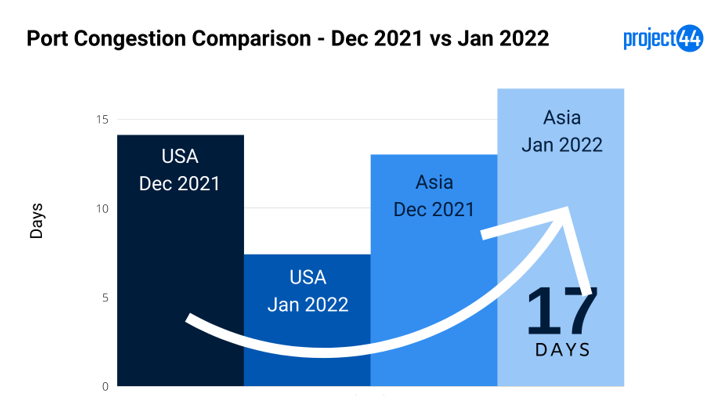

The US West and East Coast ports saw a reduction in port congestion during January, as workers cleared a substantial backlog amid Covid-19 outbreaks, according to the supply chain visibility platform provider Project44.

Particularly, the number of ships waiting per day to berth at US ports, on average, fell from 14.1 ships in December to 7.4 in January, according to Project44 intelligence.

However, while there was some easement at US ports, including Los Angeles (POLA) and Long Beach (POLB), congestion shifted to Asian ports, which recorded an increase from 13 ships per day to 16.7 per day, on average, from December to January.

Among the Asian ports, Hong Kong recorded the biggest increase, from 13 ships per day in December to 16.7 per day in January, according to the company’s data.

Regarding the European ports, they noted a month-to-month average decline from 6.5 ships per day in December to 5.6 ships per day in January.

“In January there were signs of improving conditions at some ports, however, we still have a ways to go before there is a return to normalcy,” stated Josh Brazil, director of supply chain insights at project44.

The port congestion increase in Asia has been attributed to new Covid-19 outbreaks in the continent and specifically in China, as well as to pre-Lunar New Year planning by carriers.

According to a Maersk news update, despite Covid-19 cases, container loading and discharge operations have been working normally at the ports of Ningbo, Tianjin, Shenzhen, Dalian, and Guangzhou. The district-level lockdowns and mass testing led to warehouse closures and trucker shortages.

In Ningbo, for example, a cluster of Covid-19 cases in early January in the city’s Beilun district led to extensive trucker delays, as drivers had to undergo testing and quarantine before being allowed into Beilun’s three container terminals.

“The Omicron variant of Covid-19 continues to impact port workers and other supply chain stakeholders, and this will continue to be a major contributor to delays,” claimed Brazil.

While data indicates that there has been a marginal decrease in the ship berth time in Los Angeles, the average time that a ship spends at berth in the Californian port is 10 times more than it spends in Shanghai, indicating the huge gap in port productivity at the busiest port of the United States.

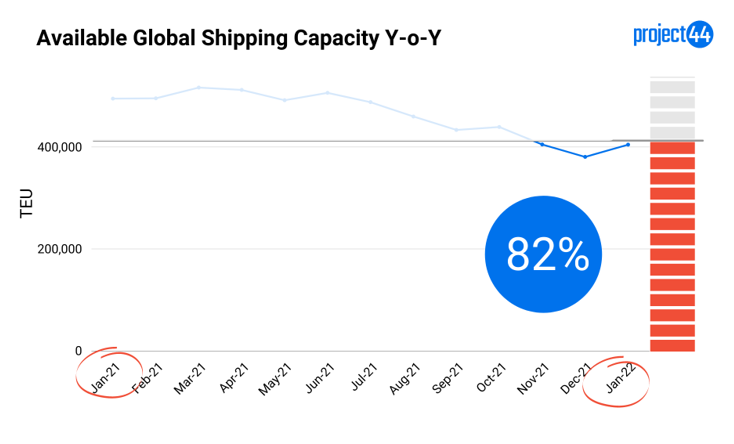

Available shipping capacity is at 82% of the 2021-level

Although there was a slight increase in available shipping capacity from December 2021 to January 2022, it was still at around 82% of January 2021’s level, according to Project44 data.

While this slight increase from December to January proved beneficial for shippers needing to replenish inventories ahead of the Lunar New Year on 1 February, the increase was not enough for retailers facing low inventory levels and strong demand.

Container Dwell Times

Project44 sees that a “cut and run” strategy is occurring, as carriers prioritise schedules over waiting to load export cargo.

With the exception of some major Chinese ports, almost all global ports tracked by Project44, export containers waited longer to leave ports versus import containers waiting for pick-up and delivery to customers.

The Chicago-based company believes that this increase in export container dwell time may be attributed to the delay in the vessel’s berthing, which is caused by port congestion.

According to Project44 intelligence, the import volumes into the US West Coast ports have been on a steady decline since August of 2021 and as a result of these declining volumes, the average import container dwell times dropped to 5.2 days and 5 days respectively in Long Beach and Los Angeles.

However, January export container dwell times for Los Angeles were much higher than import ones, while some carriers prioritised empties over full export containers.

Other carriers are “cycling” their discharges with one box off and one box on, but for many of these carriers, prioritisation of imports is most important.

“The time in port for ships has been reduced, and in some cases, there is little time to load the vessel after discharge,” noted Stephen Nothdurft, HMM’s vice president of the US Midwest, who also claimed that there are intentions to have laden boxes placed on the ship, but “cut and run” and other factors have clouded the overall operations.

HMM had to shift some of their extra loaders to the Port of Tacoma’s Washington United Terminal to avoid cut and runs in Los Angeles.

Empty Container Movement

Many of the outbound containers are empty and are being sent back to Asian ports and manufacturers to reload and ship as full containers back to US ports to satisfy what has become consumers’ insatiable desire to spend on goods.

In December, the Port of Los Angeles announced a US$100 daily penalty on carriers that fail to clear empty containers off the docks as the empties were piling up.

However, in January the port deferred the penalty because it may have “unintended consequences,” as some of the empty containers that have been sitting the longest may be buried under others, costing time “that our marine terminals simply don’t have to waste right now,” port executive director, Gene Seroka, said in an announcement.

At the end of January 2022, the port of LA was sitting with around 62,253 empty containers to be shipped out. The port shipped out 3.95 million empty containers in 2021 compared to 1.18 full containers, according to Project44 intelligence.

Transhipment Rollovers

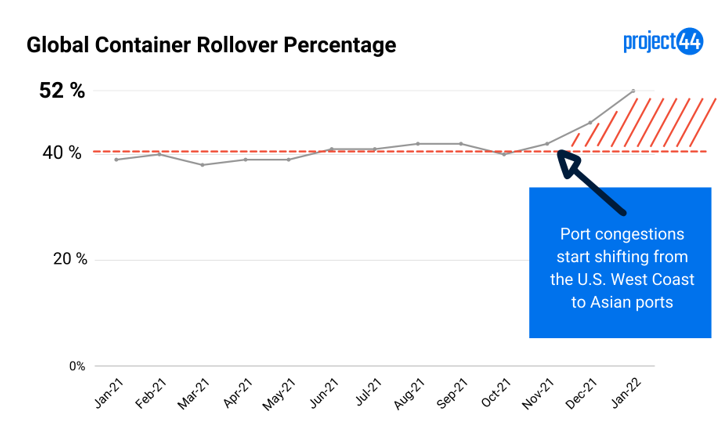

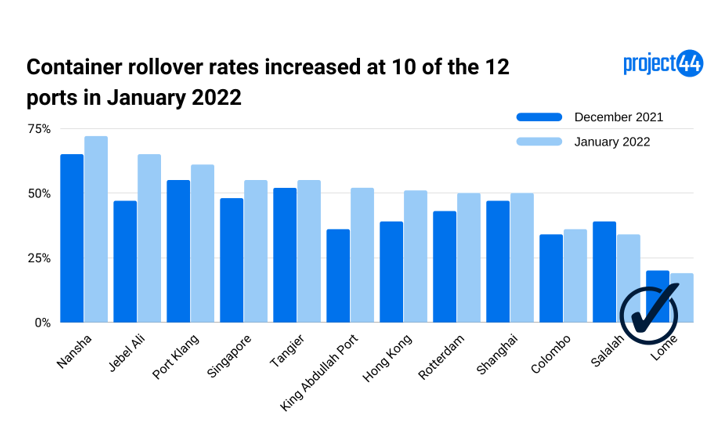

Transhipment rollovers have inched upwards each month since October due to a number of reasons including blank sailings, port congestion and Covid-19 and related labour issues.

But January’s overall rollover percentage of 52%, was a bigger month-to-month increase compared to recent months, 6% higher than in December, likely due to Asian port congestion.

The port of Jebel Ali saw the biggest month-on-month increase of transhipment container rollover rates, from 47% to 65%, while Nansha recorded the highest percentage of container rollovers of 72% in January 2022, possibly due to Omicron outbreaks at the port affecting the workforce.

While the ocean freight market will likely see a slight lull during February, it is expected that demand will pick up once again once manufacturing facilities reopen.

The potential for further port congestion is also likely in the coming month, according to Project44, as US retailers and other shippers replenish and increase safety inventories.

US retail inventories remain low and many shippers did not have enough inventory on hand during the December holiday season to satisfy customer demand.

Moving forward, many retailers plan to increase their inventory levels “just in case”, as a short-term strategy to address the backlogs and delayed deliveries that many retailers are experiencing.

Once backlogs are cleared and deliveries are normalised, we anticipate that retailers will drop this strategy and resume leaner inventory levels to avoid too many promotions that typically weigh on earnings.

However, container shortages may be a concern as ports have prioritised the clearing of import containers over the reposition of empty containers.

“Whether or not there will be enough empty containers positioned in the right locations after the Lunar New Year is a big unknown right now,” pointed out Brazil. “If they are not, we may see further delays,” he concluded.