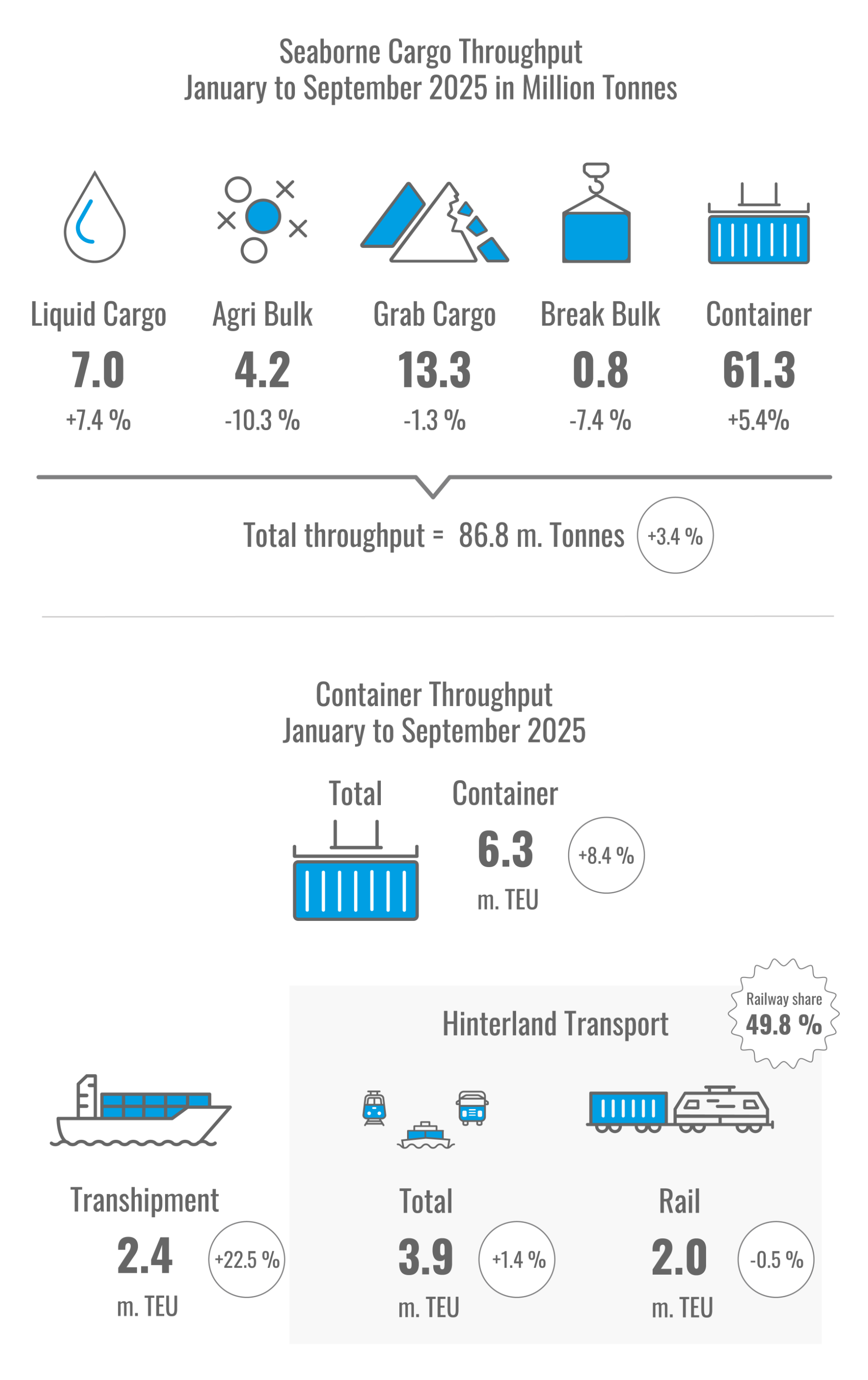

Container throughput rises 8.4% to 6.3 million TEU; seaborne cargo up 3.4% to 86.8 million tonnes

Throughput at the Port of Hamburg remained robust after the third quarter of 2025. While U.S. container traffic declined, trade with Asia and Europe continued to grow.

Container throughput continues to grow; bulk cargo stable

From January to September 2025, seaborne cargo throughput increased 3.4% year-on-year to 86.8 million tonnes. Container throughput rose 8.4% to 6.3 million TEU, representing 61.3 million tonnes of containerized cargo (+5.4%). Bulk cargo remained largely stable at 24.6 million tonnes (-0.8%). Grab cargo showed strong growth (+9.4%), led by coal (+16.4%) and ore imports (+3.8%).

Growth in Asia and Europe offsets U.S. decline

Container throughput growth was driven by Asia (+11%) and Europe (+14%). U.S. traffic declined 23.9% to 395,000 TEU due to trade complications. In Asia, trade with China rose to 1.8 million TEU (+7.9%), Malaysia surged 89.8% to 273,000 TEU, and India grew 45.5% to 214,000 TEU. Intra-European trade also performed well, with Denmark (+37.1% to 147,000 TEU), Finland (+26.5% to 195,000 TEU), and Poland (+18.9% to 276,000 TEU) showing strong gains.

Hinterland container transport rises

In Q3, new liner services from Southern Europe, the Mediterranean, and South America contributed to higher container volumes. Transshipment throughput increased 22.5% to 2.4 million TEU. Rail transport remained high at 2.0 million TEU (-0.5%), with continued trend toward high-capacity utilization. Overall, container hinterland transport increased 1.4% to 3.9 million TEU.

The Port of Hamburg continues to expand its role as a key gateway for European and global trade, with strong growth in Asia and Europe offsetting declines in the U.S. market.