With Covid-19 rising in many large oil markets uncertainty about the future of oil’s fundamentals remains unusually high, according to Marine Bunker Exchange (MABUX), who highlighted that “any change in this state of affairs depends on how the pandemic develops.”

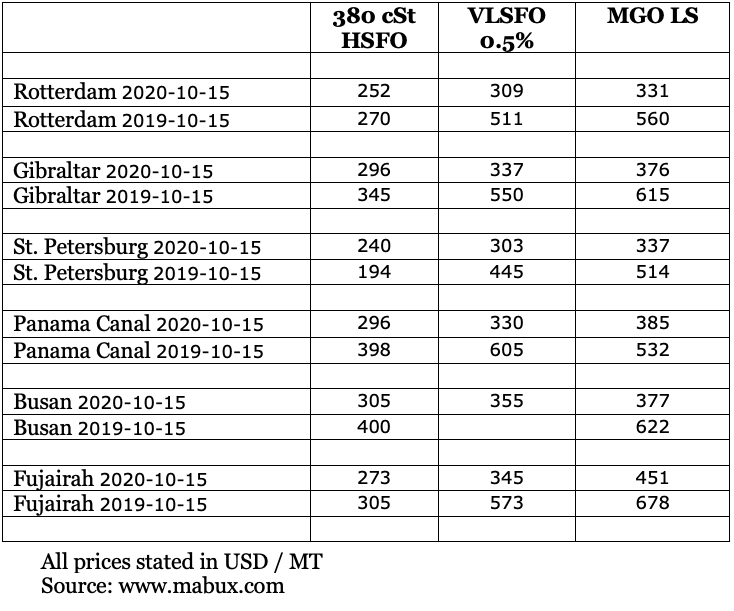

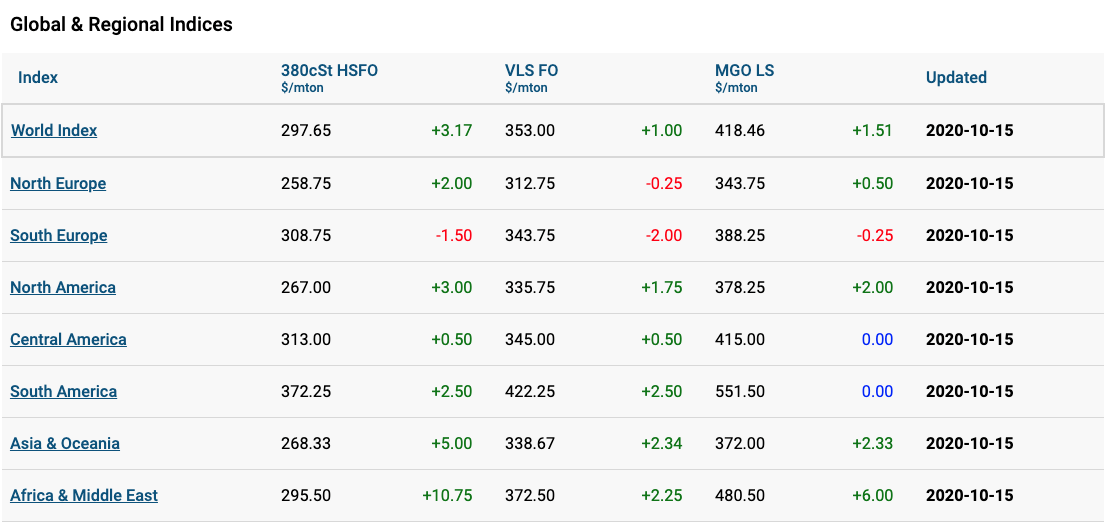

The World Bunker Index MABUX continued its slight upward evolution for a week with the 380 HSFO index rose to US$297.65/mt, VLSFO added US$4.00 reaching at US$353 / mt, while MGO increased to US$418.46/mt.

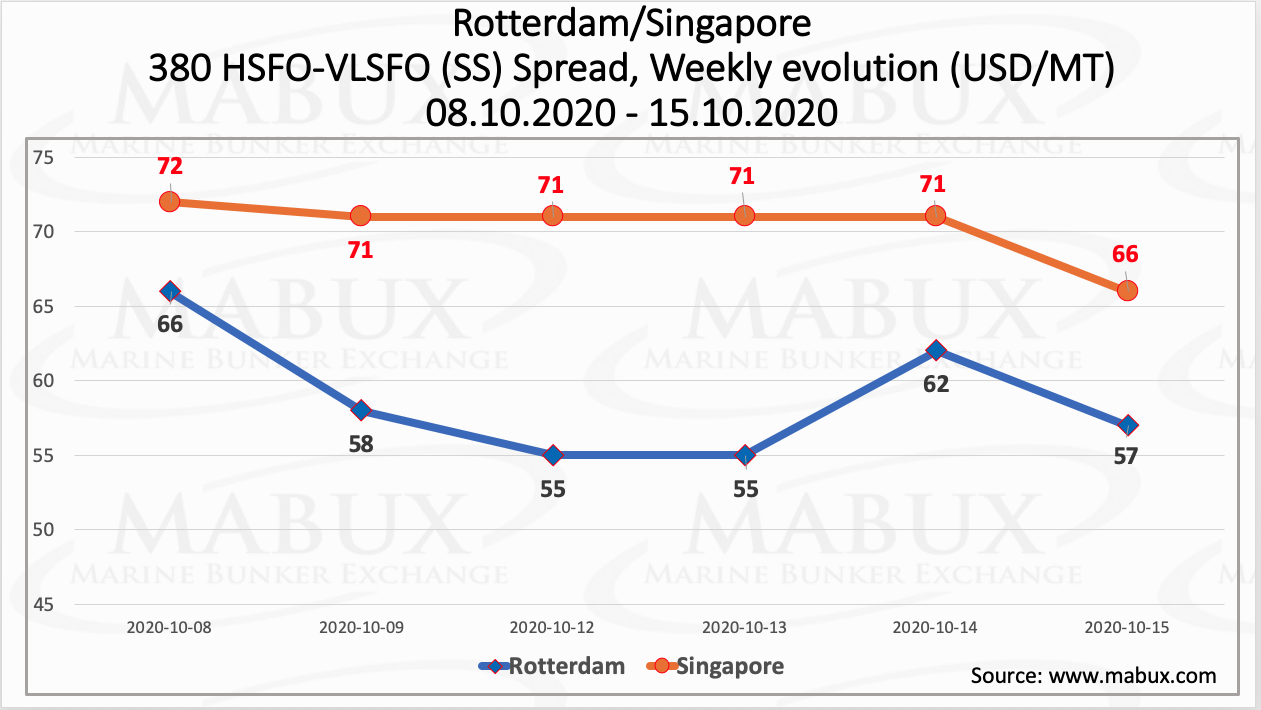

The global scrubber spread (the price difference between 380 HSFOs and VLSFOs) has also increased slightly, adding US$3.43, and averaged US$56.84.

The spread in both hubs: Rotterdam and Singapore has shown a decline of US$9 and US$6 respectively over the last week. At the same time, the average spread in both ports did not change significantly, having decreased by US$1.67 in Rotterdam and added US$1.00 in Singapore.

The Organization of the Petroleum Exporting Countries (OPEC) estimates that the global demand for oil-based bunker fuels will drop by 4.8% in 2020 from last year’s level. OPEC also expects a 10% demand growth over the next five years. The strongest growth is expected in the so-called “Non-OECD Other Asia” category, which includes Singapore.

Bunker volumes at Singapore in September totalled 4.2 million tonnes, up month-on-month and year-on-year. At 2.29 million tonnes, VLSFO sales were the highest for the year, while MGO volumes totalled 25,000 tonnes, which is the lowest seen this year and a significant decrease from the 108,500 mt sold in January.

There is a proposal for a new Emission Control Area (ECA) coming to the International Maritime Organization (IMO) in the near future, namely for the Mediterranean. At least initially, it is expected to be a proposal for a sulphur-only ECA with a 0.10% limit. The proposal is expected to have 2024 as the target year for entry into force.