The Port of Klaipėda delivered a record-breaking performance in 2025. Cargo volumes continued to rise across several segments. Containers, ro-ro, LNG, oil products, minerals, and construction materials all hit new highs. Passenger traffic also reached record levels.

The port handled 39 million tonnes of cargo during the year. Strong investment, improved security, modern technology, and environmental solutions supported this growth. Despite geopolitical pressure and sanctions, volumes increased and operations remained strong.

Container Traffic Leads Growth

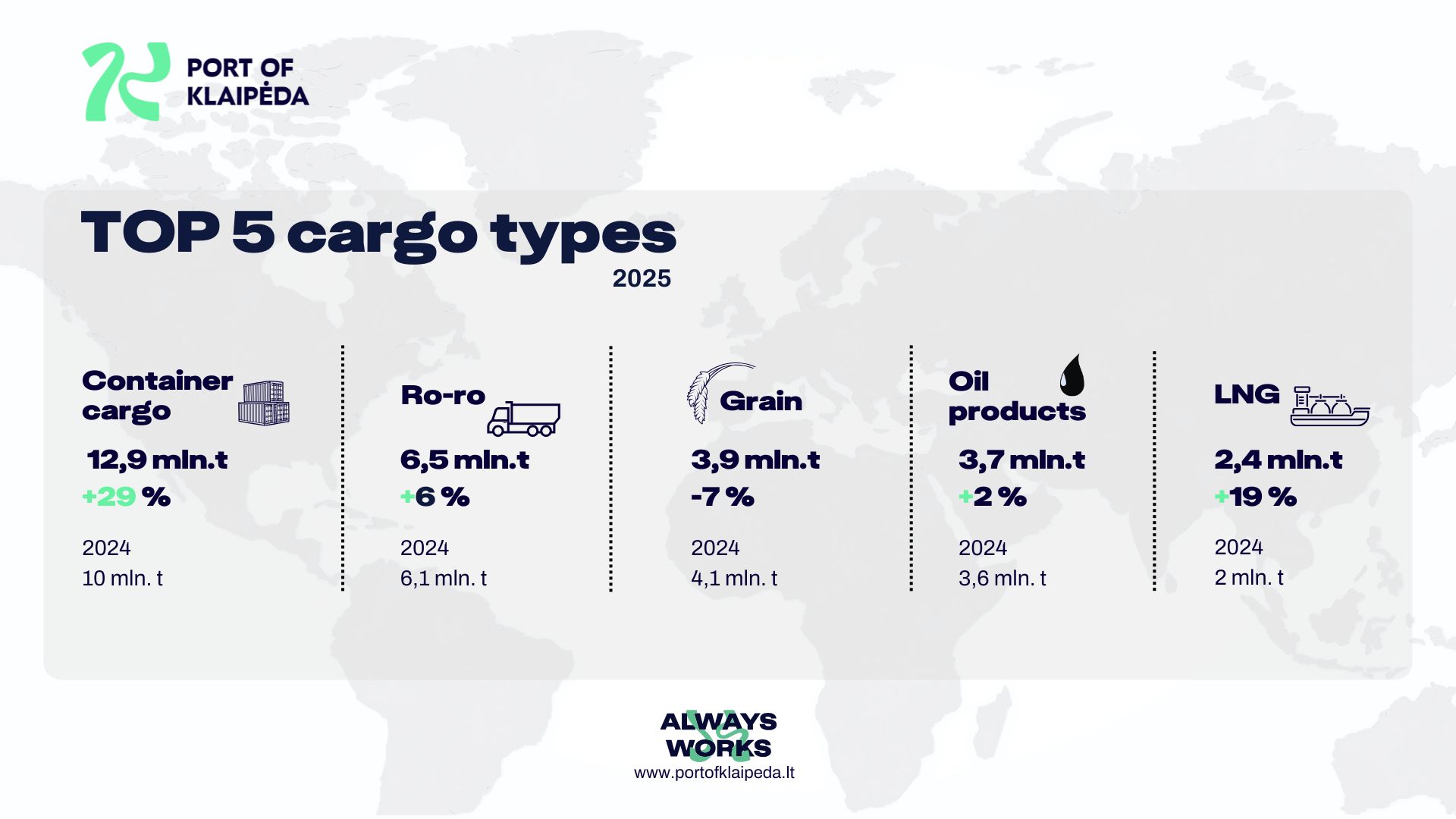

Container handling recorded the strongest growth. The port handled almost 13 million tonnes of containerised cargo. This marked a 29% increase from 2024.

The port reached one million TEU in early October, earlier than ever before. By year-end, total throughput reached 1,308,687 TEU. This exceeded the previous record by 22%. Container tonnage also set a new high, beating the earlier peak from 2022.

Ro-Ro and LNG Volumes Rise

Ro-ro cargo grew by 6% to 6.5 million tonnes. Ferry traffic also set a new vehicle record. The port handled 353,759 vehicles, nearly 10,500 more than the previous high. New ferry services and higher sailing frequency drove this growth.

LNG volumes increased by 19% to 2.4 million tonnes. Results improved compared with both 2024 and the previous record year of 2023.

Construction Materials and Passenger Traffic Hit Highs

Construction materials and minerals reached a new record of 2.1 million tonnes. The port supported major national infrastructure and construction projects.

Passenger numbers also increased sharply. A total of 415,000 passengers travelled through the port. This marked the highest level in more than five years. Cruise traffic reached a new record. The port welcomed 76,620 cruise passengers on 59 ships, up 19% year on year.

Some Cargo Segments Decline

Not all cargo segments grew. Timber and forestry products fell to 606,000 tonnes. Scrap metal volumes dropped 11% to 1.2 million tonnes due to weaker demand and trade restrictions.

Grain handling declined by 7% to 3.9 million tonnes. Harvest volumes and domestic consumption affected exports.

Fewer Ships, Higher Efficiency

Vessel calls fell by 3% to 5,313. Larger ships and improved infrastructure allowed the port to handle more cargo with fewer calls and lower environmental impact.

Local ferry services also remained strong. Ferries to the Curonian Spit carried 2.9 million passengers and 358,400 vehicles.

Baltic Market Leadership Strengthened

Klaipėda reinforced its leading position in the Baltic region. No other Baltic port recorded double-digit growth in 2025. Riga and Liepāja reported declining volumes, while Tallinn and Ventspils posted moderate growth.

Container handling further strengthened Klaipėda’s dominance. Other Latvian and Estonian ports stayed below 500,000 TEU and mostly saw declines.

With 39 million tonnes handled, Klaipėda increased its market share to 41.4%. The port widened its lead over regional competitors and confirmed its role as the Baltic States’ top cargo gateway.