The following Q3 2025 Shipping Market Analysis report, was conducted by Dr. Michael Tsatsaronis, Assistant Professor at the Department of Port Management and Shipping, National and Kapodistrian University of Athens.

The research team includes undergraduate and postgraduate students, as well as doctoral candidates from the department. This report provides a detailed examination of recent trends and developments in the shipping market, offering insights derived from ongoing academic research.

CONTAINER MARKET

-

FREIGHT MARKET

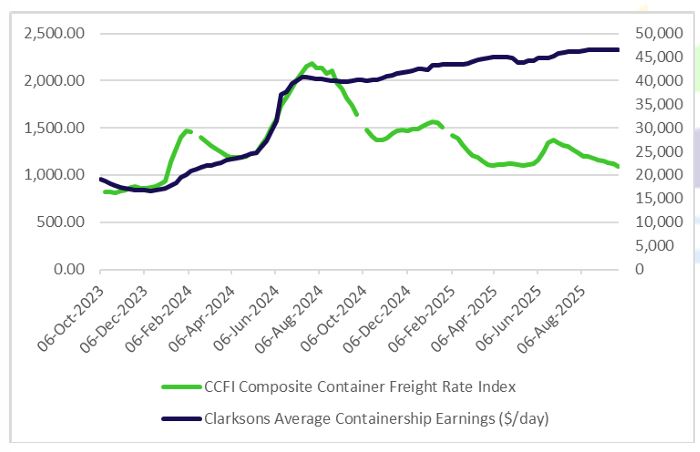

During July, the containership market was on a continuous downward course, with freight rate declines persisting for several consecutive weeks and no signs of recovery emerging. The market weakness was attributed to a general drop in demand for maritime transport, combined with increased vessel capacity availability, conditions that consistently exerted pressure on freight rates.

A decisive factor in shaping the adverse market climate was the imposition of United States tariffs on certain categories of goods, which restricted cargo flows and reinforced the prevailing downward trend.

The impact of these trade measures, coupled with the ongoing decline in demand, created a prolonged environment of uncertainty and pressure, highlighting the sector’s dependence on developments in international trade and geopolitical-economic conditions.

During August 2025, the containership market continued to face strong pressures, with freight rates following a prolonged downward trajectory. At the beginning of the month, there were signs of stabilization, yet these proved short-lived, as the market soon entered a phase of successive declines.

The outlook for the sector remained uncertain, shaped by persistent overcapacity and the re-imposition of US tariffs, which further constrained demand for maritime transport. These pressures resulted in an unbroken downward course, which by the end of the month had extended to eleven consecutive weeks of falling freight rates.

The overall picture for August confirmed the fragile balance of the market and highlighted the uncertainty surrounding its prospects throughout the remainder of the year.

During September, the containership market remained on a downward trajectory, as freight rates continued to decline for several consecutive weeks. The initial signs of stabilization observed at the beginning of the month were not sustained, with the market quickly returning to a state of pressure.

The imbalance between supply and demand, combined with reduced trade activity on the Far East–Europe routes, continued to negatively affect the formation of freight prices. At the same time, the prolonged decline reinforced uncertainty within the shipping sector, while expectations for recovery remained limited.

Overall, the month reflected a market still tested by global economic developments and seeking a more stable course amid an environment of persistent volatility.

-

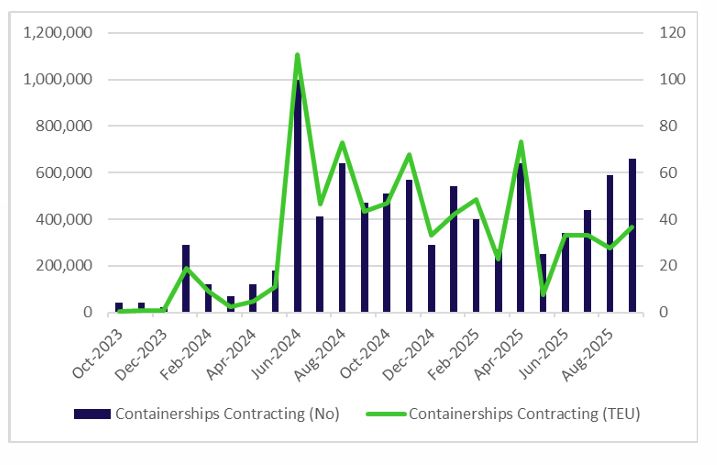

NEWBUILDING – SALES & PURCHASE

The containerships newbuilding market entered the third quarter of 2025 with heightened activity. Minerva Marine signed letters of intent with two Chinese shipyards. The deal includes the building of up to eight ships of 1,800 TEUs in two Chinese shipyards, Yangjiang Shipbuilding and Huanghai Shipbuilding.

Each shipyard will build two ships, and they both have options for building two more. The ships will run on conventional fuel and are expected to be delivered between 2027 and 2028. MSC placed an order for six new ships with a capacity of 22,000 TEUs in China Merchants Heavy Industries’ Haimen shipyard. The new ships will be carrying dual fuel (conventional and LNG), and deliveries are expected to start in 2027.

Huangpu Wenchang Shipbuilding (China) will implement TS Lines’ shipbuilding program by building five firm and five optional ships of 5,000 TEUs capacity each, with delivery date the year 2028. In addition, Nihon Shipyard (Japan) agreed with Yang Ming Marine Transport to build three methanol dual fuel vessels, 8,000 TEUs each. The worth of the deal is between $351–394 million, and the deliveries are expected between 2028 and 2030.

Yang Ming Marine Transport (Taiwan) ordered seven dual-fuel (conventional and LNG) 15,500 TEUs vessels, with delivery estimations in 2028 and 2029. Navios Maritime Partners is building four more vessels at South Korea’s HJ Shipbuilding & Construction.

The capacity is 8,000 TEUs for each ship; deliveries will start in 2027, and all of them will be equipped with dual-fuel engines and scrubbers. Finally, Capital Maritime (Greece) placed an order for two dual-fuel containerships (conventional and LNG), with a carrying capacity of 2,800 TEUs each, and expected deliveries in 2027 (July and September).

For July 2025, the sales and purchase market traded at extremely low levels. Specifically, only three containerships have changed hands this past month. The need to renew the fleet and create more energy-efficient ships is driving the market down, at least for July.

Newbuildings’ activity remained at a similar level in August 2025. Euroseas Ltd. placed an order at the Jiangsu New Yangzi Shipbuilding Co. shipyards (China) for two vessels with a carrying capacity of 4,300 TEUs each. The cost of each vessel is $59.25 million, and they are expected to be delivered between March and May of 2028. In addition, Costamare ordered four new vessels from Zhoushan Changhong shipyards in China.

Each vessel will have a carrying capacity of 3,100 TEUs and will be delivered to Costamare between April and December 2027. The company has arranged an eight-year charter for each vessel.

July’s low activity for the sales and purchase market continued in August. Capital Energy Carriers sold the vessel Manzanillo Express for $6.9 million to a non-disclosed buyer. The delivery of the 13,300 TEUs vessel is scheduled in the third quarter of the year.

Despite the historically high levels of orders for new containerships, companies continued to place orders at a rapid pace in September. CMA CGM has signed a letter of intent with a subsidiary of China State Shipbuilding Corp.

The deal with Dalian Shipbuilding Industry Co. includes the construction of six new ships with 22,000 TEUs of carrying capacity each and an option of building four more with the same characteristics. All ships will be equipped with an LNG dual-fuel engine, while the pricing details remain unknown.

In parallel, the company received its new methanol dual-fuel containership, increasing its transport capacity by 13,000 TEUs. The same shipyards received an order by Danaos Corporation for the construction of two new containerships with a carrying capacity of 7,500 TEUs and a cost of $80 million each.

Navios Maritime ordered four new containerships at the HJ Shipbuilding shipyards in South Korea. Each ship will cost $115 million and have a carrying capacity of 8,850 TEUs.

-

DEMOLITIONS

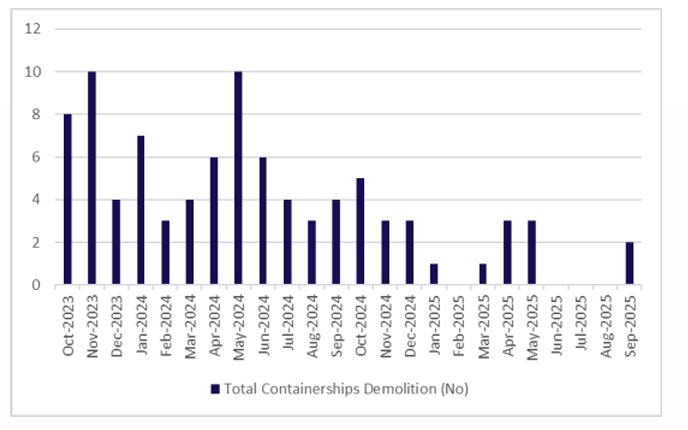

In August 2025, containership scrapping was a “bright exception” to the general market climate. From the beginning of the year to the end of July, only five ships of the category were sent for recycling, a significantly lower number compared to the thirty-three containerships that were scrapped in the corresponding period of the previous year and the forty-five the year before.

This limited mobility highlights the specificity of the sector in relation to other ship categories, where scrapping recorded higher rates.