The following Q2 2025 Shipping Market Analysis report, was conducted by Dr. Michael Tsatsaronis, Assistant Professor at the Department of Port Management and Shipping, National and Kapodistrian University of Athens.

The research team includes undergraduate and postgraduate students, as well as doctoral candidates from the department. This report provides a detailed examination of recent trends and developments in the shipping market, offering insights derived from ongoing academic research.

CONTAINER MARKET

-

FREIGHT MARKET

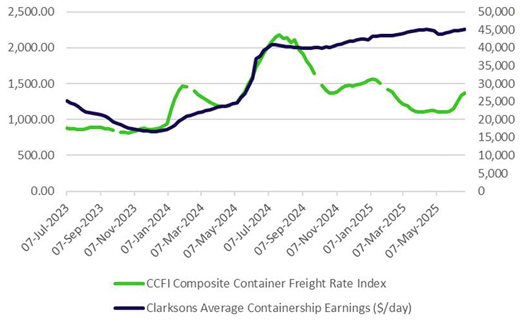

The second quarter of 2025 was marked by continued volatility in the containership freight market, with short-lived rallies, persistent uncertainty, and sharp route-specific fluctuations. While the quarter offered glimpses of recovery—particularly in May and early June—the broader picture remains one of fragility and imbalance, shaped by macroeconomic pressures and evolving geopolitical dynamics.

In April, the market showed tentative signs of stabilization, following a period of weak demand and declining rates that defined much of the previous year. A modest upswing in rates was observed on key trade lanes—especially between Asia and the United States—driven by renewed geopolitical tensions, including escalating tariff threats between Washington and Beijing.

However, this brief recovery proved unsustainable. By the final week of April, rates had softened once again, reaffirming the market’s vulnerability and its dependence on external factors such as trade policy shifts, inventory cycles, and consumer demand in major economies.

May continued this pattern of fluctuation, with freight rates rising and falling in response to shifting sentiment and demand levels. The most notable improvements occurred on transpacific routes, particularly in the second half of the month, where rising U.S. import volumes led to stronger vessel utilization and improved spot rates.

This upward trend fostered cautious optimism across the sector, suggesting that a bottom may have been reached in some segments of the market. However, the recovery remained uneven, with other trade lanes—such as intra-Asia and Asia–Europe—showing less pronounced gains.

June opened on a strong note, buoyed by the momentum from late May. Spot rates on China–US and China–Europe routes surged amid increased bookings and port congestion in parts of East Asia. Yet this rally was short-lived. As June progressed, signs of weakening demand began to emerge, particularly in the U.S. market, where macroeconomic uncertainty—including concerns over consumer spending, interest rates, and retail inventories—contributed to reduced booking volumes.

This reversal placed renewed pressure on major east–west trades, eroding earlier gains. Despite the mid-month softening, spot rates in late June remained significantly higher than those observed in early spring, leaving some room for cautious optimism heading into Q3. Market sentiment, however, remains fragile, with charterers and carriers alike maintaining short-term strategies in response to uncertain demand visibility and ongoing geopolitical friction.

-

NEWBUILDING – SALES & PURCHASE

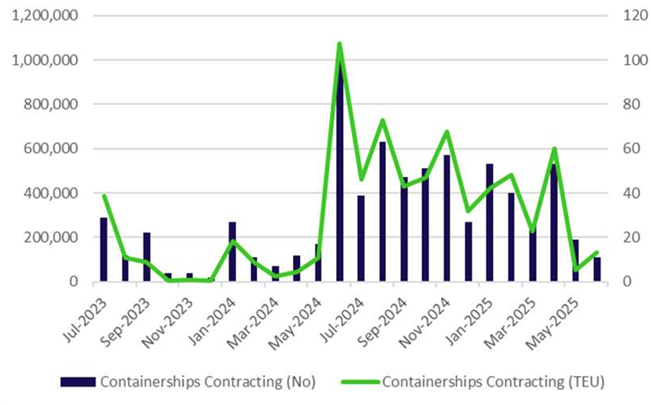

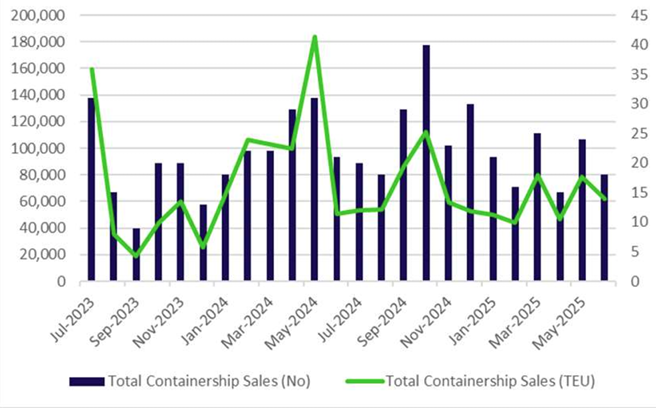

Despite geopolitical headwinds—particularly escalating U.S.–China tariff disputes—the containership newbuilding market continued to expand significantly during Q2 2025, driven by long-term planning, fleet modernization goals, and environmental compliance pressures. Orders remained strong throughout the quarter, with major carriers and shipowners committing to large, next-generation vessel programs.

In April, South Korea’s HD Korea Shipbuilding & Offshore Engineering (HD KSOE) secured contracts for 24 new containerships from various Asian and Oceanian operators. The first tranche included 20 vessels of varying sizes: four with a capacity of 8,400 TEU, eight with 2,800 TEU, and six with 1,800 TEU. These ships are scheduled for delivery in the first half of 2028.

Additionally, HD KSOE signed a separate deal for two more boxships valued at approximately $400 million. Samsung Heavy Industries also secured an order from an Asian shipowner for two containerships worth $358 million, to be delivered by January 2028.These contracts underline Korean yards’ continued leadership in high-value, technologically advanced containership construction.

In May, the orderbook expanded further as OOCL placed a landmark order for 14 large containerships valued at over $3 billion with COSCO-affiliated Chinese shipyards. Deliveries are expected between 2028 and 2029. Although fuel specifications were not disclosed, the investment reflects OOCL’s long-term commitment to scale and efficiency.

In parallel, Hapag-Lloyd announced an order for six dual-fuel (conventional and LNG) containerships of 16,000 TEU each, placed with Hengli Heavy Industry and Fujian Mawei shipyards in China. These vessels are set for delivery around 2027.

Momentum continued into June, as Ocean Network Express (ONE) ordered eight 16,000 TEU dual-fuel vessels from Hyundai Heavy Industries in South Korea, reaffirming its strategy to modernize and decarbonize its fleet. At the same time, Seaspan, a major lessor and member of the Atlas Group, ordered six 8,300 TEU methanol-fueled containerships from Hudong-Zhonghua shipyards in China.

These vessels are expected to be chartered to COSCO, indicating strong liner support for alternative fuel propulsion. Also in June, HD Hyundai Samho Heavy Industries (a subsidiary of HD KSOE) announced an order for two dual-fuel boxships worth $280 million, with delivery scheduled for March 2028.

Completing a major investment cycle, Hapag-Lloyd took delivery of the final vessel from its 12-ship dual-fuel program, marking the conclusion of one of the most significant recent containership renewal efforts in the sector.

The Q2 2025 containership order boom reflects a long-term focus on capacity expansion, emissions compliance, and operational flexibility. The strong demand for dual-fuel and methanol-powered vessels highlights a clear shift toward greener propulsion, while delivery timelines extending into 2028–2029 suggest that the sector anticipates continued growth in global container volumes and stricter regulatory requirements.

Despite short-term freight rate volatility, carrier strategies appear firmly anchored in long-term resilience and environmental transition.

-

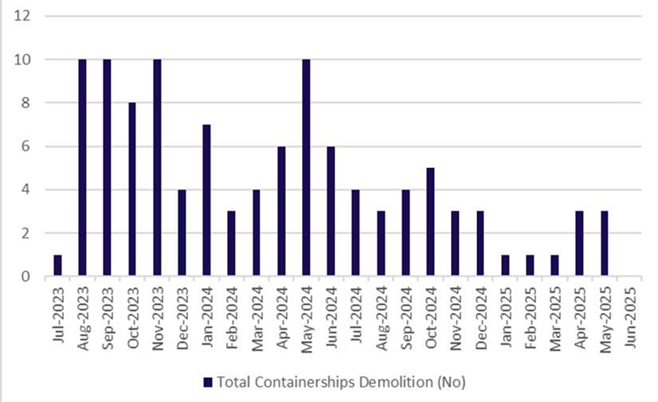

DEMOLITIONS

Containership demolition activity remained exceptionally subdued in Q2 2025, continuing the broader trend of limited scrapping across vessel segments. In April, scrapping volumes reached one of the lowest levels on record, with just three vessels sold for demolition—each to different countries: India, Turkey, and Singapore. This near standstill reflects both strong asset values and the broader market disruption caused by escalating trade tensions.

A key contributing factor to the slowdown was the sudden imposition of steep U.S. tariffs on Chinese-built ships and a wider range of goods. The abrupt policy shift generated uncertainty across global supply chains and prompted owners to delay disposal decisions, opting instead to retain aging vessels amid shifting trade flows and temporarily firming charter markets.

While scrapping levels typically increase when freight rates soften, current demolition trends remain disconnected from short-term rate signals. High residual values, cautious sentiment, and long delivery schedules for newbuilds are all supporting vessel retention, even for older tonnage.

As the Hong Kong International Convention (HKC) comes into force later in 2025, the demolition landscape is expected to change—particularly in terms of environmental compliance and yard selection. However, in Q2, the containership scrapping market remained stagnant, reflecting both market uncertainty and the sector’s ongoing preference to trade, rather than recycle, aging capacity.