend with a slight increase in 2023 followed by a decrease in 2024. This implies stable yet modest maritime performance, aligning with its lower scores in port connectivity.

Jebel Ali Port is one of the world’s most advanced ports and has a significant strategic advantage due to its location and infrastructure. As such, it consistently maintains a high port connectivity index, indicating a robust and stable port operation.

On the other hand, Salalah serves as a key logistics hub in the Arabian Sea, positioned advantageously on major shipping lanes connecting the East and the West. Despite its efficiency, it faces stiff competition from other regional ports. It shows moderate connectivity, maintaining a steady level over the years, however, there is a significant decline after 2023, which could justify the latest investment in new port equipment.

Djibouti is aiming to leverage its strategic location at the mouth of the Red Sea to serve as a major transshipment hub for East Africa, traditionally following the model set by Jebel Ali, which is located in another crucial maritime spot (straight of Hormuz).

Djibouti’s connectivity index is relatively stable something that allowed the port to overpass Salalah in the middle of 2023, indicating a significant competition between the two ports.

The UAE’s high scores in operational metrics are indicative of effective integration of technology and efficient management practices at its ports, primarily Jebel Ali. This is reflective of its overall strategic maritime position and operational excellence. Meanwhile, the high connectivity of Jebel Ali showcases its tactical advantage in handling transshipment and large-scale operations

Oman and Djibouti demonstrate lower innovation and performance scores, suggesting areas for development in technology integration and operational practices to enhance their competitive stance. Additionally, the two ports have relatively limited power to compete directly with the giant port of Jebel Ali. Instead their role is to focus more into regional trade networks and specialized services.

It can be said that both ports of Djibouti and Salalah are about to involve into a high competitive situation, considering the fact that Chinese investments in Djibouti are about to elevate the quality level of the port. This potential scenario could alarm Salalah in order to start improving its tactical profile, although it maintains a big difference in operational level.