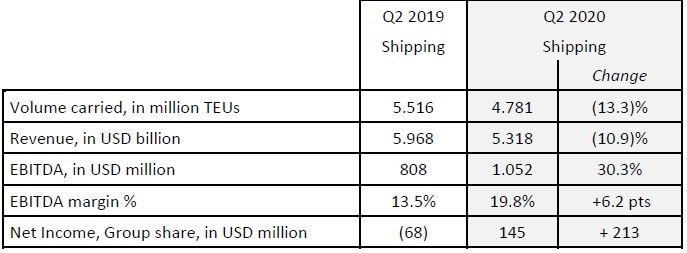

CMA CGM’s container traffic volumes decreased for the first time since 2009 as a result of lockdown measures in several countries.

A perceptible fall of 13% in the company’s Q2 box volumes, which is “more limited than initially expected”, led CMA CGM to adapt its deployed capacity to demand, cutting down vessels and containers, said the company.

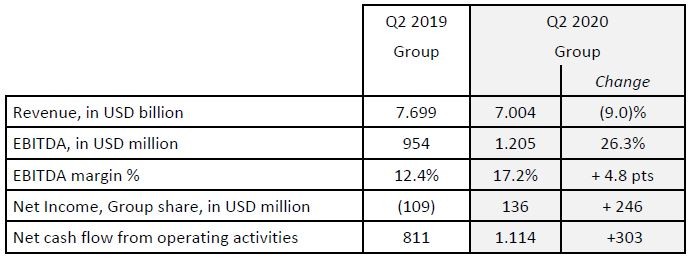

The significantly reduced demand due to the pandemic crisis resulted in the shutdown of production units, in particular in China, during the first quarter, which then followed by a sharp downturn in global consumer demand in March and April. Second-quarter revenue declined by 9%, reaching US$7 billion.

However, the French shipping group improved its profitability in all its business activities during the second quarter of the year, taking advantage of reduced operating costs, including the decline in oil prices.

“Despite the Covid-19 pandemic, our Group reported excellent results during the second quarter, thus strengthening our financial structure,” stated Rodolphe Saadé, chairman and CEO at CMA CGM Group.

The Marseille-based company presented significant increases of 26% in earnings before interest, taxes, depreciation, and amortisation (EBITDA) and 7.5% in operating margin, while it posted positive net income with a group share of US$136 million, compared with a loss of US$109 million during the second quarter of the last year.

At the same time, the group’s operating performance generated operating cash flow in excess of US$1.1 billion.

“Thanks to our agile business model and synergies between our shipping and logistics business activities, we were able to adapt our service offerings,” added Saadé.

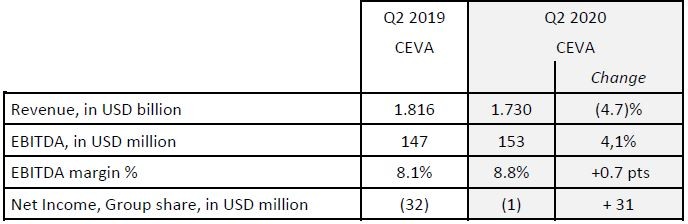

CEVA Logistics, a company owned by the CMA CGM Group, showed the initial signs of recovery in the last quarter. CEVA’s Q2 EBITDA increased by 4% to US$153 million and its net loss reached US$1 million, compared with a net loss of US$32 million during the second quarter of 2019.

The decision of the French Group to make CMA CGM the sole carrier on the Transpacific trade, aiming at “simplifying the product offering while optimising the cost base and adapting to the current economic and trade environment,” marked the latest quarter.

Although CMA CGM remains cautious in the current health and economic environment, it is confident in its business outlook for the third quarter of 2020. The shipping firm said it believes that the current momentum of the shipping market, driven by both volumes and freight rates, could boost its next-quarter performance.